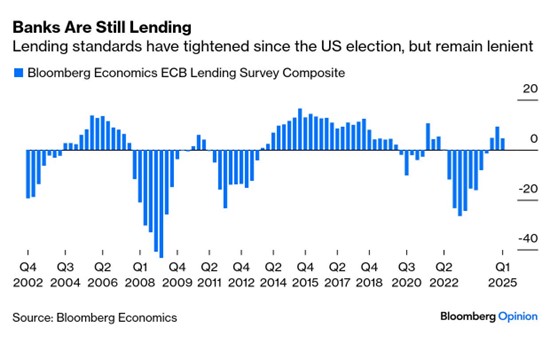

| Welcome back to our Newsletter and podcast – We hope you had a great break and looking forward to a happy, healthy and above all, prosperous 2025. Cobie and I like to keep this newsletter and our podcast evolving. We’d love to hear from you about what you like or dislike, what you’d like more or less of – both in the newsletter and podcasts. Do you have topics you’d like to hear a blog on? Do other people’s wealth journeys interest you? Market Watch Despite the DeepSeek bombshell over last week (see Cobie’s focus segment below) broader markets ended somewhat unscathed. On the JSE there has been a turnaround in fortunes since the beginning of theyear.  (All graphs from Sharedata.co.za) Despite the short, sharp deep-sea dive, the Nasdaq recovered fairly quickly but just underlines what we have been saying for months – the Mag 7 now have to monetise that massive capex they have spent on AI. (To put it in perspective, one high-end Nasdaq chip used in the AI models costs circa $50,000  The South African Reserve Bank (SARB) cut its repo rate by 25 basis points (bps) on Thursday for the third consecutive Monetary Policy Committee (MPC) meeting, bringing the benchmark rate to 7.5%. Still, the governor’s tone was one of caution for further cuts for the rest of the year amid an uncertain global environment. The reduction takes SA’s prime interest rate for commercial banks to 11%. The last time SA’s repo rate was below 7.75% was in the first few months of 2023 (and then had to respond to the rising rates in the US). Kganyago said four MPC members opted for the cut, while two wanted a hold (not the unanimity we’ve seen in the US and EU). SA inflation has fallen firmly within the Sarb’s 3-6% target range, with the Consumer Price Index (CPI) coming in at 3% for December. While this was marginally higher than the November CPI print of 2.9%, it was still below economists’ expectations of around 3.2%. Future rate cuts may be slow coming, especially if the FED continues to pause. Meanwhile, Kganyago confirmed that the MPC is also keeping an eye on the implications of a possible trade war scenario globally in the wake of increasing tariff threats by new US President Donald Trump. “In response, our model projected the rand depreciating to nearly R21 to the dollar, with domestic inflation reaching 5% and the policy rate half a percentage point higher, at its peak, relative to the baseline forecasts,”. That’s pretty severe, quite frankly. .“We also looked at a scenario of accelerated structural reforms, domestically. This showed SA economic growth picking up gradually, getting to 3% in 2027. Importantly, this scenario also showed lower inflation and lower interest rates in South Africa, demonstrating how structural reforms can reduce the country risk premium and create more monetary policy space,” Kganyago added. If RSA Inc can keep inflation in line with our trading partners – it will bode well for the exchange rate and our economy. We will be watching Trump and his proposed tariffs on BRICs very closely.  Trump shenanigans last week The White House, on Thursday, had to walk back President Trump’s order to freeze trillions of dollars in federal grants and loans after a federal judge had on Tuesday temporarily blocked the order after it caused mass confusion across the country. (Basically, it was illegal – spending is the purview of Congress) The Trump administration had struggled to explain the funding freeze, a decision that interrupted the Medicaid system, which provides health care to millions of low-income Americans (who are found in far higher proportions in the red MAGA states, ironically). In life and presidencies, the same adage applies – surround yourself with turkeys and you’ll never fly with eagles. Watching the confirmation hearings for the Trump cabinet picks on the news, this is definitely a turkey hunt. Karoline Leavitt, the White House press secretary, tried to save face on this embarrassing turn-around and wrote on social media that: “This is NOT a rescission of the federal funding freeze.” She said the President’s executive orders on federal funding “remain in full force and effect, and will be rigorously implemented.” In other news, Robert F. Kennedy Jr., Trump’s pick for health secretary, faced tough questions and struggled to convince senators that he was not against vaccines. Kennedy — who has been vocally sceptical of vaccines, supports unorthodox diets and has spouted conspiracy theories — is one of Trump’s most polarizing choices. That’s before we get to his substance abuse history and his own admission that a parasitic worm had eaten his brain. Without being ableist, you just have to listen to this man to know he has challenges. Guantánamo Bay: Trump has ordered his administration to prepare to house 30,000 “criminal aliens” at the Navy base. In recent weeks, about 40,000 immigrants have been held in private detention centres and local jails around the country. I doubt he is going to get much pushback on that issue – nobody, Republican or Democrat wants ‘alien’ criminals. Trump’s vengeance agenda is well underway, he has abruptly fired dozens of officials in ways that apparently violated federal laws. The possibility of lawsuits may be exactly what his lawyers are hoping for. Prosecutors moved to drop the classified documents case against two of Trump’s co-defendants. Howard Lutnick, whom Trump picked to lead the Commerce Department, said he would take a tough stance on tech sales to China (following on the growing evidence that DeepSeek might actually have access, illegally, to those high-end chips. Just as he promised the President has moved with lightning speed to purge officials he deems disloyal and rid agencies of policies he considers liberal. If anyone in RSA has access to our dear President, please beg him to fly under the radar and keep his opinions to himself – or start a GoFundMe to send a decade’s supply of industrial strength duck tape. The last thing our fragile economy needs is to lose AGOA. Wait for Trump to tire of all this vengeance and go back to golfing most of the time.  Earnings The one factor that we predict will move markets is going to be earnings. So far in the last week, Meta shares climbed as CEO Mark Zuckerberg predicted a “really big year,” expecting its artificial intelligence assistant to reach over 1 billion people and become the most widely used. (Sure, Mr Zuckerburg, but how are you going to monetise it? Advertising is already tapped out) Tesla shares gained on plans to begin robotaxi operations and forecast a sales recovery. Microsoft fell after it projected slow growth in its cloud-computing business. Interestingly, Deutsche Bank’s fixed-income traders closed out last year with the best fourth quarter on record – in a notoriously difficult bond trading environment. Tesla’s earnings were far from stellar. Arguably, in fact, they were downright bad. Various fundamental measures — operating income, profit, and earnings per share, or EPS — fell short of analysts’ estimates. Elon Musk’s prediction at his last earnings call of a 20% to 30% growth target set the expectations bar far higher. That explains the shares’ immediate plunge in post-market trading. But the nosedive was fleeting, with a rebound turning into an outright gain and Musk and his head of investor relations, Travis Axelrod, took turns to talk up the company’s outlook (all while ditching the 20% growth target, and never even mentioning CyberTrucks). From the graph below you can see that Trump’s bromance with DJT has paid off handsomely (so far). What will happen when these two massive egos eventually collide – which is inevitable.?  Graph from Market Watch The hypothesis that Tesla’s share-price surge since US President Donald Trump’s reelection had more to do with Musk than his core business looks ever stronger. Among the highlights, Musk sees a path for Tesla to be the world’s biggest company by market cap, and as big as the next five combined; self-driving cars will start a pilot run in Austin in June; and the great new trump card is robots, which have hands so dexterous that they can thread a needle. Trump’s threats of tariffs and his anti-green policies are least helpful to Tesla’s electric-vehicle business, which Musk himself concedes – but the market is ignoring that. Add these headwinds to disappointing earnings and the share price should have tanked. Musk’s talk about an expansive deployment of full self-driving cars and robotaxis as central to Tesla’s outlook was all very exciting, but nothing new. Nevertheless, the Tesla chief made it compelling for investors to overlook past performance, embracing a so-called “epic” power of automated vehicles supercharged by AI. It’s understandable that not everyone is convinced by Musk’s playbook. To quote: No question it is a tech company. It focuses on software and developing software for robots and autonomous vehicles. Their core business is selling cars and energy storage and charging. The mission is to advance sustainable transportation and energy. They were doing a wonderful job before they pivoted into these businesses. We are not sure how they will be, but we are sure there will be robotics and cyber cabs. That is not coming anytime soon. Where does growth come from the next several years until these technologies work? Meanwhile, the reaction to Microsoft’s miss is telling of the standards the company is held to. The stakes are high as investors want to see signs that AI is helping businesses make money. Microsoft, is in a better positions than some of the other Mag 7 like Apple to monetise AI. AI is already being used in the existing Microsoft… It’s s so well-positioned. It’s a giant portfolio company with weapons in every area. And yet Microsoft, in a renewed phase of dramatic growth, was punished, while Tesla was given a pass for a total failure to raise profits. It’s econo-politics – as much as we’d love to keep politics out of the understanding and prediction of markets – with someone like Trump, it is impossible. Meta’s earnings were decent, which was impressive given that it was carrying grandiose projects that are yet to make money, like its Reality Labs, which had losses of close to $5 billion on a paltry revenue of about $100 million. Zuckerberg also admitted that he didn’t know whether it would make any money. It’s a prospect, and the company is not even sure of its timeline. But somehow, investors prefer Big Tech to talk big on AI, even if their projects appear more fanciful than reality. When it comes to actual revenue growth, Tesla — whose shares have surged about 90% since its third-quarter earnings — is no match for Meta: It’s true that you buy a company’s future earnings when you buy its stock. But it’s amazing that so much can be taken on trust. Somehow, even after the almighty DeepSeek shock, investors still seem prepared to give Big Tech the benefit of the doubt.  Eskom Now that the load shedding spotlight is behind them, everyone can focus on the next big problem for Eskom – municipal debt The Auditor General of South Africa (AGSA) has given power utility Eskom another qualified audit for the 2023/24 financial year, raising the alarm over the group’s financial viability amid rising municipal debt. While the AGSA said that the company remains a going concern, this is purely dependent on continued government debt support and the utility’s ability to resolve its most pressing financial crisis: municipal debt. It was noted by the AGSA that Eskom’s overall audit position had deteriorated in 2023/24, compared to the year prior, with an improvement in only one area and a decline in three others. The improved area was generation and improved plant operations – hence no load shedding. However, the audit report noted that this was off a low base (no kidding), and still not in line with the expectations set by the government in the National Development Plan. More concerning, however, were the declines in distribution, finances and oversight. The group has reported operating losses of R57 billion, and its current liabilities exceed its assets by R50 billion. The utility said it hopes to return to profitability in 2025. The utility remains highly dependent on the national government for support on its debt-reliant liquidity position, and there is no certainty on price rulings from energy regulator Nersa, nor on what will be done about the mountain of municipal debt that is accruing. Meanwhile, the group also has to contend with significant electricity losses from theft, illegal connections, vandalism, ghost vending and illicit tokens, which ramp up Eskom’s cost to produce electricity. Hiking prices won’t help According to the AGSA, Eskom has very limited options in addressing its financial challenges. It has to cut cost and raise more revenue—but both paths are not looking good for the utility. The elephant in the room is the massive overstaffing in the wrong areas which happened during the Zuma years – estimated to be as high as 1/3 of the employee base. Eskom has targetted cost savings of around R10 billion over the next two years (R5 billion each in 2024/25 and 2025/26). However, the AGSA said that current and historical audits have found that Eskom simply does not have the appropriate systems, processes and controls to quantify irregular, fruitless and wasteful expenditure, nor recover the losses due to criminal conduct. The alternative—to increase revenue through a path to cost-reflective tariffs—is the next option. The auditor said that as Eskom continues to raise tariffs, this may further fuel the demand for illegal electricity connections and illicit prepaid tokens—enabled by unscrupulous Eskom officials. In the interim solar continues to roll out – and while it has probably been the saving grace when it comes to the freeze in load-shedding – but does mean less revenue for Eskom – hence the focus on hiking network charges. The auditor said that municipal debt remains one of the biggest viability risks to Eskom after debt service costs. Increasing tariffs without addressing Eskom and municipal distribution infrastructure and revenue management challenges will therefore not address Eskom’s viability challenges. We will likely have an Eskom that is supplying electricity, only for that electricity to be lost through bad debts and non-technical losses, ie, illegal connections. The cost of primary energy in South Africa could be much lower—but only if the losses from criminal conduct, irregular expenditure and fruitless spending at Eskom could be eliminated. Plant availability has improved to 62.97% from 55.27% during the same period in the previous financial year. This has resulted in no load-shedding since the end of March, saving the utility R11.9 billion in diesel expenditure year-on-year. Alongside other cost-cutting measures and the accounting adjustment being a once-off hit taken during the last financial year, Eskom expects a profit after tax of more than R10 billion in FY2025. A profit in the next financial year would be Eskom’s first since 2017.  US FED Following the expected 25bps cut in interest rates by the FED last week, the US Federal Reserve is in no “hurry” to adjust interest rates again, as indicated by the central bank’s chair Jerome Powell. Trump is gung-ho on dropping rates, so this might help Powell play out the clock and watch and see what the inflationary impact of the tariff hikes (due to start in earnest last Weekend and into today, Monday). The Fed’s rate-setting committee voted unanimously to keep the bank’s benchmark lending rate at between 4.25 % and 4.50 %. The Fed’s pause follows three consecutive rate reductions which together lowered its key rate (in total) by a full percentage point. Bear in mind that this time last year we were predicting a drop of 2-3%. Unemployment is still very low – an important bellwether for the state of an economy. Inflation, however, remains somewhat elevated. Wording is important when it comes to FED-speak. The reference to progress toward the 2% has been removed. Have they finally realised that the goalpost might have moved? Just as a reminder, the US central bank has a dual mandate from Congress to act independently to tackle inflation and unemployment. It does so primarily by raising or lowering its key short-term lending rate, which influences borrowing costs for consumers and businesses. Most analysts agree that the US economy is going fairly well, with robust growth, a largely healthy labour market, and relatively low inflation which nevertheless remains stuck above the Fed’s target. In a post to his Truth Social account, President Trump slammed both Powell and the Fed, accusing them of failing “to stop the problem they created with inflation.” Both Trump and Biden were responsible for the inflation spike, the Fed’s culpability lies in failing to act quickly enough. Futures traders see a probability of more than 80 percent that the Fed will extend its pause to rate cuts at its March meeting, according to data from CME Group. Personally, I think they’ll wait a bit longer perhaps closer to mid-year. What Trump policies might affect markets and inflation – we have covered this in previous newsletters but let’s just book mark it here: Trump has revived his threats to impose sweeping tariffs on US trading partners as soon as this weekend and to deport millions of undocumented workers. ICE is already active in Blue states and that is impacting the all-important harvest that is well underway. He has also said he wants to extend expiring tax cuts and slash red tape on energy production. Businesses will love this, and by extension, so too will markets. Most — though not all — economists expect Trump’s tariff and immigration policies to be at least mildly inflationary, raising the cost of goods faced by consumers. Asked about the likely impact of Trump’s proposals, including tariffs, Powell said the Fed would have to “wait and see” how they affected the economy. This guy has almost done a quiet quit on Trump’s USA – He’d probably rather be fired than leave the legacy of rampant inflation.  EU bond watch The European Central Bank cut rates for the fifth time since June, with the region’s economy stalling and the 2% inflation target in reach. Officials reduced the deposit rate by a quarter-point to 2.75%—as predicted.. And while they continued to describe their current monetary-policy stance as “restrictive,” the ECB could drop the label at its next meeting in March. The gap between the interest rates in the EU and USA are widening. No matter how they try, sometimes central bankers can’t avoid creating an event to spice things up a bit. Not President Christine Lagarde. On the back of utterly lacklustre GDP numbers in Germany and the eurozone we might have expected more from her – perhaps reassurance? There are worries about the fiscal deficits in several European countries, led by France, which would normally push yields upward but there are no signs of this. But slow growth has convinced investors that the ECB is going to have to keep cutting, and so yields took a tumble:  In part, this rate-cutting cycle reflects the global trend. Ever since last October, when markets grew confident that Donald Trump would return to the White House, yields in the US have risen far faster. That in turn puts more pressure on the euro. Last September, the consensus was that the Fed funds rate would be one percentage point above that of the ECB by the middle of this year. That has now risen to two percentage points: One of the first places one would see the effect of a bond change is in bank lending, but so far this is only happening slowly.  Bond finance also suggests that conditions are easy. The spread on European corporate debt compared to equivalent Treasuries is now, according to Bloomberg indexes, at its lowest since 2021, when the major central banks started hiking: Another sign of growing resilience comes from banking stocks. Brutalized by the GFC (Global Financial Crisis)and by the euro-zone sovereign debt crisis that followed, they remain far below their highs. But they are on a good run, and are now at their highest since 2012. The region looks far more resilient against a crisis than it did then, even if it’s hard to get excited about growth.  Tariffs still on and ramping up It looks like there could be 25% tariffs on goods entering the US from Mexico and Canada before this week starts. President Trump believes trade sanctions will help in the fight against fentanyl smuggling, and is probably still hoping that the US consumer doesn’t understand that the exporting nation, China, Canada or Mexico actually doesn’t pay those tariffs – they do. As late as Friday though, the forex markets don’t seem to believe him. There’s a sense, accentuated by the volatility surrounding Trump 2.0, that this year could be a crucial test to trade relations right across the world. A Trump presidency, driving tax cuts, deregulation, a focus on oil and gas production, tariffs and a tougher stance on China, will likely offer opportunities for macro traders around currency fluctuations, interest rate changes, and commodity price swings, and could fuel a rise in mergers and acquisitions activity for event-driven funds, especially in energy, finance, and technology. Trade disruptions could lead to more corporate defaults or debt restructuring, a traditional great opportunity for vulture funds to show their worth, while the potential upheaval in US industries like healthcare, technology, and energy, could result in distressed events. If hedge funds are able to persuade investors that they can help hedge against risk, they could attract more capital from pensions. Trump spoke off the cuff, as is his habit, so there’s room to doubt that tariffs will indeed be imposed on Saturday. To quote: We’ll be announcing the tariffs on Canada and Mexico for a number of reasons. Number one is the people that have poured into our country so horribly and so much. Number two are the drugs, fentanyl and everything else that have come into the country. Number three are the massive subsidies that we’re giving to Canada and to Mexico in the form of deficits. Trump also insisted that tariffs on Canadian goods wouldn’t hurt the US: “We don’t need the products that they have. We have all the oil that you need. We have all the trees you need.” While this may be true, US supply chains are geared to sourcing these goods from Canada, and substituting them would take time, and lead to price rises in the interim. West Texas Intermediate crude briefly spiked by 80 cents after his comments, but swiftly declined again. From all this we can deduce that tariffs are not priced in by markets even now, that traders are on edge, and that new trade duties will be countered by a rise in the dollar. That would reduce US competitiveness. If, as still seems likely, the presidential strategy is to use the threat as a bargaining tool on other issues, the White House might want to register that it’s making the day-to-day jobs of anyone trying to run a business much more difficult.  Indians love Trump – but the markets tell a different story In this interesting survey, you can see which countries like Trump or don’t -look at India :  We Saffers are 50-50 – Ya/Nee The Reserve Bank of India (RBI) is set to cut its main policy rate on Feb. 7 followed by just one more cut next quarter, this is largely unchanged from a month ago. The steady outlook comes despite recent data showing economic growth slowed to an annual 5.4% in the July-September quarter, well below the 8.2% seen in the last fiscal year. In its Feb. 1 budget, the government is not expected to increase infrastructure spending, a main driver of growth in past years, leaving the onus on the RBI to revive the $4 trillion economy. The Indian economy seems to be relatively insulated against global shocks over the coming year — including tariffs levied by the new administration of US President-elect Donald Trump. It is expected that India’s GDP will keep growing strongly in the long term. It is expected that India’s economy will grow at an average of 6.5% between 2025 and 2030. Their 6.3% forecast for 2025 is 40 basis points below consensus. The decelerated growth rate is, in part, because public capital expenditure growth is declining. The Indian central government’s capex growth declined from 30% year-on-year CAGR between 2021 and 2024 to mid-single-digit growth in nominal terms in 2025, according to budget estimates. Author: Dawn Ridler  All things that are AI Two weekends ago, the world got to know DeepSeek. People were espousing its amazing power which if anything else is as powerful as its US rivals. Perplexity as an example, quickly incorporated the DeepSeek option based on the model hosted in the US. What has the Americans scratching their heads is how the Chinese were able to launch DeepSeek at a fraction of the cost and produce better efficiency whilst using Nvidia’s previous generation chips. Remember that the topline chips are not allowed to be exported to China. So a race that the Americans thought they had a monopoly in has quickly changed. The Chinese it seems can also compete and do so more efficiently. Now I think that much of the costs incurred by DeepSeek is probably not accurate and consider that it was announced after the new US dispensation decided to launch the Stargate project which promised to spend $500 billion on AI data centres. It certainly smells like politics are involved. The project involved heavyweights including Oracle, Nvidia, SoftBank and Open AI. So, a ton of money chasing the AI holy grail only to find that the Chinese can produce an even smarter solution and it seems at a lower price. It’s amazing to watch as history unfolds .. the world superpowers seems to be fighting in AI land. This led to a volatile day for tech sector stocks on the following Monday. AI poster child Nvidia sold down by -16.97% and TSMC was down -13.3% on the day. Market naysayers were calling the end of the tech bull run and espousing the fine qualities of Gold. So, lots of noise all around and it is in this environment where investors need to see the wood for the proverbial trees. This is where, if you are a student of history, it can really help. The old adage that history doesn’t repeat itself but certainly rhymes comes to mind. When ideas and products stand the chance to change the world paradigm and by default societies, it attracts competition. It’s part of our human DNA to want to solve problems and when a chance to work on a project that can change the world in which we live, bet your bottom Dollar it will attract a range of characters. History tells us that there will be a group who will spend a fortune on trying to control the industry and by default its future. If they succeed, they end up becoming the industry. If they fail, they end up becoming pioneers but never see the hoped for profits. There are also a group which are charlatans. They know which buzzwords to use and how to pitch an idea but ultimately are there for the simple reason to defraud and steal. A third group of people exists who are already in the industry and know that they would need to incorporate new ideas and trends but are watching rather than acting. They are interesting as they have a profit motive. That requires them to protect their current margins and look for opportunities to expand them. Their fortunes are tied to how and when they do this. In all of this, there is a cost. The cost of investing in ideas or the cost of waiting and not acting are all implications which need to be weighed up. What has become clear in the AI race is that costs are going to be coming down. Pat Gelsinger from Intel fame says that computing obeys the gas law. It fills the available space as defined by the resources available. Everywhere where computing power is concerned (CMOS, PC’s, multicore, virtualization, mobile etc) radically lower prices drive an expansion and higher adoption rates. This can only happen the more open the collaboration is between parties. Politics may stand in the way in the short term but long term we are all going to benefit from DeepSeek’s efforts. If the cost of incorporating AI is going to become cheaper this will drive margins for corporations. Suddenly Microsoft doesn’t need to spend what they previously budgeted, and the efficiency gains from AI will further drive margins. That’s good news for them any many others. Author:- Cobie Legrange EXCHANGE RATES:  The Rand/Dollar closed at R18,67 (R18.38, R18.73, R18.03, R18.05, R18.11, R18.21, R17.58, R17.60, R17.66, R 17.41, R17.48, R17.12, R17.42, R17.85, R17.82, R17.71, R17.85, R18.32, R18.26, R17.95, R18.23, R18.20)  The Rand/Pound closed at R23,16 (R22.93, R22.80, R22.99, R22.98, R22.72, R22.99, R22.73, R22.72, R22.89, R22.75, R22.93, R22.90, R23.20, R23.44, R23.41, R23.13, R23.39, R23.28, R23.32, R23.34, R23.00, R22.63, )  The Rand/Euro closed the week at R19,35 (R19.31, R19.23, R19.09, R18.87, R19.19, R18.85, R19.09, R19.07, R19.05, R19.19, R19.12, R19.47, R19.79, R19.72, R19.80, R19.70, R20.01, R19.94, R19.58, R19.74,)  Brent Crude: Closed the week at $76,40 ($77.60, $79.98, $71.00, $72.38, $75.05, $70.87, $73.86, $73.99, $75.57, $78.67, $77.95, $71.96, $74.68, $71.47, $76.99, $79.05, $79.09, $79.43, $77.56, $85.03, $83.83, $84.86, $85.22).  Bitcoin closed at $99,049 ($104,559, $104,971, $99,341, $97,113, $97,950, $90,679.47, $79,318, $68,277, $66,989, $62,876 , $62,267, $65,596, $62,603, $54,548, $57,947, $63,936, $59,152, $60,847, $61,903, $59,760,). Articles and Blogs: New Year’s resolutions over? Try a Wealth Bibgo Card instead.NEW Wills and Estate Planning (comprehensive 3 in one post) NEW Pre-retirement – The make-or-break moments Some unconventional thoughts on wealth and risk management Wealth creation is a balancing act over time Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Keeping your legacy shining bright Financial well-being when dealing with Dementia and Alzheimers Weathering the storm Pruning your wealth farm Should you change your investments with changing politics? Taking a holistic view of your wealth Why do I need a financial advisor? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏