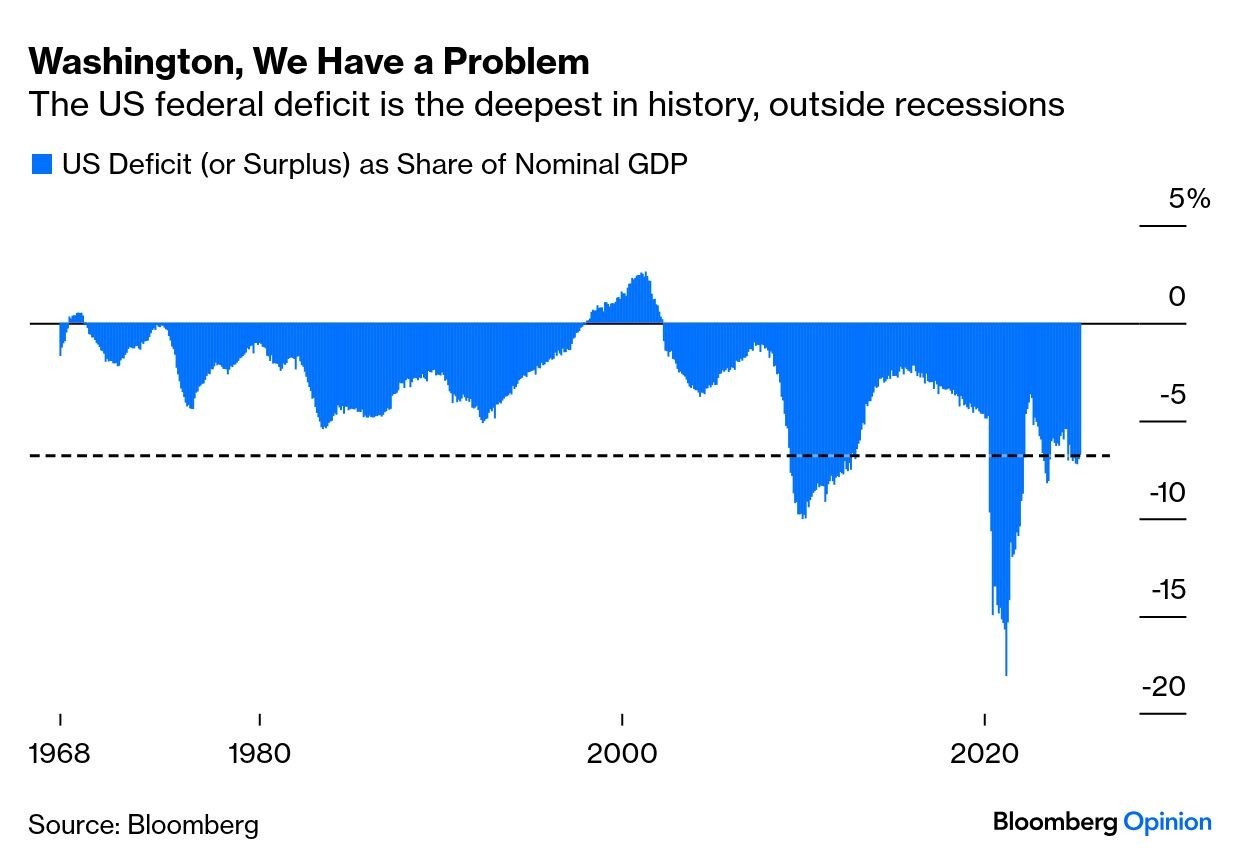

| The podcast to this newsletter is available here. Market View The JSE hasn’t stopped hitting new highs  if you do a bit of deeper dive into the sectors, the one stand out is the industrial sector:  And here is the individual category performance:   Budget Deficit update Just when you thought the tariff de-escalation was a sign of a calmer trading environment in the US , no such luck. After the longest six weeks in US politics, The so-called Big, Beautiful Bill hit Congress. It certainly is big, but not very beautiful. It still has a way to go before it becomes law, even with the trifecta of the arms of government controlled by the Republicans. I might be deluding myself, but there are signs that some Republicans are waking up to the fact that Trump is going to be out of office in 3 ½ years’ time and it’s time to start planning for a future without Donut Donald, but where they still have a voice. Democrats are all over the place, but when they stop licking their wounds and stop behaving like emotionally traumatised Gen Zs, and start coalescing, the Republicans willneed to start putting the Donald in the rear view mirror. The bottom line on this new tax bill is that the combination of tax cuts with feeble attempts at cost cuts will mean a deeper deficit. The Doge machete has been singularly ineffective. Cobie and I have spoken about the budget deficit at length, and it really is the one thing that could tip the USA (and perhaps the rest of the globe with them) into a recession that makes 2008 look like a Gold Painted Qatari Plane trip. I think we forget sometimes that most of Biden’s tenure was during the pandemic, and that the Biden administration avoided a widely anticipated recession over the last two years by priming the fiscal pump. Yes, that kept the economy going, but it led to inflation. As a result, he federal deficit has never been this deep outside a recession. Indeed, it hadn’t been this serious even during the downturns of the 1970s and 1980s:  US downgraded In important news released on Friday, the US was stripped of its last top credit rating by Moody’s Ratings (the other two major ce4dit rating agencies downgraded the US years ago), reflecting deepening concern that ballooning debt and deficits will damage America’s standing as the preeminent destination for global capital and increase the government’s borrowing costs. Moody’s lowered the US credit score to Aa1 from Aaa on Friday, joining Fitch Ratings and S&P Global Ratings in grading the world’s biggest economy below the top, triple-A position. The one-notch cut comes more than a year after Moody’s changed its outlook on the US rating to negative. The credit assessor now has a stable outlook. This was the statement: While we recognise the US’s significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics. Moody’s blamed successive administrations and Congress for swelling budget deficits that it said show little sign of abating. On Friday, lawmakers in Washington continued to work towards a massive tax-and-spending bill that’s expected to add trillions to the federal debt over the coming years.  Not-so-Boring old bonds (again) The Bond vigilantes are back in play. Just to remind you who these elusive creatures are : A bond vigilante is an investor who sells government bonds in response to fiscal policies they view as inflationary or irresponsible. This action drives up borrowing costs for the government, effectively pressuring policymakers to adopt more disciplined financial strategies. The term was coined by economist Ed Yardeni in the 1980s, describing traders who sold off U.S. Treasury bonds to protest Federal Reserve policies they deemed too inflationary. Bond vigilantes have historically influenced economic policy by forcing governments to reconsider excessive spending or borrowing. Bonds have moved in conjunction with expectations for the Federal Reserve. As we have said repeatedly, tariffs posed a clear and present danger to US growth. After April 2, when the administration was insisting that trade levies were not merely a negotiating tool, FED funds futures began discounting a series of cuts (to stimulate the economy). Now that Trump is backpedalling faster than a camper meeting a bear in the woods, that is over. The implicit rate for next month’s Fed meeting is at a new high, with the chance of a cut now negligible. I think its safe to say that the US’s new normal is going to be higher for a lot longer is the new normal.  The average (AAA rated) Euro ten-year bonds have found a new, slightly higher level in the 2.5-2.75% range (remember, not so long ago, they actually went negative).   Big Pharma Trump’s executive order aimed at compelling drug makers to reduce prices was no surprise — it was a matter of when, not if. Last year, US medication spending surged to $487 billion, intensifying long-lasting concerns over soaring health care costs. With Big Pharma struggling to shake its reputation for exploitative pricing, Trump’s order seemed inevitable. Despite surging costs and the tailwinds from Covid-19 vaccines and then obesity drugs, health care stocks’ performance has been lacklustre. The ratio of the S&P 500 health care stocks to the overall index highlights a gradual descent since late 2022. The artificial intelligence rally sucked up a lot of oxygen — but not even the breakthrough in GLP-1 blockbuster drugs for obesity has turned this around: The diabetes drug insulin is a great place to find the huge price disparities across the globe:  The US is also the overwhelming leader in the number of people suffering from diabetes.  U.S. President Donald Trump signed an executive order on Monday last week directing drugmakers to lower the prices of their medicines to align with what other countries pay, which analysts and legal experts said would be difficult to implement. The order gives drugmakers price targets in the next 30 days, and will take further action to lower prices if those companies do not make “significant progress” toward those goals. The order was not as bad as feared, investors, analysts and drug pricing experts said, and they questioned how it would be implemented. Shares of drugmakers, which had been down on the threat of “most favoured nation” pricing, recovered and rose on Monday after the announcement . Trump told a press conference that the government would impose tariffs if the prices in the U.S. did not match those in other countries and said he was seeking cuts of between 59% and 90%. “Everybody should equalize. Everybody should pay the same price,” Trump said. The United States pays the highest prices for prescription drugs, often nearly three times more than other developed nations. Trump tried in his first term to bring the U.S. in line with other countries but was blocked by the courts. One comment of Trump’s got my attention: He said his order on drug prices was partly a result of a conversation with an unnamed friend who told the president he got a weight-loss injection for $88 in London and that the same medicine in the U.S. cost $1,300. This is the equivalent of a market researcher, tasked to find out the most popular washing powder, basing her ‘findings’ on a single conversation with their domestic worker. This is the cognitive level of the most powerful person on the planet.  Trump’s tour around the global sand pit Ever the creature of habit, Trump’s first overseas tour was in the Middle East, just as it was in Trump 1.0. At least he’ll get a warmer welcome there than anywhere in Europe (even if it is just the ambient temperature – hovering around 38c at this time of the year.) Maybe that is what made him sleepy during the press conferences, or maybe he was just sleeping off the Big Mac from the pop-up brought in exclusively for his use. Let the man nap, for goodness’ sake, he’s almost 80.  The Trump administration called its $142 billion defence deal with Saudi Arabia “the largest defence sales agreement in history.” Critics aren’t so sure… (Shocker!) The deal, announced as part of US President Donald Trump’s visit to the Middle East this week, appeared ambitious and sweeping, touting purchases linked to the air force and space, missile defence, coastal security and various other upgrades. But like the broader $600 billion economic deal that it was a part of, the defence agreement lacked any specifics. And sceptics of the administration immediately pointed to questions around the numbers. One is that Saudi Arabia’s entire defence budget this year is $78 billion. To quote Riedel, a former senior US intelligence and national security official : “It’s great publicity — makes it look like this trip was spectacularly successful,”. “But the numbers don’t add up.” The White House, Pentagon and Saudi embassy didn’t immediately respond to requests for details of the agreement, such as which systems the kingdom would purchase, terms of the prospective contract and delivery timelines. Exactly what happened last week in the big, huge, massive, unprecedented, ginormous deal with the UK. The State Department referred questions to the White House. Another great big juicy nothing burger. The White House said President Donald Trump had also secured deals totalling more than $243.5 billion with Qatar, laying the groundwork for a bigger $1.2 trillion economic pledge with the tiny Gulf country, no doubt in appreciation of the $400m dollar jet gifted to Trump (that is going to take at least 3 years to retrofit and de-bug). A critical focus of the partnership with Qatar is defence. The US and Qatari governments have signed off on a $1 billion agreement for Raytheon, a major American defence contractor, to provide counter-drone capabilities to Qatar. The agreement would make Qatar the first international customer for Raytheon’s Fixed Site-Low, Slow, Small Unmanned Aerial System Integrated Defence System, which is designed to counter unmanned aircraft. He does know that Qatar is the biggest supporter of Hamas, right? Does it give safe harbour to the leaders? Irrelevant? Of course, there are also the minor details of already inked plans to develop a golf course, clubhouse and beachfront villas on its coast for the Trump organisation  Tariff update (warning – can change on a whim) Over the last few weeks, we have spoken at length about the potential impact of tariffs, especially in the spat with China, and speculating who would blink first. (Spoiler alert, it was Trump, via his ‘talking head’ Scott Bessent.) The two superpowers stepped back from the brink, at least temporarily, agreeing to drastically lower the steepest levies introduced since Trump returned to office and removing some non-tariff barriers. The initial agreement, which holds for 90 days, came as the economic pain of tariffs above 100% started to bite for both sides, putting at risk the almost $700 billion of goods exchanged between the US and China each year.  Stats already show that trade across the Pacific Ocean slumped in April, Chinese manufacturing activity has slowed, and American consumers have faced higher prices for products as varied as umbrellas, batteries and refrigerators. A deal that fully de-escalates the tariff war could take longer to hammer out than the three-month reprieve — if such a pact is even possible. Remember that when the two sides agreed to put their trade dispute on hold in 2018, the “Phase One” deal that emerged wasn’t struck until more than 18 months later, during which time further tariffs were imposed. China’s failure to increase its purchases of US goods to the agreed level set the stage for the current trade war.  After a round of trade talks held in Switzerland over the last couple of weeks, the US agreed to reduce its tariffs on Chinese imports to 30%. This comprises a 10% “reciprocal” duty, in line with what most of America’s other trading partners are subject to, and a 20% levy announced earlier in 2025 tied to the flow of illegal fentanyl into the US. China agreed to match the US “reciprocal” rate and lower its new tariffs on American imports to 10%. It also said it would suspend or cancel its non-tariff countermeasures imposed since April 2.  How did China get so big so quickly? We all know that the US and China are in a big tariff standoff, but perhaps it would be useful to look how they got there (and how quickly). In 2000, as China prepared to join the World Trade Organisation, the US granted the country “permanent normal trading relations” status, meaning equal tariff treatment with other trading partners. This kickstarted rapid growth in trade between the two economies. Companies in the US and elsewhere began shifting a substantial amount of production to the East Asian nation. This hollowed out some domestic American industries in a process later dubbed the “China shock,” but it also helped bring down the price of consumer goods at home as China became the world’s factory. By 2024, the total value of imports and exports between the US and China was almost nine times higher than in 2001. While Trump’s first trade war put a dent in the relationship, the Covid-19 pandemic sparked a resurgence and Chinese exports to the US hit a record in 2022.  Total US-China trade peaked in 2022 but is still worth almost $700 billion. What have been the top exports between the US and China? Last year, the three biggest US imports from China were smartphones, laptops and lithium-ion batteries. Liquefied petroleum gas, oil, soybeans, gas turbines, and machines to make semiconductors were some of the most valuable US exports to China.  Apple Inc. is one of the US firms that reoriented its supply chain over the past two-and-a-half decades, now contracting much of its manufacturing to firms in mainland China (but recently announced a gradual switch to India). Until recently, almost all iPhones were made in a few huge factories there — largely by Hon Hai Precision Industry Co., better known as Foxconn — using parts from South Korea, Taiwan, Japan, mainland China, the US and elsewhere. The California-based tech giant is far from the only company that took advantage of China’s deep supply chains and lower costs. More than 70% of the $56 billion of smartphones imported into the US last year were from China, according to Bloomberg analysis of trade data from the US International Trade Commission. Meanwhile, almost 90% of games consoles brought in from overseas by the likes of Sony Group Corp., Microsoft Corp. and Nintendo Co. Ltd were shipped from China too. Why has Trump targeted China’s exports above all others? The deficit with China is the largest of all the US trading partners, coming in at $295 billion in 2024, although in reality it’s bigger as tariff-free imports of small packages under the “de minimis” loophole (that we spoke about last week) haven’t been counted. Trump has also complained that China didn’t abide by the terms of the trade deal signed in his first term. The agreement was meant to redress the import-export imbalance, partly through a huge ramp-up in Chinese buying of American goods. While China did increase its purchases, they fell short of the targeted level, and the trade gap was exacerbated by the pandemic-driven surge in US imports (see above). Beyond trade economics, the US and China are increasingly viewing one another as competitive threats and are trying to reduce their mutual reliance on goods seen as vital to national security. The US has limited or banned exports of many high-end semiconductors and the tools to make them, as it attempts to slow China’s technological and military advancement. Without these restrictions, the trade imbalance between the two countries would likely be smaller. For its part, China tightened export controls on a number of critical minerals and rare earths — crucial raw materials used in the likes of MRI machines and missiles, making them more difficult for US companies to access. China controls most of the production and processing of a whole host of these metals and minerals. How will China be affected by higher US tariffs? The Chinese economy is in a weaker state than during the first trade war, grappling with persistent deflation, lacklustre consumer demand and an extended property slump. Ahead of the Geneva trade talks, the governor of China’s central bank, Pan Gongsheng, announced across-the-board interest rate cuts on May 7 alongside other steps that could pump 2.1 trillion yuan ($291 billion) into the economy. China’s government is opposed to an exodus of its manufacturers as this would weigh on employment, cut tax revenue and hurt gross domestic product. The threat to the manufacturing base could spur Chinese officials to expedite the pivot to a more consumer-focused economy, something economists have said is a more sustainable model and which the government has been talking about for years. Another option for Chinese firms is to try to negotiate lower input prices with their suppliers to offset the impact of the tariffs for purchasers in the US. But that will likely worsen the factory gate deflation that’s become endemic in China and further push down corporate profits. A third alternative is to keep the manufacturing engine running and shift exports from the US to other markets. As Chinese shipments to America sank by 21% in April, exports to India and the 10 Southeast Asian nations in the Asean group soared by more than 20%, while exports to the European Union were up 8%. This enabled China’s total exports to expand by 8%. This could have unintended consequences in those other nations already concerned about a flood of cheap Chinese goods undercutting their producers. China could be hit with further anti-dumping tariffs as countries move to protect their domestic industries. Just a small taste of how Chinese firms were already being impacted by tariffs, Temu is passing on nearly all of Trump’s new import taxes to US customers on products directly shipped from China. At rival Shein, the average price for the top 100 products in the beauty and health category more than doubled in the last two weeks of April, while toys and games prices jumped by more than 60%. For US exporters, their shipments to China fell by almost 14% in April. Some US industries could be hit particularly hard by China’s retaliatory import taxes. The Trump administration is already considering plans to offer assistance to farmers amid worries that tariffs will have a disastrous effect on America’s agricultural producers. China is the largest US export market for soybeans and cotton. In the last trade war, the US government offered $28 billion to farmers hurt by lost sales. How ironic is that while the US likes to think of itself as the most evolved economy in the world, its exports don’t reflect that. On the spectrum of economic evolution, one usually starts with agrarian economies, industrialised economies (manufacturing) and finally service and technology economies. Unfortunately, there are about another 192 countries that also have this agrarian experience, and you don’t have to be a rocket scientist to replace these exports at a lower price. The US are finding this out the hard way with SoyBeans. Play stupid games… Author: Dawn Ridler  The Bounce The markets, only a few weeks ago, were nursing a -20% drawdown with many speculators running for the hills. Jurrien Trimmer from Fidelity produced the below graph showing the various paths the market can follow after a drawdown of more than 20%.  The current market is shown in black relative to other drawdown periods. It’s interesting to see how the market sold down, and then pivoted hard upwards again after the US realised their policy blunder. But from this point forward, will markets follow the 2018 analogy or perhaps follow a trend lower again, given that earnings expectations have now firmly shifted lower? Look at 1968 as an example. The 1968 sell-down marked the start of a prolonged period of market weakness that lasted into the early 1970’s. The market peaked in 1968 and then sold down by 30% by mid-1969. The period was characterised by inflationary pressures, tighter monetary policy, and significant structural challenges in the financial markets. What makes today different from the past is that economies have become debt refinancing mechanisms rather than growth mechanisms. In the past, inflation would increase with a subsequent rise in rates, driving markets lower. Because governmental debt levels were moderate, their increase in repayment rates (as interest rates rose) could be absorbed. But with Western debt levels high today, the repayment rate matters much more. The Fed and the US treasury know this and will act to preserve a low rate on bond yields, which will allow them to continue refinancing their debt pile. This is why the Trump tariff blunder was so strange. Policy makers must have warned the President that this will drive inflation higher and ultimately force yields higher as a consequence. This is why President Trump attempted to tell Jerome Powell, the Fed chair, to lower interest rates or lose his job a few weeks ago. This unfortunately, sent markets into a tailspin again. So the economic world today is much different to 1968. Debt servicing has become a national imperative and the events across markets in the last few weeks show that policy decisions can seriously derail these efforts. It is within this economic paradigm that markets live and operate. It’s as if the financial regime in the US has a floor built into the market until they can squash some of the debt that has been piling up over time (US debt to GDP: 124%). So even if earnings expectations are now lower, I doubt if markets are going to be forced into a tailspin again… that is unless something else happens left-field. And this brings me to investor behaviour. This is the one thing that we have control over and is often the largest influencer of long-term returns. It is incredibly difficult to do nothing when markets are falling, even for seasoned professionals. Remember that news that sends markets lower always has a doomsday narrative attached to it. Look at some of the rhetoric this time round. The US is going into a recession, inflation is going to spiral out of control, the shelves are going to be empty etc. The more news you read, the more you will want to sell out completely. But if you sat on your hands and watched, you would have been part of the recovery to date. As a matter of fact, if you bought some stocks when markets were down, you would have done even better. This is why I always make a point of holding some cash in reserve in our client’s portfolios …… you never know when you may need it! Author: Cobie Le Grange EXCHANGE RATES: The Dollar is ststill within the 100 range, but has strengthened slightly over the week   The Rand/Dollar closed at R18.04 , we are almost back to the same level as last year. (R18.16, R18.39, R18.64, R18.89, R19.12, R19.10, R18.36, R18.21, R18.18, R18.20, R18.71, R18.35,R18.38, R18.41, R18,67, R18.38, R18.73, R18.03, R18.05, R18.11, R18.21, R17.58, R17.60, R17.66, R 17.41, R17.48, R17.12, R17.42, R17.85, R17.82, R17.71, R17.85, R18.32, R18.26, R17.95, R18.23, R18.20)  The Rand/Pound closed at R23.95 , while not quite back at last year’s level, the direction is encouraging (R24.16, R24.40, R24.82, R25.10, R25.01, R24.73, R23.78, R23.55, R23.52, R23.50, R23.53, R23.19, R23.12, R22.85, R23,16, R22.93, R22.80, R22.99, R22.98, R22.72, R22.99, R22.73, R22.72, R22.89, R22.75, R22.93, R22.90, R23.20, R23.44, R23.41, R23.13, R23.39, R23.28, R23.32, R23.34, R23.00, R22.63, )  The Rand/Euro closed the week at R20.13 , again, not quite at last year’s levels, but a good Rand appreciaton (R20.43, R20.78, R21.21, R21.52, R21.72, R20.93, R19.95, R19.72, R19.83, R19.72, R19.41, R19.20, R19.29, R19.02, R19,35, R19.31, R19.23, R19.09, R18.87, R19.19, R18.85, R19.09, R19.07, R19.05, R19.19, R19.12, R19.47, R19.79, R19.72, R19.80, R19.70, R20.01, R19.94, R19.58, R19.74,)  Brent Crude: Closed the week at $65.41 ($63.88, $61.29, $65.86, $67.72 $64.76, $65.95, $72.40, $72.13, $70.51, $70.33, $73.03, $74.23, $74.51, $74.65, $76,40, $77.60, $79.98, $71.00, $72.38, $75.05, $70.87, $73.86, $73.99, $75.57, $78.67, $77.95, $71.96, $74.68, $71.47, $76.99, $79.05, $79.09, $79.43, $77.56, $85.03, $83.83, $84.86, $85.22).  Bitcoin closed at $103,551 ($104,615, $96,405, $94,185, $84,571, $84,695, $82,661, $83,074, $84,889, $82,639, $83,710, $85,696, $96,151, $96,821, $96,286, $99,049, $104,559, $104,971, $99,341, $97,113, $97,950, $90,679.47, $79,318, $68,277, $66,989, $62,876 , $62,267, $65,596, $62,603, $54,548, $57,947, $63,936, $59,152, $60,847, $61,903, $59,760,). Articles and Blogs: Kick Start your own Retirement Plan NEW You matter more than your kids – in retirement NEW To catch a falling knife Income at retirement 2025 Budget Apportioning blame for your financial state Tempering fear and greed New Year’s resolutions over? Try a Wealth Bibgo Card instead. Wills and Estate Planning (comprehensive 3 in one post) Pre-retirement – The make-or-break moments Some unconventional thoughts on wealth and risk management Wealth creation is a balancing act over time Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Keeping your legacy shining bright Financial well-being when dealing with Dementia and Alzheimers Weathering the storm Pruning your wealth farm Should you change your investments with changing politics? Taking a holistic view of your wealth Why do I need a financial advisor? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |