| The podcast of the newsletter is available and you can download it HERE. We welcome all your input so please don’t hesitate to contact us if you’ve got any queries or suggestions. Market Watch The JSE has recovered from the previous week’s wobble while the GNU was being thrashed out and now looks like it’s sustaining above the 80,000 mark. While the year-on-year performance is now above 9.5%, this is still almost on par with the yield from bonds.  The S&P 500 however is on a much better trajectory (see Cobie’s commentary below).   UK elections As expected, the Tories were thoroughly trounced out of the UK government last week, and the voters handed the Labour government a whitewash. While Rishi managed to hold onto his seat, many of his ministers did not, including the very popular Penny Mordant. Keir Starmer won a historic victory, the second-biggest for the party after Tony Blair’s 179-seat majority in 1997. The Conservative Party has also secured both the lowest share of the vote and the lowest seat tally in the party’s history, bringing a humiliating end to 14 years of Conservative rule.  There is little doubt, that based on the poor voter turnout, this election was much more an anti-Conservative election than a pro-Labour one. There was none of the excitement that surrounded Blair and New Labour or Jeremy Corbyn in 2015-2019. Rather, it’s been more a sullen determination to get rid of the Tories by whatever means necessary, including a large amount of tactical voting, which is a relative rarity in the British system.  Where has loadshedding gone – and why? The power utility Eskom has hit 100 consecutive days without load shedding. The last time the country saw such a prolonged period without load shedding was from 8 September 2020 to 11 December 2020. What’s behind this sudden turnaround – I think most of us are sceptical! Eskom has attributed the achievements to its operational recovery plan which was initiated in March 2023 amid some of the worst load shedding on record, which included an aggressive maintenance plan and other operational improvements. Alongside this, there was a significant drop in demand from users amid the rollout of alternative energy generation—such as rooftop solar. Some things are easier to hide than others, but if you look at the Energy Availability Factor (EAF) which is now averaging around 61.5% – a remarkable turnaround from the 50% levels seen during the over 12-month period of “permanent load shedding” in 2022/23. This improvement can be seen in the most recent EAF graph – showing that we’re getting back to 2021 levels.  Eskom has gradually reduced breakdowns and unplanned losses in the fleet from 18,000MW to an average of 12,000MW. Eskom also noted that it has become less reliant on costly open-cycle gas turbines (OCGTs) to keep the lights on. Eskom got another boost from the commercial operation of Kusile Unit 5, which is now contributing an additional 800MW to the grid. For the rest of the year, it anticipates Kusile unit 6 also coming online (adding another 800MW), and unit 2 of the Koeberg nuclear power stations returning after its maintenance programme to add another 930MW. Obviously, the sudden introduction of the R200 monthly fee for prepaid in JHB has caused an uproar and is surprising in that it often affects the poorer communities. For once this is not the DA’s problem, having excluded themselves from the provincial government in the province (you have to look for silver linings wherever you can find them).  |

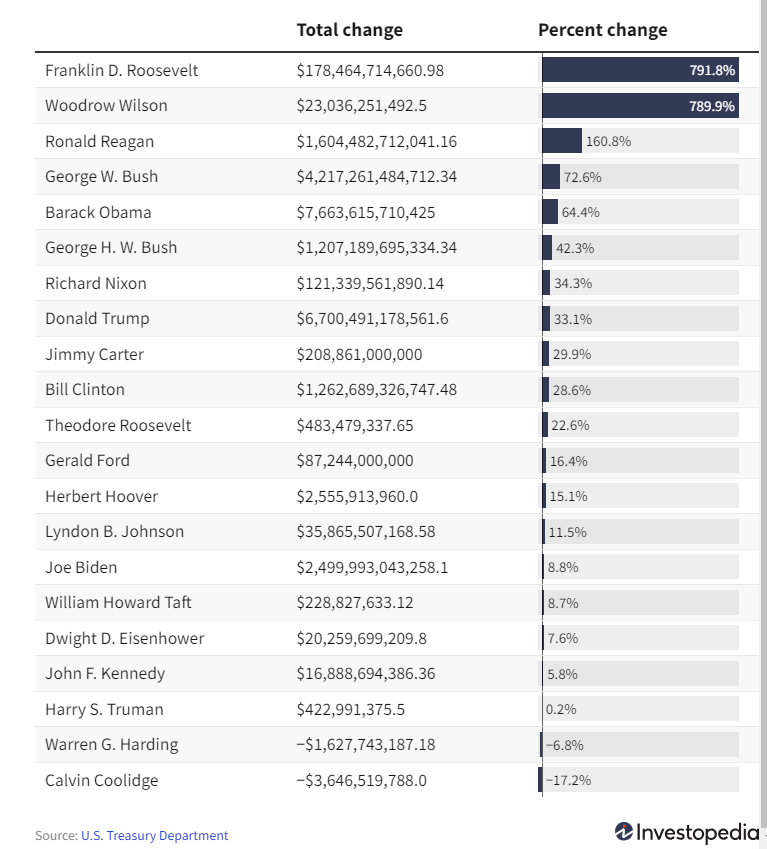

| US Deficits and Presidents I’m sure there are plenty of US citizens who wished that they had short sharp election races like you see in Europe, the UK and even here in RSA. Discussions around Biden’s abysmal performance in the debates haven’t faded, and there are increased calls, even from his own party, to step down before the primaries. He didn’t help matters last week when he said he just needed ‘more sleep’ and the leak that his team is not scheduling anything official after 4pm in the afternoon. To be fair, Trump is a well-known night owl and never started his official duties in the Oval Office before 11am. Polls are showing that Kamala Harris is polling well against Trump, despite not having been adequately groomed in the last 3 years (IMHO). Handing her the poison chalice of immigration set her up to fail in many respects. As the US headed into the 4th of July celebrations, Wall Street celebrated with fresh records for the S&P 500 SPX (see Cobie’s piece for more on this) and Nasdaq Composite COMP. So, what if Trump does win the election? Some investors (even this early, some 4 months out) are hopeful that they’ll see more of what was seen in Trump’s former presidency — fiscal expansion, reflation and fewer regulations. What could investors gain from a Trump presidency? Nouriel Roubini, the economist who is nicknamed “Dr. Doom” for his often-gloomy predictions, warns that a second term for Trump could spark a trade war that could hurt stocks. “I would say protectionism (Trump’s strategy) is going to lead to a gradual increase in inflation and that will be something that will be of concern, certainly to the bond market,” Roubini said in an interview with Bloomberg. US deficit: A history lesson:  We often talk about the US’s deficit problem, and it will continue to balloon in a prospective Trump presidency. You can see from the graph above that Trump packed on over $6.7tn in debt – and only a tiny fraction of that can be blamed on the pandemic. George Bush and Barak Obama had to deal with the Credit Crisis fallout. Funding wars is one of the main ways that the president can increase the national debt. In fact, before 1930, almost all the budget deficits run by the American government were the results of wars. The Civil War left the U.S. government owing more than $2.6 billion at the end of the war in 1865. Just five years earlier, in 1860, the year before the Civil War started, the national debt was only $64.8 million. During World War II in the 1940s, then-President Franklin D. Roosevelt’s spending on the war effort created some of the largest deficits as a percentage of total gross domestic product (GDP) in American history. The U.S. government borrowed about $211 billion to help pay for WWII. In the early 2000s, then-President George W. Bush launched the invasion of Afghanistan and the War on Terror following the September 11 terror attacks. Less than two years later in March 2003, President Bush also invaded Iraq. The cost of these wars over 20 years was estimated at around $8 trillion in September 2021. These wars began by President George W. Bush added significantly to the national debt during his presidency and the presidencies of Obama and Trump. The cost of the wars is also reflected in the yearly military budget, which reached record levels of more than $600 billion in 2009 as Bush’s presidency ended.  AI: A deeper dive into its possible longer-term trajectory. As Nvidia Corp. has maintained a streak of hitting quarterly revenue and profit numbers out of the park, what might be lost to investors is that so much of the action around generative artificial intelligence still hinges on the build-out of computing infrastructure, rather than demand for products and services making use of the technology. There is the worry that the transfer from AI enablers (those building the technology and infrastructure) to the adopters (the people who actually use it) may take much longer than anticipated. Nvidia remains an obvious play among companies helping data centers build the computing capacity needed to support their corporate clients’ development of products and services that develop generative AI. True end-users are almost negligent at this point in time. There are some AI ‘middle men’ (enablers) like META who are investing huge sums in AI hardware. Those massive investments are obviously going to have to generate revenue from end users – based on the capital being spent, it would need to be at least an additional $300bn for META (so far). At the moment revenue from AI across the board is barely at $3bn. About 53% of Nvidia’s revenue comes from these huge (magnificent 7) companies – what happens when they stop buying ‘in anticipation’ and start holding back until revenues start to catch up? All of the Magnificent 7 are in a race not to be left behind, hoping to secure future market share. Is this really sustainable?  RSA Inflation and interest rates South African inflation expectations for the next two years declined, signalling progress in the central bank’s efforts to rein them in before its policy meeting later this month.  Average inflation expectations two years ahead — which the bank’s monetary policy committee uses to inform its decision-making — fell to 4.9% in the second quarter from 5.2% previously, (Stellenbosch-based Bureau for Economic Research.) The drop will help ease concerns expressed by the MPC at its last meeting that inflation expectations remain above the 4.5% midpoint of the bank’s target range, where it prefers to anchor them. The reading, coupled with easing inflation pressures, may pave the way for interest rates to be lowered later this year. For now, however, analysts expect the MPC will leave the key interest rate at 8.25% for a seventh straight meeting on July 18. We had hoped that the SARB would follow the European’s lead on this, but we will have to wait and see. There is only a 37 bps drop for this year priced in at this stage. Governor Lesetja Kganyago has been cautious in proclaiming an end to the MPC’s inflation fight. He’s repeatedly said the MPC won’t cut rates until inflation is firmly at 4.5%. Much of our inflation is imported and dependent on the exchange rate – if this continues to improve and stay in the R17/$ range we might be able to get this inflation beast under control.  French elections This weekend the French enter into Round 2 of the French Presidential elections. This win for Marine Le Pen is deeply divisive. Earlier this year just over 50% of French voters said Marine Le Pen’s National Rally party posed a threat to democracy (not unlike the (some) US’s opinion on Trump). On Sunday she will appeal to the other half in an attempt to pull off an election result that could reverberate across Europe. Le Pen’s party is set to emerge from the vote with the largest number of seats in parliament, even if an outright majority looks out of reach. Either outcome would be an unprecedented development in France’s postwar history, a crushing blow for President Emmanuel Macron, and could lead to years of turmoil in the European Union’s second-largest economy.  Interestingly, Le Pen’s move from fringe to frontrunner has been due in large part to her willingness to renounce her political heritage: where the overt racism of her father Jean-Marie Le Pen consigned him, over a long career, to no better than a distant second place, she has sought to soften some of his more divisive rhetoric and to reassure business over her economic policies. Florian Philippot, her vice president until 2017, said he doesn’t recognize the person he used to know. “They’re now embracing financial interests,” he said of his former party. “It is hard to see what is left of the Marine Le Pen who was against the system,” he told Bloomberg. Over three generations the Le Pen family has shepherded the far-right into the mainstream by ducking and weaving and morphing when political winds change. The Le Pens have been ruthless about cutting loose any baggage, whether that be voter promises no longer serving their purpose — or each other. Never destined to head the party her father, Jean-Marie, co-founded, the National Rally leader only got the top job because her sister plotted to overthrow him and was sidelined. After Marine clinched the leadership, she had her father expelled. France is in for interesting times after the Olympics – save some beer to cry into perhaps? Projections show Le Pen’s far-right National Rally party is set to fall well short of an absolute majority in the French legislative, so French politics could get messy. The National Rally and its allies are on course to win 190 to 250 of the 577 seats in the National Assembly on Sunday. That would be significantly below the 289 which would enable it to pass bills easily and push through its agenda.  Japan We often look at the Japanese economy – mostly because they are a poster child for failed economic reform, and have the largest ageing population in the world – something that the West is going to have to grapple with in the not-too-distant future. Japan’s household spending unexpectedly fell in May, raising the likelihood that consumption won’t be a key driver for the economy in the second quarter, and complicating the prospects for the central bank’s next interest rate hike.  Real outlays, adjusted for inflation, declined 1.8% from a year ago and spending slipped 0.3% from April. Consumption (the backbone of most country’s GDP) continues to be weak as real wages remain negative and consumers expect inflation to stay on, companies are finding it hard to pass on rising costs to consumers given the current state of consumption. Annual pay negotiations showed labour unions won a 5.1% raise this year, the highest in more than three decades. However, only a small portion of workers in Japan belongs to unions, and a broader pay gauge that includes non-unionized workers has shown much weaker gains, with wages lagging behind inflation for more than two years.  P/E ratios and future growth Currently, the S&P 500 boasts a P/E ratio of 28x. Historically this isn’t an outrageous number, but I would probably argue that it requires a sustainable increase in earnings to ensure the longevity of a bull market. However, look at the chart below. It shows the earnings (orange) of the S&P500 relative to its price (blue) action over time. (I sometimes prefer looking at markets in the following way as it strips the P/E ratio into its underlying components):  One can see the post-COVID boom in earnings and the subsequent normalisation of earnings once the excesses had worked their way through the system. What is interesting though is the divergence between price and earnings today as compared to the past. The S&P500’s price is expecting an earnings jump as tech companies continue to roll out their AI alternatives. The equally weighted version of the S&P500 is much more reasonable at 16x earnings. Generally speaking, the only way for prices to go up over time is to ensure that earnings continue to grow. As the earnings grow, this compresses the ratio allowing for more price expansion. The question investors should be asking themselves is why would earnings continue to grow? Inflation as I have argued before in this newsletter could structurally stay higher given the reshuffling of the geopolitical landscape. The great monetization underway as Western governments attempt to refinance their current debt pile could force governments to accept a higher refinance rate as the quality of their debt has deteriorated. Also, consider that the great leap ahead in technology will drive productivity levels but not necessarily at the inclusion of higher better paid jobs for the average citizen. Governments have a large task ahead and the current debates amongst the Presidential hopefuls are more about immigration issues than how to become structurally and economically sound again. It’s within this environment that one has to look at the current valuation in the market. Companies that are indebted will find this new environment difficult as well as those which require debt to grow. The increase in debt costs will certainly put a damper on their future growth assumptions. Companies that rely on discretionary spending may find life more difficult as well. There is a difference between luxury and discretionary spending though. The wealthy will always spend on luxury, but discretionary spending requires the middle class to spend their extra marginal earnings. This is going to become a tough market. But amongst the countless counters that make up the S&P500 there are those which sell an essential service or products that you and I will find difficult to live without. They are cash-generative and grow despite the political landscape. If you find these opportunities, you have invariably stumbled across gold. Author:- Cobie Legrange EXCHANGE RATES:  The Rand/Dollar was still exceptionally volatile during the week and closed R18.23 (R18.20, R17.91, R18.37, R18.90, R18.87, R18.42, R18.26, R18.43, R18.51, R19.09, R18.68, R18.99, R18.76, R18.72, R19.15, R19.30, R18.97, R19.03, R18.80, R18.78, R19.03).  The Rand/Pound closed at R23.34 (R23.00, R22.63, R23.37, R24.18, R23.98, R23.46, R23.11, R23.80, R23.22, R23.62, R23.61, R23.93, R23.90, R24.06, R24.18, R24.47, R23.61, R24.03, R23.87, R23.86, R24.15.)  The Rand/Euro closed the week well up at R19.74 (R19.49, R19.14, R19.67, R20.59, R20.42, R19.97, R19.08, R19.86, R19.92, R20.35, R20.25, R20.56, R20.43, R20.47, R20.71, R20.93 R20.38, R20.51, R20.38, R20.40, R20.72.)  Brent Crude: Brent closed the week up at $83.83 ($84.86, $85.22, $82.30, $79.91, $81.73, $82.16, $83.43, $82.73, $82.82,$87.39, $90.87, $86.58, $85.33, $81.80, $83.80, $83.40,$83.14 $80.91, $77.36, $83.66, $78.33.) This price rise is due to the building back of inventories and increased tensions in the Red Sea which will interrupt deliveries.  Bitcoin was down again at $56,814 ($61,436, $65,635, $ 66.975, $71,257, $68,362, $69,391, $66 328, $60,880, $63,154, $64,135, $68,804, $64,681, $69,078, $68,340, $62,315, $54,649, $52,510, $47,195, $ 42,897, $41,608, $41,680). Articles and Blogs: Taking a holistic view of your wealth NEW Why do I need a financial advisor ? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |