The podcast to this newsletter can be listened to here

Dawn was Michael Avery’s stand-in on Fine Music Radio last week, and had some interesting interviews, including one with Jeremy Sampson, The Brandfather and an interesting discussion with Johan Steyn around AI.

|

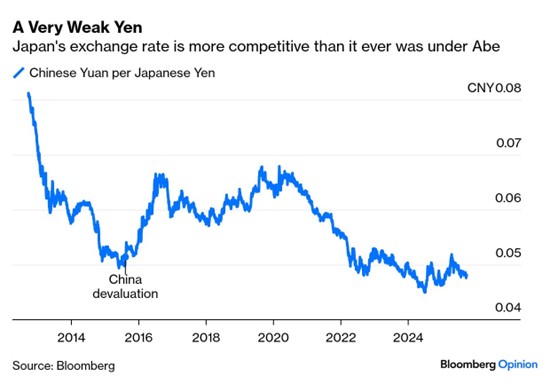

| Your summary with links if you’d like to pick and choose… ⚡️ Energy: Renewables vs Fossil Fuels * Renewables surpassed coal in global electricity production for the first time. * US coal plants face decommissioning; Trump administration pledges $625m to revive coal. * Electricity demand is surging due to AI/data centres. * Wind energy is highlighted for sustainability, cost-effectiveness, and job creation and is clearly the future. * The Oil sector underperforms; drilling activity declines despite political support. Did you know: Bird deaths from turbines are minor compared to cats and vehicles 🇯🇵 Japan’s “Iron Lady” Moment * Sanae Takaichi elected LDP leader, likely next PM—first female premier. * Markets react positively; Nikkei surges. * Takaichi is seen as reviving Abenomics with a focus on deregulation and innovation. * Risks include Japan’s high debt and inflation concerns. 🏦 Two-Pot Retirement System Update * OPFA received over 10,000 complaints, many linked to two-pot withdrawals and employer non-payment. * Private Security Sector Provident Fund (PSSPF) flagged for poor monitoring and enforcement. * Employees urged to verify pension contributions are being properly invested. 🏙️ Johannesburg Coalition Politics * Council Speaker Margaret Arnolds denies coalition collapse rumours. * Tensions rise after partners leave WhatsApp group. * Analysts warn of instability despite official reassurances. 🇺🇸 Understanding the Filibuster * Filibuster allows U.S. Senators to delay/block legislation via extended debate. * Requires 60 votes for “cloture” to end debate. * This is central to the 2025 government shutdown, with Democrats blocking Republican funding bills. * “Nuclear option” (eliminating filibuster) is considered by Republicans but controversial. 📉 SA Macro & Interest Rates * SARB cut rates from 8.25% to 7% since July 2024; inflation target revised to 3%. * Gold (+54%), Silver (+66%), Platinum/Palladium (+67%) surge in 2025. * SA’s debt-to-GDP at 74%; 20% of revenue goes to debt servicing. * Lower rates help government borrowing but hurt retirees relying on interest income. Global Roundup RSA The South African Treasury is attracting strong global interest in its $500 million foreign-currency financing drive, with over 100 proposals from investors eyeing alternatives to traditional Eurobonds. Meanwhile, the rand held its recent gains—buoyed in part by rising gold prices—trading in the R17.10 – R17.20 to the dollar as markets await fresh manufacturing data. On the corporate front, a court sided with Transnet in a long-running dispute, ordering the release of locomotive spare parts from Chinese CRRC, which could ease logistical bottlenecks in freight operations. The JSE keeps breaking new records, now up a nice, nearly 28% year-on-year  USA In the U.S., the government shutdown continues to cast a pall over economic visibility, delaying key data releases like the monthly jobs report and complicating the Fed’s decision framework. The Treasury also made headlines by finalising a $20 billion currency swap with Argentina and buying pesos directly—a bold geopolitical-economic move, and not particularly popular back home. Equity markets remain near record highs, but some analysts flag rising vulnerabilities around AI valuations and fiscal risks. Since late Friday, markets and currencies have been in turmoil because Trump has had yet another hissy fit with China over their rare earths standoff and imposed another 100% tariff (no, I don’t know what it is now – nor does anyone). The Rand depreciated too, and the US bourses had a wobble. This could well be over by Monday again. China has newfound confidence and is not rolling over to Trump’s demands. They know where they have leverage and are using it. Global Globally, markets are exhibiting a so-called “everything rally,” with broad strength across asset classes on optimism about geopolitical calm. The Bank of England warned that the AI hype may be overextended, cautioning of a possible sharp correction if sentiment turns. Inflows into non-U.S. equity funds have surged (over $175 billion), showing investor wariness of U.S. concentration risk and overvaluation.  Renewables v fossil fuels President Donald Trump’s rambling tirade to the United Nations over climate policy should be seen as a belated and somewhat futile attempt to thwart a reshaping of the global energy mix, if the latest shifts in energy supply are any indication. In the first half of this year, renewables for the first time produced more electricity globally than coal. This comes after several years of pullback in coal-fired power generation. Of the 12.3 gigawatts slated to be retired from the US grid this year, nearly 70% is from coal-fired plants, according to the Energy Information Administration. This pace of decommissioning isn’t surprising, as the growing “ideological” appeal of green energy resulted in a surge of new investment. The political backlash represented by Trump and his attempt to reverse years of technological advances is yet to feed through into production numbers. Renewable energy accounts for 34.3% of all electricity produced, compared to 34.2% for coal:  But this issue transcends ideology. Bluntly, it’s not personal, it’s business. What’s become clear is that electricity demand is surging, driven by the energy-hungry data centres needed to fuel artificial intelligence. Years of efficiency gains for renewables have positioned them to meet this new demand. Does this spell doom for coal, or simply a pause in new investment? Judging by the exchange-traded fund tracking the sector, investors aren’t pricing in a downturn:  Coal’s lustre is freshly boosted by the Trump administration, which has announced moves to support coal-fired power generation in the US. The Department of Energy is investing $625 million to “expand and reinvigorate America’s coal industry.” This includes $350 million for recommissioning and modernising old plants, and $175 million for coal power projects in rural communities. To be blunt, though, for now, coal’s extended lifeline relies on the unprecedented rise in electricity demand. They need as much as they can get, from anywhere. A global shortage of natural-gas turbines adds to the need to keep the furnaces lit. Delivery delays range from one to seven years, with costs climbing sharply. Those setbacks are also a boon for renewable energy developers.Renewables’ capacity can only stretch so far, and fossil fuels aren’t disappearing anytime soon. Energy sector indexes, primarily comprised of oil exploration, production, and auxiliary service companies, have underperformed the broader market since the last big price surge in the summer of 2008. Apart from a brief spike during Russia’s invasion of Ukraine, oil prices have largely moved sideways. The sector, whether on a US or global level, has lagged the market terribly throughout. Drilling activity is fast declining despite the “Drill, Baby, Drill” mantra. Without sustained price gains, it’s hard to make a business case for such investment. Rigs have dropped from 468 at the start of the year to 399 by the end of August. This is beginning to be reflected in output. Since the US shale boom began in 2010, there have been sustained production declines only twice: during the price war of 2014-16 when the OPEC+ cartel drove down prices in a bid to punish shale producers, and during Covid. The first sustained decline outside of such extreme conditions will be a noteworthy event. Video game designers use a concept called “coyote time”, allowing characters to walk on air for a short time before gravity asserts itself and they fall to earth. This year, it has felt like the US oil industry has been operating on coyote time, waiting for gravity to take effect. Regardless of this administration’s energy priorities, demand has to be met in a timely and cost-effective manner. In the absence of sustained generation for energy-guzzling data centres, it is preposterous to delay other sources of energy merely for ideological differences. This can harm businesses and, to some degree, residential customers. It also risks the US’s quest for AI dominance — and that is something Washington cannot afford. We all know how much Quixote Donald hates windmills, founded, bewilderingly, in his (newly found) concern for birds that are killed by them, and recycling concerns. In the United States, it is estimated that wind turbines kill about 538,000 to 1.17 million birds each year. In contrast, cars and trucks kill between 89 million and up to 340 million birds annually in the U.S. Free-ranging domestic cats kill an estimated 1.3 to 4 billion birds every year in the United States alone, and global annual bird mortality caused by cats is likely several billions more. This makes cats one of the most significant human-linked sources of bird deaths worldwide, with feral and unowned cats contributing the majority of these kills. The numbers are particularly catastrophic on islands and in regions with vulnerable bird species. An interesting aside: Having one ‘black blade’ can dramatically decrease the number of bird deaths, especially large birds and raptors.  The inconvenient truth is that one of the oldest forms of renewable energy on earth has become an increasingly cost-effective way to produce power Bear in mind the following: Wind energy is renewable and will never run out as long as wind exists, making it sustainable for the long term. It does not emit carbon dioxide or other toxic pollutants, significantly reducing the environmental footprint compared to coal, oil, or natural gas. The operating costs are low once turbines are installed because there’s no need for fuel, and maintenance is limited. Wind energy supports economic growth through job creation in manufacturing, installation, maintenance, and operations; wind is one of the fastest-growing job sectors worldwide. Wind projects deliver local economic benefits via state and local taxes and land-lease payments, contributing to infrastructure and community development. Turbines can coexist with farming and other land uses, allowing efficient use of space in rural settings. Wind energy is increasingly cost-competitive due to advancements in technology and energy storage, making it an affordable option for clean electricity. Wind turbines help lower greenhouse gas emissions by replacing electricity generated from fossil fuels, contributing to improved air quality and public health. Contrary to popular opinion, most materials in wind turbines can be recycled, and ongoing research aims to make them even more sustainable.  Of course, wind energy has its limitations; it is variable, generating electricity only when wind is available (but energy can be stored in batteries, as it is with solar.) Turbine construction can cause local disturbances (they can be noisy)and may impact wildlife if not carefully managed.  Japan’s Maggie Thatcher? Japan’s long-hegemonic (read male-oriented) Liberal Democratic Party has thrown caution to the wind and elected its own Iron Lady, Sanae Takaichi, as leader and therefore the likely next prime minister. Like Margaret Thatcher, she stands to be her nation’s first female premier. This is a risky move when safer (and blander) options were available. But markets are really excited about it. Why? In part, it’s about what the vote demonstrates about the LDP. It had an alternative in Shinjiro Koizumi, 44-year-old son of a former prime minister, i.e. a nepo-baby. The party’s legislators get the final vote after the broader membership narrows the field to two, and it’s a genuine surprise that they chose Takaichi.  The sight of the ruling party treating the political situation as an emergency and doing what voters want is positive in the eyes of investors. The LDP is a minority government, its polling numbers are terrible, and voters are furious about inflation, so it’s encouraging to see that those in power understand this. As for investors, their immediate reaction was to sell the yen and buy stocks.  Meanwhile, the Nikkei 225 gained 3.7% at the opening in Tokyo. That extends what is turning into an epic rally. In common currency terms (accounting for the weakness of the yen), the Nikkei is way ahead of US stocks this year. It has gained 51% in dollar terms since the low set the day before the US announced a 90-day moratorium on the Liberation Day tariffs. Takaichi said last year that the Bank of Japan would be “stupid” to hike rates.Behind all of this lies the legacy of Shinzo Abe and Abenomics. Abe, tragically assassinated in 2022, was prime minister from 2012 to 2020, with Takaichi one of his most loyal lieutenants. He tried to jolt the economy out of its long malaise with three “arrows” — hugely stimulative fiscal and monetary policy, and reforms to force companies to release the cash they were holding. Japanese stocks outperformed the rest of the world for his first years in charge. Then they started to lag. Since he stood down five years ago, they’ve fallen badly behind under a series of premiers antagonistic to Abe’s faction. Investors assume Takaichi will administer a second dose of Abenomics, and investors like the sound of that. But the medicine didn’t work for long the last time. The first two arrows hit their targets, weakening the yen, but the third — governance reform to shake up Corporate Japan — never landed. Abenomics’ big returns slowly dwindled. Takaichi wants to fix that. She wants her legacy to be one of liberating made-in-Japan innovation and competitiveness. She is an admirer of Hayek [as Thatcher was] and it is her libertarian instincts that will capture the imagination of markets. Specifically: Watch out for a new deregulation and privatisation drive, as well as changes to the corporate code that speed up industrial consolidation… She once famously asked: Why does Japan have seven motorcycle companies? But there are big risks. The idea of Abenomics-style big government spending is alarming. The country is already by far the developed world’s most indebted. And Takaichi has toned down the rhetoric of late — perhaps because she understands the changes since the first Abenomics. Inflation is higher now, and deeply unpopular with voters. A weaker yen, in a country that imports many goods, would be disastrous. That limits the scope for lower rates. And the exchange rate already makes Japan startlingly competitive with China — it’s unlikely to be allowed to fall lower:  Takaichi had toned down calls for big spending and tax cuts, instead promoting smart government investment in energy, food, and economic security. She appears to bring seasoned politicians into her team, including some from rival factions within the LDP. Ultimately, she has to get the economy moving, primarily by ensuring Abe’s third arrow finally hits its target. That will be much harder with a weakening yen. The market’s initial take that this will be like another dose of Abenomics is probably right; its early judgment that markets will react the same way they did last time might be wrong. If Takaichi is to succeed, this version of Abenomics will have to be very different from the first.  Two-Pot update Since the launch of the two-pot retirement system last year, in its Integrated Report 2024/25, the Office of the Pension Funds Adjudicator (OPFA) recorded 10,331 new complaints and 10,100 finalised matters. Mostly linked the rise to the 1 September 2024 launch of two-pot withdrawals, alongside persistent employer non-payment of contributions under section 13A of the Pension Funds Act. From September 2024 to March 2025, the OPFA logged 239 two-pot complaints and 2,246 enquiries as funds grappled with higher-than-expected withdrawal volumes and backlogs linked to employer arrears. As the minister of finance, Enoch Godongwana, noted in his foreword, funds ‘underestimated the uptake’ and some ‘could not pay the claims as employers owed arrear contributions’. Two categories continued to dominate the caseload. The minister wrote that ‘the primary areas of concern relate to withdrawal benefits and non-compliance with section 13A of the Act, where employers fail to pay over pension contributions to the fund’. He added: ‘The recurrence of these issues and the high number of complaints remain of great concern, and stakeholders are urged to remediate this undesirable result of poor fund governance, management, and administration.’ The positive aspect of this is that the rash of employees wanting to withdraw from their savings pot has brought to light these failures by employers to pay over the contributions, before it is too late, at retirement, for example. (I have found several of these instances over the years, and never been able to get money back for the employee). The Private Security Sector Provident Fund (PSSPF) remained the hotspot. The report stated the fund ‘does not appear to have a proper monitoring system’ to detect non-payment and has ‘consistently failed to act against defaulting employers’, resulting in millions of rand prescribing to the detriment of members. During the year, the PSSPF lodged 395 complaints against employers, while individual members brought 3,433 complaints. Communication conflicts with the administrator, Salt Employee Benefits, were escalated to the Financial Sector Conduct Authority (FSCA), the report stated. If you are in a company pension/provident fund, are you getting regular statements, or have access to them online? Do not assume that because the deduction is being made on your paycheque that it is being invested on your behalf.  Jo’Burg at the coalition crossroads While this is still an evolving story… Johannesburg Council Speaker, Margaret Arnolds, has dismissed growing speculation that the city’s fragile multiparty coalition is on the brink of collapse, insisting the alliance remains intact despite recent tensions among its partners. Her comments come in the wake of allegations that several coalition partners abruptly left the WhatsApp group used by coalition members for coordination and communication. Arnolds described the situation as an “internal matter” that was receiving urgent attention from all parties involved. “This is an internal matter that is currently receiving the utmost priority and attention from all coalition partners. It would be premature and irresponsible to comment further at this stage, as discussions and deliberations are still ongoing,” She also condemned leaks to the media about the coalition’s internal processes, saying such actions were “deeply regrettable” and seemingly designed to sow division. “Any leaks relating to these internal processes appear intended to create instability within the government. We remain focused on maintaining unity and working constructively toward a resolution,” Arnolds added. The Johannesburg multiparty coalition has long been characterised by reports infighting, power struggles, and shifting loyalties among the coalition partners.  Recent reports of a digital fallout on the coalition’s WhatsApp group signalled mounting frustration among smaller parties, some accusing their larger partners of unilateral decision-making and lack of transparency. Political analysts say the Speaker’s assurance is meant to steady the ship and project confidence, but the episode reveals the fragile nature of Johannesburg’s coalition politics. We all know from family dynamics that leaving the family WhatsApp group is often the first sign of a bun-fight loading.  What is the Filibuster? As the US government shutdown continues, you’re going to hear more of this term, and the ‘Nuclear option’. Here’s what I found out: A filibuster is a legislative tactic used in the U.S. Senate, allowing one or more senators to prolong debate indefinitely and thereby delay or block a final vote on legislation or other matters. Unlike the House of Representatives, which has strict rules on debate time, the Senate allows unlimited debate unless a supermajority (typically 60 senators) votes for “cloture” to end debate and proceed to a vote. A filibuster can involve continuous speeches or procedural moves to prevent a bill from coming to a vote. The goal is usually to force the majority to make concessions or withdraw the legislation. The filibuster is not in the U.S. Constitution but developed as a Senate tradition, which today means most major bills effectively need 60 votes to advance. Filibusters have occasionally been used to block important measures, such as civil rights or spending bills. The current U.S. government shutdown is deeply tied to the filibuster. In 2025, Democrats in the Senate used the filibuster to delay or block passage of a Republican-backed funding bill, leading to a lapse in federal funding and the shutdown of government services. Because Senate rules require 60 votes to end debate (cloture) and pass most legislation, a unified minority can use the filibuster to stall crucial bills, such as temporary spending bills needed to keep the government open. Currently, the shutdown persists because Senate Democrats are withholding their votes, preventing Republicans from reaching the 60-vote threshold to pass the funding bill and end the shutdown. There is intense pressure on both sides: Republicans have threatened to eliminate the filibuster entirely (the “nuclear option”) if the stalemate continues, though Senate leaders have publicly opposed this drastic step thus far. (It could backfire when they become the minority again). Progress toward ending the shutdown may hinge on either side relenting, public pressure shifting, or enough moderates crossing the aisle to break the filibuster and approve funding. Overall, the filibuster is a procedural tool giving the minority party significant leverage in the Senate, especially during contentious negotiations over government funding, as seen in the 2025 shutdown. Author: Dawn Ridler  SA Macro and rates Bond yields have been trending lower as the SARB has been cutting interest rates. In July 2024, rates in SA were at 8.25% versus now at 7%. That is after 5 cuts in the interest rate. As the ZAR continues to strengthen against the Dollar, this should ease inflation pressure and the newly adopted target of 3% rather than the previous inflation band of 3-6% may just make sense. Work done by Investec shows how inflation could play out in the coming years:  There isn’t much driving inflation, and if one considers the easing underway in the US and elsewhere, it only makes sense that inflation should ease here as well. South Africa has a large unemployment problem and therefore poses little risk that the economy may become overheated due to consumption. For 2025, we have seen Gold rise by 54% and Silver by 66% given their hard asset qualities over owning a currency. Platinum and Palladium is up over 67%. Copper, though, has only risen by 23% and soft commodities are lower off the back of no new activity in consumer markets. This hard asset rally has buoyed the JSE but hasn’t necessarily lifted all stocks to the same degree. It again points to how commodity-focused South Africa really is. From here on in, the emphasis for Treasury will be to carefully manage the debt pile that the government has racked up. At a debt-to-GDP ratio of 74%, South Africa is becoming more beholden to debt repayments a similar fate which is facing large Western countries. Yes, their debt piles are larger than South Africa’s, but the tools available to them are also quite different to what is available to an Emerging market like South Africa. Investec shows how South Africa compares relative to other peers:  With 20% of Revenue going to debt servicing costs, this makes South Africa less efficient when it comes to getting bang for their tax revenue bucks. This will make kickstarting growth more difficult. Managing the debt is equally important to ensure that there isn’t a bond crisis, which South Africa will find hard to defend. Lower rates are important as this allows the government to raise capital with more favourable payment terms. The SA 10-year bond currently trades for 9% which is somewhere within the long-term range for this asset.  It’s conceivable that yields will continue to trade lower given the anaemic global inflation environment. Good news for the government … not so much for those who are retired, relying on interest to fund a monthly income. Author: Cobie LeGrange EXCHANGE RATES:  The Rand/Dollar closed at R17.50 (R17.22 , R17.35, R17.33, R17.37, R17.58, R17.65, R17.44, R17.61, R17.74, R18.15,R17.76, R17.72, R17.90, R17.58, R17.89, R17.99, R17.92, R17.77, R17.95, R17.88, R18.04, R18.16, R18.39, R18.64, R18.89, R19.12, R19.10, R18.36, R18.21, R18.18, R18.20, R18.71, R18.35, R18.38, R18.41, R18,67, R18.38, R18.73, R18.03, R18.05, R18.11, R18.21,)  The Rand/Pound closed at R23.37 (R23.19, R23.22, R23.35, R23.55, R23.73, R23.84, R23.53, R23.84, R23.84, R24.09, R23.88, R23.76, R24.22, R24.08, R24.49, R24.22, R24.35, R24.05, R24.18, R24.14, R23.95, R24.16, R24.40, R24.82, R25.10, R25.01, R24.73, R23.78, R23.55, R23.52, R23.50, R23.53, R23.19, R23.12, R22.85, R23,16, R22.93, R22.80, R22.99, R22.98, R22.72, R22.99, R22.73, )  The Rand/Euro closed the week at R20.33 (R 20.22, R20.30, R20.35, R20.38, R20.61, R20.62, R20.44, R20.56, R20.64, R21.04, R20.86, R20.61, R20.93, R 20.70, R20.91, R20.74, R20.68, R20.24, R20,37, R20.27, R20.13, R20.43, R20.78, R21.21, R21.52, R21.72, R20.93, R19.95, R19.72, R19.83, R19.72, R19.41, R19.20, R19.29, R19.02, R19,35, R19.31, R19.23, R19.09, R18.87, R19.19, R18.85, ,)  Brent Crude: Closed the week $62.14 ($64.28, $69.67, $66.57, $66.80, $65.52, $67.38, $67.73, $66.08, $66.07, $69.46, $68.29, $69.21, $70.58, $68.27, $67.39, $77.27, $74.38, $66.56, $62.61, $65.41, $63.88, $61.29, $65.86, $67.72 $64.76, $65.95, $72.40, $72.13, $70.51, $70.33, $73.03, $74.23, $74.51, $74.65, $76,40, $77.60, $79.98, $71.00, $72.38, $75.05, $70.87, $73.86, $73.99).  Bitcoin closed at $111,888 ($124,858, $109,446, $115,838, $115,770, $110,752, $108,923, $114,916, $117,371, $118,043, $113,608, $118,139, $118,214, $117,871, $108,056, $107,461, $103,455, $105,017, $105,643, $104,049, $103,551, $104,615, $96,405, $94,185, $84,571, $84,695, $82,661, $83,074, $84,889, $82,639, $83,710, $85,696, $96,151, $96,821, $96,286, $99,049, $104,559, $104,971, $99,341, $97,113, $97,950). Articles and Blogs: Abdication or diversification? NEW Carbo-loading your retirement NEW Spoiled for choice Who needs a plan anyway 8 questions you need to ask about retirement What to do when interest rates drop How to survive volatility in your investments What to do when interest rates drop Difficult Financial Conversations Financial Implications of Longevity Kick Start Your Own Retirement Plan You matter more than your kids in retirement To catch a falling knife Income at retirement 2025 Budget Apportioning blame for your financial state Tempering fear and greed New Year’s resolutions over? Try a Wealth Bingo Card instead. Wills and Estate Planning (comprehensive 3 in one post) Pre-retirement – The make-or-break moments Some unconventional thoughts on wealth and risk management Wealth creation is a balancing act over time Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |