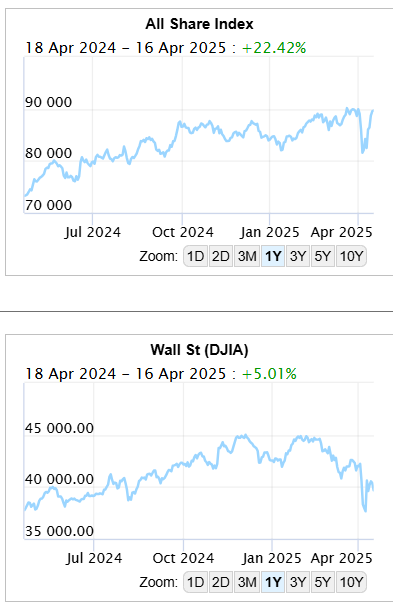

| Cobie and I like to keep this newsletter and our podcast evolving. We’d love to hear from you about what you like or dislike and what you’d like more or less of – both in the newsletter and podcasts. Market View Markets across the world have had a rocky week, but the JSE seems to be weathering the storm and is almost back to the pre-Tariff Tantrum levels. In the US, it’s not quite so rosy with tariffs still on hold, and the threat of more to come.  China is not capitulating to the US; to the contrary, they are making use of the ‘enemy of my enemy is my friend’ philosophy, and retaliating with a scalple, not a bazooka. The ban on soya and beef exports from the US is targeting those red states that voted for Trump. Brazil and Australia have picked up that demand slack. Recessionary fears With all the turmoil we have seen in markets in the last two weeks, it’s little surprise that there are whispers of a looming recession in trading rooms. I am sure many of you remember the 2008 ‘Great Recession’ – I certainly do, very vividly. I spent many months in 2007 in the US, in my previous career. Being in St. Louis, Missouri, there wasn’t a lot to do, so I watched too much TV – and all the news then was about ‘subprime loans’. The graph below shows the S&P during that period. I decided to become a financial advisor in October 2007, and the market bottomed out in Feb 2009 and didn’t recover back to the same levels of 2007 until mid 2013. It was called the Great Recession for a good reason; there were some huge fundamental flaws that had developed in the Western Bond markets, and these had to unwind and normalise. Stock markets bounce all over the place, that’s just what they do, and have mini-corrections often – but when the bond markets, who are supposed to be the steady, boring underpinning to investments start to wobble, things can go badly wrong. Normally, when there is a flight of capital out of stock markets, they go into bonds, and the yield usually drops. In the simplest terms, the bond market is a supply-demand market. When there is demand for the bond, the yield drops; when there is little demand, the yield has to be ‘more appetising’ to encourage investors, and yields rise. When yields rise, the capital value in the secondary market (where 90% of the trading takes place) decreases, and visa versa. (yes, you can have a loss of capital in bonds!). This time round (so far) the flight of capital has NOT gone into bonds, to the contrary, yields, which were coming nicely down to the 4% threshold, went back north – a strong indicator that the US wasn’t the ‘safe haven’ that international investors were looking for. So, where has the money been going? Some of it has definitely been going into gold. You can see this from the biggest Gold ETF below But it is also reflected in the gold price: If this trade war Trump-inflicted-wound turns into a recession, it is going to be quite the most infamous legacy to live up to. The recession fears this time around have been driven entirely by a new policy (US tariffs) that might yet be revoked. The chances still are that it will create an epic buying opportunity at some point in the future. But that time to buy will come much later if there is a recession. While the uncertainty over tariffs persists, it will be hard to put together a market rally. From Rexsolom’s perspective, despite all the uncertainty, if quality babies are being thrown out with the orange bathwater, we will pick them up, put them into the portfolios we manage and give them free rein to grow. Quality shares aren’t deliberately being ‘thrown away’ – this is usually done by emotionless ETFs rebalancing, or algos and bots. ETFS have had a great decade tracking the US markets at low cost, but what goes up… Bond watch There is very little doubt that it was the bond market that motivated the smart people in the Trump administration (there are a couple, I think) to get him to backtrack with a 90-day suspension of the tariffs (except to China). Thank goodness that seems to have worked, and bonds now seem to be coming back down to the 4% level. Trump is so unpredictable, though, this could turn on a single Truth Social Tweet. Consider the one below out on Friday: It seems the President wants the FED to help ease lower yields. Mocking Jerome Powell won’t change his mind … data will! There is $8 trillion in bonds held outside of the US, as you can see from the table below, and some of those holdings are unexpected. The Cayman Islands (British territory) are only 275 sq km. Luxembourg is only 2,586 km sq, Lesotho is 30,355 sq km. Of course, Cayman and Luxembourg are well-known financial centres – not always in a good way. JD Vance has also been doing his own brand of damage, no doubt at the behest of his master. In Europe, he didn’t read the riot act over defence spending — which would have been reasonable — but made such a wide-ranging attack on Europe and all it stood for that his listeners decided the US could no longer be trusted as an ally. The subsequent boost to defence spending in Germany isn’t to make sure it keeps its NATO commitments, but to ensure its independence from the US. This is one of those sea-change moments (albeit in a veritable bouillabaisse of sea-change moments). Global opinions of the US are at an all time low, and with trust and respect waning, it is probably changed forever. Respect, once lost, never restores itself to its former glory. Those Trump trades are well and truly unwound at this point. What a great first 100 days! Mar-a-Largo accord The phrase “Mar-a-Lago Accord” was coined by US money market “wizard and previous Credit Suisse Strategist Zoltan Poszar back in June 2024 on the idea that the US could force countries to accept a weaker dollar and lower interest rates on their US Treasury investments in order to still be protected by the US security umbrella. The phrase is a spin-off of the 1985 “Plaza Accord” where France, Japan, West Germany and the UK agreed with the US to jointly weaken the dollar. Replacing the Plaza Hotel in New York (which, ironically, Trump owned from 1988 to 1995) with Trump’s Mar-a-Lago Club in Palm Beach, Florida, as the venue of a potential new deal seems fitting and makes for a catchy phrase. The idea was picked up by then Hudson Capital’s strategist Stephen Miran and outlined in more detail in November. (Miran is a name to watch, it is suspected that he is the man whispering into Trump’s ear over this tariff chaos). Miran’s paper did not really catch the market’s attention before he ascended to chairman of Trump’s Council of Economic Advisors. The paper provides a sort of intellectual framework for much of what Trump is currently doing with security and trade policies. In Trump’s opinion, the main reason for the demise of the American Dream is an artificially strong dollar, which has led to the dismantling of US manufacturing and loss of “well-paying blue-collar jobs.” The strong dollar is a result of its status as a reserve currency, which amplifies investments into the US. With local manufacturing uncompetitive, the US is then forced to increase imports, leaving it dependent on foreign countries for a number of goods. Trump, frankly, has an outdated and romanticised notion of manufacturing. With other countries (China for instance) “unfairly” supporting their manufacturing sectors, the problem is amplified. Connected to this problem is also the US (self-appointed) role of global police, leaving it with a large military cost burden, which again leads to public deficits and debts (easily financed because of the dollar’s reserve status). Trump sees the stronger dollar as the main reason for the falling share of US industrial jobs The thinking goes: In order to bring the system into a more “fair” balance, the US should assume a weaker dollar and disincentivise imports to rekindle domestic manufacturing. It should also make other countries pay a larger share of the defence bill themselves and accept a lower payout on their US treasuries for the paydown of past security guarantees. Countries that do not agree to these terms should be left out in the cold. The US is taking on a disproportionately large share of defence spending, leading to increasing public debt Tariffs are, in this regard seen as an important instrument. On the one hand, raising tariffs will heavily incentivize foreign companies to move production capacity to the US, and this will create domestic jobs. Revenues from tariffs will help reduce the fiscal deficit and open up for tax cuts, which again makes it more attractive to invest in the US. The threat of tariffs is also seen as a bargaining tool to make other countries bend to the will of the US in terms of military spending, immigration, drug smuggling, etc. Trump himself has not openly advocated for the idea of an accord, but some of his policies could be seen as working in this direction (with Miran in the background). The threat of a US retreat from NATO and closer ties with Russia have led to a massive increase in European defence spending. Higher tariffs have led to several companies announcing large investment plans in the US. The dollar has also weakened, mostly as a result of global investors allocating away from American equities. So far, the more financially nuclear option of restructuring the outstanding US debt, either by applying a tax on coupons, lowering coupons or terming the debt out to 100 years has so far not been seriously discussed. US Treasuries are the backbone of large parts of the global financial system, and messing it up could have serious repercussions. Less than a third of US Treasury securities are held abroad, so in order to meaningfully reduce the overall public debt, you could not spare domestic investors. While we already are seeing parts of Miran’s Mar-a-Lago Accord in action, we doubt that we will see a globally coordinated deal à la 1985’s Plaza Accord. Back then, most currencies were still administered by central banks, and the financial market had a much smaller role in the economies. Effectively controlling the level of the dollar would be much harder right now. Defaulting on the US Treasury debt would surely lead to a much weaker dollar, but it would come with a lot of unwanted side effects. If the Trump administration starts to float such an idea, it could lead to a marked selloff in the US bond market. Regardless of a coordinated accord to weaken the dollar, we still expect the fallout of US policies to weaken the dollar over time. A more isolationist US should lead to less foreign investments and lower growth rates over time, as will a more restrictive fiscal policy. Higher European defence and infrastructure spending will increase growth and reduce the economic gap to the US, while also opening up investment opportunities outside of the US. Exodus From the Dollar? If the US overplays its hand, in both defence and foreign policy, the rest of the world decides it is no longer to be trusted, and the huge sums of foreign capital in the US leaves in a rush, prompting a vicious circle. The US stock market crashes and Treasury yields surge as the Trump administration belatedly realises that it had been getting quite a good deal out of being nice to its allies. If there’s evidence of a loss of trust, it comes from the interaction of the dollar with bond yields. Usually, exchange rates are driven in large part by interest rate differentials — money flows to places where it will be paid higher rates. Loss of trust can outlast any reversal – let’s look at the ‘Liz Truss’ moment (and forget, if we can, that she was one of the last people to see the Queen alive). That was a serious loss of trust. The result was Truss’s swift exit, which is not an option in the US political system unfortunately. But confidence in the currency has since been more or less restored. UK gilts are under severe pressure again, but it isn’t affecting the pound. So a crisis need not end faith in a currency forever, and the dollar has much more underpinning it than the pound does. Still, the possibility of an exodus from dollar assets and a lasting breach of trust remains. Markets will watch for signs of it in the days and weeks ahead. It will be hard for risk assets to stage a sustained rally until this risk has been averted. Until then, uncertainty leaves everyone in a state of suspended animation. Tech versus services The rout on the Nasdaq continued last week Tech companies were at the forefront of last Wednesday’s ructions (China’s ‘recalcitrance’ and upping of the ante). AI chip giant Nvidia said its sales to China would cost it $5.5 billion in accounting charges due to the administration’s curbs on AI chip exports, while ASML, the world’s biggest supplier of computer chip-making equipment, said tariffs have made the outlook for both 2025 and 2026 uncertain. Other U.S. chip equipment makers could see a hit of about $1 billion yearly due to the levies, industry officials told lawmakers last week. On Wednesday last week the tech-dominated Nasdaq Composite fell 3%, led by a 7% drop in Nvidia. Fellow chipmaker Advanced Micro Devices said it would take a $800 million hit from the administration’s curbs on sales to China. Remember though , ‘services’ aren’t included in this tariff war (yet) so the likes of Meta and Microsoft will fare better – but have still been caught up in the tariff contagion. Year to date, Microsoft is down 11,2%, Nvidia 24,4%, Amazon down 20,8%, Tesla down 36,3%. The inauguration was probably the last time those billionaire CEOs were happy.  Japan, the nation currently at the front of the queue in talks, was thrust into the position of having scheduled talks between ‘economic revitalization’ minister Ryosei Akazawa and U.S. Treasury Secretary Scott Bessent turn into a meeting with Trump himself on Wednesday evening. The U.S. president said he would attend the discussions personally to cover other non-trade issues as he continues to focus on the U.S. balance of trade with other countries. Japan exports more than 1 million cars to the U.S. every year, particularly affordable models that could see their price tag rise by thousands of dollars if tariffs stay in place. Some automakers have broached moving some production to the U.S., but that is not an easy task. US consumer sentiment It is not US industry and manufacturing that powers the US GDP, it is the US consumer Fed Chair Jerome Powell, in a speech in Chicago last week, noted the slowing economy but added that “inflation is likely to go up as tariffs find their way and some part of those tariffs come to be paid by the public.” U.S. consumer sentiment has deteriorated sharply since Trump ratcheted up the rhetoric around tariffs in mid-February. Banking CEOs have said consumer spending has not dipped dramatically, but cracks are starting to appear. Retail sales were robust in March, largely due to the best month for auto sales since 2023 (tariff panic buying), but other components in spending were softer, and service-sector spending could start to ebb as people load up on goods, worried about higher prices. Retailers are aware of this possibility as well, as China-based discount retailers Temu and Shein encouraged shoppers to buy “now at today’s rates,” saying in nearly identical letters that they would be raising prices beginning April 25. Spending on goods and equipment – both to and from the United States – could also face a bumpier path. Author: Dawn Ridler US Exceptionalism If US exceptionalism is a thing, we certainly are not seeing it from their political class at the moment. The Trump administration in many ways are trying to walk back their trade tariff faux pas but by continuously trying to act tough. This is most telling when the administration keeps saying that the Chinese can reach out to make a deal even though it was the Americans which started the latest trade war. Why should the Chinese? They are the world’s largest economy and are being attacked by the world’s largest economy. This requires a robust response which came in the form of retaliatory tariffs. So as the Americans continue to watch Xi Jinping on his South Asian tour last week, I cannot but think that they may act and talk tough but inside the political system there is not much coherence. Unintended consequences have not been given enough thought. In a way, the Americans during the trade debacle glimpsed the future. It’s a world where supply chains are more localised and where procurement occurs from allies. It’s where technology is kept for self-advancement and protection, perhaps at the expense of others. And this is the world which will become the norm in the future … just not today. America is in the throws of figuring out who their allies are, and this surely is a first step before one embarks on a trade war with the globe. The problem the Americans are facing is that to undo decades of globalisation requires much more than tariffs. Take the Apple iPhone as an example. If you own one, it’s a product which is the culmination of materials sourced across the world and designed and assembled in various jurisdictions. It may be brought to you by Apple Inc, which is a US based company, but much of its assembly happens in China. iPhones in many ways require human intervention, requiring eyes on minuscule details. Believe me, if Apple could automate the process, they would have done so a long time ago to drive their profit margins higher. But yet they rely on the Chinese to painstakingly sit and help assemble the iPhone. Why not use Americans? When the Chinese economy started expanding, many workers needed to make a choice between subsistence farming and joining the workforce. The alternatives provided at that stage led to many workers joining assembly lines across the country at wages which the West would never work for. Assemble an iPhone enough and you become an expert at it. Now as the Chinese worker needed to make a choice, so too does the American government want the average American to choose between the services industry and an assembly line. One could argue that the Chinese chose upward mobility whereas the American choice can hardly be seen as that. And this is what the Trump administration fails to understand when it implements blanket tariffs. They are asking the average American to work at a job they would never want assembling products which they have no skill in doing. But yet, the US is marching onto what looks like a Tariff – retake. What seems to be happening with tariffs now is that they are becoming perhaps more specific. The US government announced that they will limit the sale of Nvidia’s H20 chips, which were still allowed to be sold to the Chinese under certain restrictions. This will lead to a $5.5 billion charge to Nvidia. The stock closed -6.87% down on the news. As I said in the beginning, the Americans have glimpsed the future but disassembling global trade is a much harder task than they anticipated. Perhaps in a decade from today a localised world becomes the norm, just not today Author: Cobie Le Grange EXCHANGE RATES: The Dollar has found a new, weaker, level- below 100 The Rand/Dollar closed at R18.89 ( R19.12, R19.10, R18.36, R18.21, R18.18, R18.20, R18.71, R18.35,R18.38, R18.41, R18,67, R18.38, R18.73, R18.03, R18.05, R18.11, R18.21, R17.58, R17.60, R17.66, R 17.41, R17.48, R17.12, R17.42, R17.85, R17.82, R17.71, R17.85, R18.32, R18.26, R17.95, R18.23, R18.20) The Rand/Pound closed at R25.10 (R25.01, R24.73, R23.78, R23.55, R23.52, R23.50, R23.53, R23.19, R23.12, R22.85, R23,16, R22.93, R22.80, R22.99, R22.98, R22.72, R22.99, R22.73, R22.72, R22.89, R22.75, R22.93, R22.90, R23.20, R23.44, R23.41, R23.13, R23.39, R23.28, R23.32, R23.34, R23.00, R22.63, ) The Rand/Euro closed the week at R21.52 (R21.72, R20.93, R19.95, R19.72, R19.83, R19.72, R19.41, R19.20, R19.29, R19.02, R19,35, R19.31, R19.23, R19.09, R18.87, R19.19, R18.85, R19.09, R19.07, R19.05, R19.19, R19.12, R19.47, R19.79, R19.72, R19.80, R19.70, R20.01, R19.94, R19.58, R19.74,) Oil Brent Crude: Closed the week at $67.72 ($64.76, $65.95, $72.40, $72.13, $70.51, $70.33, $73.03, $74.23, $74.51, $74.65, $76,40, $77.60, $79.98, $71.00, $72.38, $75.05, $70.87, $73.86, $73.99, $75.57, $78.67, $77.95, $71.96, $74.68, $71.47, $76.99, $79.05, $79.09, $79.43, $77.56, $85.03, $83.83, $84.86, $85.22). Bitcoin closed at $84,571 ($84,695, $82,661, $83,074, $84,889, $82,639, $83,710, $85,696, $96,151, $96,821, $96,286, $99,049, $104,559, $104,971, $99,341, $97,113, $97,950, $90,679.47, $79,318, $68,277, $66,989, $62,876 , $62,267, $65,596, $62,603, $54,548, $57,947, $63,936, $59,152, $60,847, $61,903, $59,760,). Articles and Blogs: To catch a falling knife NEW Income at retirement NEW 2025 Budget Apportioning blame for your financial state Tempering fear and greed New Year’s resolutions over? Try a Wealth Bibgo Card instead. Wills and Estate Planning (comprehensive 3 in one post) Pre-retirement – The make-or-break moments Some unconventional thoughts on wealth and risk management Wealth creation is a balancing act over time Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Keeping your legacy shining bright Financial well-being when dealing with Dementia and Alzheimers Weathering the storm Pruning your wealth farm Should you change your investments with changing politics? Taking a holistic view of your wealth Why do I need a financial advisor? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏