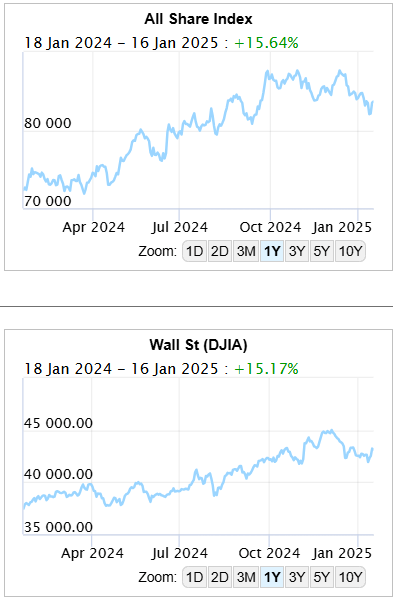

| Welcome back to our Newsletter and podcast – We hope you had a great break and looking forward to a happy, healthy and above all, prosperous 2025. Cobie and I like to keep this newsletter and our podcast evolving. We’d love to hear from you about what you like or dislike, what you’d like more or less of – both in the newsletter and podcasts. Do you have topics you’d like to hear a blog on? Do other people’s wealth journeys interest you? Market Watch Despite the JSE slipping over the Summer break, we are still tracking Wall Street y-o-y.  The Nasdaq has come off the boil a touch – will the Mag 7 take the next step and monetise their massive Capex spend on AI?   US Inflation And, breathe. US inflation is still cooling – perhaps not as fast they’d like. Unfortunately, Trump’s proposed tariffs could turn this around very quickly (but would be partially offset by a stronger dollar? Why? Tariffs are ultimately paid by the US consumer and the suppliers are not going to absorb this additional cost. A stronger dollar makes those exports more lucrative for the global exporter into the US. The intention of tariffs is to bring manufacturing back to the US.  How realistic is it to expect factory jobs to come back to the US because of tariffs? In the United States the average yearly wage is approximately $66,100,or an hourly wage is around $28.34. In China, the average yearly wage is approximately $97,528 CNY (around $13,800 USD), the hourly Wage: Around $2.50 USD (based on a standard 40-hour work week). In other words there is a 1000% difference – a 30% tariff is not even going to touch sides. Wednesday’s US inflation data showed that the rate of price rises was falling (in other words the trend), and that pressure was a bit milder. This led to an immediate ‘risk on’ bump in the markets. Inflation in the US, as measured by the change in the Consumer Price Index (CPI), rose 2.9% on a yearly basis in December from 2.7% in November. This reading came in line with market expectations. On a monthly basis, the CPI rose 0.4%, following the 0.3% increase recorded in the previous month. Breaking down the CPI into its four main elements reveals that ongoing inflation is more or less entirely about services, as has been the case for a while. Food prices are still edging upward, but nowhere nearly as fast as in 2022; energy and goods prices are largely quiescent. More detailed statistical measures confirm that inflation is coming down, but very slowly and it remains above target. Analysis produced by the Cleveland Fed show very slight declines in an ongoing, painfully slow progress toward the Federal Reserve’s 2% target. Sticky inflation is also gradually coming unstuck. Although Trump campaigned on bringing down inflation, especially in food and gas – remember that he has very little say over either of those. The price of gas – governed by factors out of his control and can’t be fixed by “Pump baby Pump”, and his tariffs would immediately bump the price of crude coming in from Canada. The price of food fluctuates all the time and has multiple variables, including the weather, which contrary to popular opinion Trump also has no control over. His immigration policies, specifically mass deportation, would severely impact farmers who rely on South Americans to do the hard, hot, dirty work required on farms that US citizens shy away from. After showing significant wage increases in the US – mostly to keep up with cost of living increases, this is back on the decline.  This is not good news for the spending power of the average US resident, and when you consider that 70% of the US GDP is made up of consumer spend, this is not good news for the GDP. Q4 2024 GDP ,and the annual 2024 is due for release on 30/1/25 and will serve as a good benchmark for Season 2 of the Trump Reality show.  Biden’s legacy The American public’s judgement on the Biden administration’s inflation record was clear and damning. He let prices get out of control, and didn’t restore living standards once the worst rises were over. For that, in large part, the Democrats were evicted from the White House. Now that the last complete month of the Biden administration is in the books, we can get a good handle on that judgement. Here is the picture of inflation under Biden: The voters were right, life was harder under Biden, and he (and Harris) were perhaps unfairly punished as a result.  Food and energy are excluded from “core” measures tracked by central bankers for the good reason that monetary policy has little ability to move them. However, people have to buy them. Increases in what we might call the “anti-core” (food and energy combined) are politically salient. As demonstrated by the following chart, drawn up from Bureau of Labour Statistics data as suggested by Carolyn Silverman of Bloomberg, anti-core prices spiked in 2022 in a way not seen since geopolitical shocks in the 1970s. That’s now been brought back under control, but the level of food and energy prices hasn’t come back down: Although we’re putting the fault of inflation at Biden’s door, we obviously know that the fault ultimately lies at the FED’s door, who hid its head in the sand when it came to inflation and reacted way too late. While some of that inflation could be blamed on the bottlenecks caused by Covid, there were also the stimmi checks that flooded unchecked into the economy (both Trump and Biden are to blame there)  The table above shows the US GDP by president – Trump has a very low bar to get over compared to his first term, and Biden has left him with a decent tailwind. Interest rates are going to be key to the markets in 2025 – but unless CPI starts to drop faster than it has done in the last year – those anticipated cuts could well slow down. The next FED FMOC (Federal Open market Committee) meeting is on 28-29 of Jan and will be interesting. If the FED decides to ‘hold’ cuts, then there is likely to be an adverse market reaction.  Dollar strength The index we most commonly use to gauge the strength of the dollar is the DXY, and you can see from the graph below it now closing in on 110 again, having come close to 100 before Trump won his second stab at the presidency. This dollar weakness has been the driving force behind the rand weakness. From an investment perspective this underlines the importance of diversifying your investment portfolio, but also the understanding just how volatile the Rand is – don’t panic, this too will pass.  Speculation is rife that Donald Trump will celebrate his inauguration today (when US markets will be closed for Martin Luther King Day) with a raft of dollar-positive executive orders. Nobody wants to be short the dollar before that. Because the dollar is a haven, it rises in times of trouble, even if the difficulties emanate from the US. It also gains when the US economy is booming. Its performance will be wishy-washy during “soft landings” when growth is unexceptional and nobody is that worried. Rates were falling as central banks looked likely to engineer a soft landing after the post-pandemic inflation. Then came the Trump victory, and data suggesting that the economy had far more puff than people had thought. Yields rose, as did the dollar. Much of the rest of the world, meanwhile, is worried about what’s to come.  Boring Old Bonds? Not last year that’s for sure. Bonds pay an important part in all diversified and balanced portfolios, but they are not easily understood by ordinary investors. The graph below shows how volatile bonds have been, globally over the last 6 months – and they haven’t settled down yet.  Just to de-mystify these bonds a little, and understand why everyone is in a tizz, let me try and explain this in simple terms: When fixed-term bonds are issued they are auctioned and the rate that they are issued at is the guaranteed rate of ‘interest’ for that bond (called a bond coupon but treated as interest by SARS for example) over the term (2, 3,5, 10, 20, 30 years) at the end of which the original capital is repaid. Very few investors (mostly large funds) want to hold these bonds for the full term – especially if there are higher yields available, they go into the secondary market and the the capital value of the bond adjusts to accommodate for the prevailing interest rate. In other words, if the prevailing yield rises, then the capital is shifted out of the capital portion to pay the new, higher yield. In other words, the capital is decreased, you get a capital loss (and visa versa of course). This sort of volatility is usually manageable when the movements are minimal – but over the last few years, yields have increased by as much as 500% resulting in significant capital loss in the secondary market.  Richemont Last week, the luxury brand with a strong international presence, Richemont, surprised markets with a much better than expected surge in sales in Q3. My initial reactions was – could this be a signal that China’s consumers are turning round? If you dig down into the numbers, alas, not.  The company showed a very solid end to the calendar year with Q3 sales up by 10% at constant and actual exchange rates including the following: * Highest ever quarterly sales at € 6.2 billion * Double-digit growth in the Americas, Europe, Middle East & Africa and Japan; slower decline in Asia Pacific despite still challenging demand in China * Marked improvement over H1 across all business areas, driven by an acceleration at Jewellery Maisons (Maisons = Houses in French, a nod to their aspirations/pretensions I guess) to +14%; Specialist Watchmakers at -8%, ‘Other’ at +11%, including Fashion & Accessories Maisons at +7% * Channel performance led by retail, up 11% at constant and actual exchange rates * Robust net cash position at € 7.9 billion All regions showed double-digit growth except Asia Pacific. Asia Pacific sales contracted by 7%, largely the result of an 18% decline in Mainland China, Hong Kong and Macau combined, primarily impacted by continued weak demand in Mainland China. The Group’s four Jewellery Maisons – Buccellati, Cartier, Van Cleef & Arpels and Vhernier – saw their growth accelerate this quarter to +14% against a demanding +12% comparative in the prior-year period. The graph below shows that this company’s share has really taken off since the pandemic.  Trump’s Treasury pick Cobie and I spoke about Trump’s somewhat reasonable pick for the Treasury – Scott Bessent, and after a week of MAGA insanity in the senate hearings for some of his other picks (Hegseth and Bondi), I did not expect the controversy we saw on Thursday. Here are some of the highlights/lowlights: * He said that a range of tariff ideas — including the controversial blanket ones that Trump promised on the campaign trail — will be part of the Trump 2.0 equation in the months ahead. * At one point during the questioning, he described Trump’s tariff policy as one with a plan that includes “a more generalized tariff as a revenue raiser for the federal budget” as he also downplayed potential costs for such a policy. * Other parts of the Trump tariff agenda, Bessent said, would be focused on using tariffs as a negotiating tool to remedy unfair trade practices and other geopolitical issues. * The Federal Reserve also came up, with Trump’s pick defending the independence of the central bank but maintaining that Trump “will have a voice.” Bessent, last year, suggested in an interview with Barrons that Trump could appoint a “shadow chair” to undermine the influence of Fed Chair Jerome Powell. * Under questioning from Sen. Elizabeth Warren, Bessent defended the debt ceiling ahead of a coming debate on that topic. But he also appeared open to abolishing the limit on US borrowing if Trump made it a priority. * Just as a side note, like all politicians, his views change with the wind or a better payday. less than a year ago in a letter to his firm’s partners that “tariffs are inflationary and would strengthen the dollar — hardly a good starting point for a US industrial renaissance.” Trump has declined to offer many details on his tariff plans as of late but posted the following to his social media platform:  Just as a reminder to those of you who are unfamiliar with tariffs and how they work: They are paid by the importer of the goods. In other words, the companies that are importing the goods. Those importers then pass on that cost to the ultimate consumer of the goods. Tariffs are not paid by other countries. Shockingly perhaps to Mr Trump, but we have no control over another Country’s Treasury. This hare-brained idea has about much impact as Trump’s Space Force.  Author: Dawn Ridler  2025 2025 is shaping up to be a year which either proves that valuations matter today or that they may matter sometime in the future. Earnings is going to be important to watch. Each US earnings season will show if equities are on the right path or if they need to sell down to fit new expectations. The performance has really come from US equities (and Bitcoin) in the last 2 years forcing valuations higher. Now its up to earnings.  If one correlates 1-year subsequent S&P 500 returns with valuations, today’s overall P/E suggests a mixed bag. History shows that those returns can be either positive or negative. The 10-year correlation though shows a much stronger relationship. This shows single digit 10 year returns when purchasing the S&P500 of today’s PE. That brings me back to the importance of earnings in 2025. If earnings surprise on the upside, it will confirm the current level of the market whereas lower earnings should force equities to sell down. Which it will be only time will tell. But apart from earnings there is something else afoot in markets as well. Bond yields have been rising in the USA and the UK amongst other first world countries. Starting in December the US 20 year yield has risen to 5% whereas the shorter dated 2 year is at 4.30%. Now remember this is happening at a time when central banks are lowering interest rates as inflation has been cooling in 2024. In reality bond yields should be falling but they are telling a story of the underlying issues that plague western nations. The first is debt. The bond market is saying that governments will have to borrow at higher rates if they want to continue on the current path of expenditure. The UK labour government last year pushed through a budget which incorporates higher taxes and expenditure. If the government wants to continue spending it will cost them more money. UK 20 year bonds are trading at 5.30%, a hefty interest bill to weigh up against new debt issuances. The second is the resurgence of inflation. The US target rate of 2%, as I said last year, is a pipe dream. Bond markets are indicating that inflation will come back thus forcing policy makers to keep rates higher. The base rate may very well also change. This forces governments to borrow at higher rates and the emphasis on GDP growth to inflate the economy to deal with the ballooning debt becomes that much more important. And then there is the unpopular choice of austerity that at some point will become the only option. At current rates the mortgage market in the US is frozen as new mortgages will have to be financed at higher levels. Spare a thought for the Los Angeles fire victims who were hoping to use mortgages to supplement their poorly insured homes. At the same time as UK and US bond yields have moved higher, their Chinese counterparts have been falling. The Chinese need to deal with their property sector overhang and provide ample liquidity to put it back on a firm footing. Chinese 10 year bonds are trading at 1.64%! The steps they have taken so far has not been adequate. I am watching this space with interest. All of this brings me back to equities. Yes, valuations are stretched but large economy bond markets in their current state are uninvestable unless you own them for the long term. That leaves investors with equities and cash as asset classes. The lack of choice and the expectation of earnings are proving to keep equities at current levels. I expect more volatility in 2025 and a much more critical eye on tech companies especially where AI earnings have been promised. But if anything 2025 is going to be interesting to observe. Author:- Cobie Legrange EXCHANGE RATES:  The Rand/Dollar closed at R18.73 (R18.03, R18.05, R18.11, R18.21, R17.58, R17.60, R17.66, R 17.41, R17.48, R17.12, R17.42, R17.85, R17.82, R17.71, R17.85, R18.32, R18.26, R17.95, R18.23, R18.20)  The Rand/Pound closed at R22.80 (R22.99, R22.98, R22.72, R22.99, R22.73, R22.72, R22.89, R22.75, R22.93, R22.90, R23.20, R23.44, R23.41, R23.13, R23.39, R23.28, R23.32, R23.34, R23.00, R22.63, )  The Rand/Euro closed the week at R19.23 (R19.09, R18.87, R19.19, R18.85, R19.09, R19.07, R19.05, R19.19, R19.12, R19.47, R19.79, R19.72, R19.80, R19.70, R20.01, R19.94, R19.58, R19.74,)  Brent Crude: Closed the week at $79.98 ($71.00, $72.38, $75.05, $70.87, $73.86, $73.99, $75.57, $78.67, $77.95, $71.96, $74.68, $71.47, $76.99, $79.05, $79.09, $79.43, $77.56, $85.03, $83.83, $84.86, $85.22).  Bitcoin closed at $104,971 ($99,341, $97,113, $97,950, $90,679.47, $79,318, $68,277, $66,989, $62,876 , $62,267, $65,596, $62,603, $54,548, $57,947, $63,936, $59,152, $60,847, $61,903, $59,760,). Articles and Blogs: New Year’s resolutions over? Try a Wealth Bibgo Card instead.NEW Wills and Estate Planning (comprehensive 3 in one post) NEW Pre-retirement – The make-or-break moments Some unconventional thoughts on wealth and risk management Wealth creation is a balancing act over time Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Keeping your legacy shining bright Financial well-being when dealing with Dementia and Alzheimers Weathering the storm Pruning your wealth farm Should you change your investments with changing politics? Taking a holistic view of your wealth Why do I need a financial advisor? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏