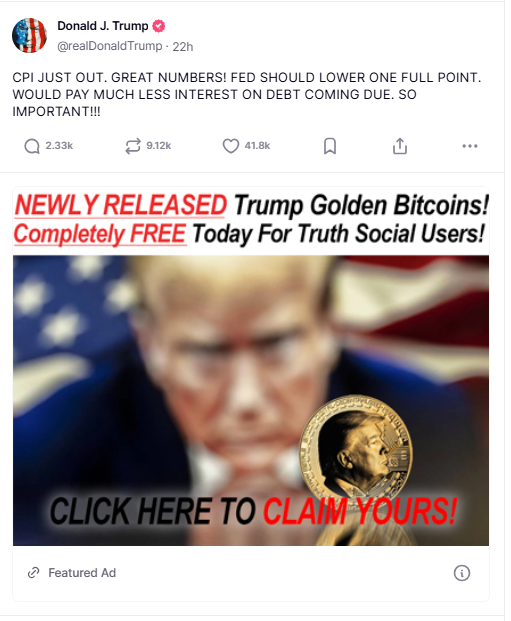

| The podcast to this newsletter, can be found here Market View Wall Street seems to have regained some of the confidence it lost over the last few months with the Trump shenanigans. The TACO Trump idea seems to prevail—in other words, he will inevitably backtrack, so keep calm and carry on. The JSE continues to show good returns for those who kept their heads when everyone was losing theirs.   Tariffs – how many times can Trump call wolf? President Donald Trump, last week, said he intended to send letters to trading partners in the next one to two weeks setting unilateral tariff rates, ahead of a July 9 deadline to reimpose higher duties on dozens of economies. “We’re going to be sending letters out in about a week and a half, two weeks, to countries, telling them what the deal is,” (bear in mind Trump’s preferred timeline for every promise that has failed to materialise has been 2 weeks, just saying…) This proclamation was made while attending a performance at the Kennedy Centre, where he has appointed himself as Chairman after firing the predecessor, and was loudly booed on his entrance. The President on May 16 said he would be setting tariff rates for US trading partners “over the next two to three weeks.” Trump in April announced higher tariffs on dozens of trading partners only to pause them for 90 days as markets swooned and investors feared the levies would spark a global downturn. Yet despite the ongoing negotiations, the only trade framework the US has reached is with the UK (with nothing concrete actually to show for it), along with a tariff truce with China. Earlier the same day Trump said that the trade framework with China had been completed and would have Beijing supply rare earths and magnets, with the US allowing Chinese students to study at American colleges and universities. (Doesn’t sound like much of deal quite frankly). Asked at the performance if he would extend the deadline for nations to cut deals with his administration before higher levies take effect, Trump said he would be open to it. “But I don’t think we’re gonna have that necessity,” he added. Trump had initially suggested he would engage in talks with each partner but has moved away from that idea, prioritizing talks with some key economic partners and acknowledging that the administration lacks the capacity to negotiate dozens of individual deals. Trump’s team is also working to secure bilateral deals with India, Japan, South Korea as well as the European Union. Commerce Secretary Howard Lutnick said earlier Wednesday that the European Union is likely to be among the last deals that the US completed, expressing frustration with conducting talks with a 27-nation bloc. In the mean time… US customs duties climbed to a record in May, helping shrink the budget deficit for the month, while doubts remain about the persistence of the inflows as the Trump administration negotiates with trading partners and faces a judicial challenge over its levies.  The Treasury Department recorded $23 billion in customs-duties revenue for May. This represents a $17 billion, or 270%, increase from the same month a year earlier. May’s figure is more than triple the monthly average of 2024. Still, Treasury Secretary Scott Bessent earlier Wednesday warned that the US faces another supersized deficit for the current year. Speaking at a House panel, he told lawmakers the gap would be 6.5% to 6.7% of gross domestic product — a third straight year in excess of 6%. Bessent wants to shrink it toward 3%.  Rare earths I think most of us know now that while China plays 3D chess, Donald thinks he is king of Checkers (ironically, it used to be called Chinese Checkers). While Donald Trump hailed the outcome of trade talks in London, Xi Jinping quietly walked away with an understated strategic gain: a negotiating process that buys China time and helps defuse the threat of more harmful tariffs and technology curbs. Shortly after two days of negotiations wrapped, Trump declared on Wednesday last week on social media that a deal had been “DONE” to restore the flow of critical rare earth minerals magnets from China, and pledged to lift curbs on student visas. Hours earlier, US Commerce Secretary Howard Lutnick revealed Washington would unwind its recent tech curbs if niche metals essential to US auto and defence firms now flowed fast enough.  China’s focus was very different. A People’s Daily commentary on Thursday, Beijing’s most substantial comments so far on the talks, made no mention of export controls. Instead, the Communist Party mouthpiece touted an “institutional guarantee” established in Geneva for the two sides to bridge differences via a “consultation mechanism.” In a long-awaited leaders’ call before the London negotiations, Xi told Trump the importance of using this channel. Ever the inscrutable Eastern attitude. While Trump seeks quick deals done directly with top leaders, Xi favours a framework led by his lieutenants that wards against being blindsided. Such haggling could drag on for years, with the “Phase One” deal from the first trade war taking most of Trump’s first term. Xi is playing the long game. While slow-walking negotiations allows China the chance to assess how hard a bargain Trump drives with other nations, the lingering uncertainty is bad for business, he added. While the Geneva talks last month wrapped with an identical US-China statement, suggesting a degree of alignment, that accord quickly fell apart over US claims China reneged on a promise to release shipments of rare earths. Beijing says it always intended to keep in place a permit process, which American companies complained moved so slowly some factories were forced to pause production. In an interesting nuance, in the announcement, Lutnick said that China was going to approve “all applications for magnets from the United States companies right away” — a sweeping claim that appeared to leave plenty of room for disappointment. Chinese Commerce Ministry spokesman He Yadong, on the other hand , pledged his country would “fully consider the reasonable needs and concerns of all countries in the civilian sector,” at a regular press briefing in Beijing on Thursday. You can bet that companies with military ties to the US will be in a similar situation to what Huawei was in the recent past.  So what are these rare earths and magnets? Rare earths are a group of 17 metallic elements found in the Earth’s crust, including neodymium, samarium, and dysprosium. Despite their name, they are relatively abundant but are difficult to extract because they are rarely found in concentrated deposits. Rare earth magnets are powerful permanent magnets made from alloys of these elements. They produce significantly stronger magnetic fields than traditional magnets like ferrite or alnico. The two main types are: • Neodymium magnets (NdFeB) – The strongest and most widely used, found in electric motors, hard drives, and headphones. • Samarium-cobalt magnets (SmCo) – More resistant to high temperatures and corrosion, used in aerospace and military applications. These magnets are crucial in modern technology, including electric vehicles, wind turbines, and medical imaging devices. However, their supply is heavily dependent on China, which produces about 90% of the world’s rare-earth magnets.  US CPI For someone who went to Wharton, one of the better business colleges in the US, one would think DJT would know the difference between a per cent and a basis point… moving interest rates 0,01% isn’t going to do much good!  You have probably become familiar with Cobie and I using these two terms – do they mean the same? Not really. A basis point (bps) is a unit of measurement used in finance to describe small changes in interest rates, yields, or spreads. One basis point equals 0.01% or 1/100th of a percentage point. The key difference: • Percentage points represent absolute changes. For example, if an interest rate moves from 5% to 6%, it has increased by 1 percentage point. • Basis points provide a more precise measure. That same 1 percentage point increase is equivalent to 100 basis points. Basis points are commonly used in financial markets to avoid ambiguity. For instance, saying “the interest rate increased by 50 basis points” clearly means a 0.50% increase, whereas saying “the rate increased by 0.5%” could be misinterpreted as either a relative or absolute change. In May the US Consumer price index increased 0.1%. Foods prices rise 0.3%; but eggs are a bit cheaper. CPI advanced 2.4% year-on-year and Core CPI gains 0.1%; increasing 2.8% year-on-year Cheaper gasoline in May partially offset higher rents, but inflation is still expected to accelerate in the coming months on the back of the Trump administration’s import tariffs. Higher rents are here to stay – mortgage interest has tripled in the last 5 years and doesn’t look like coming down any time soon. Landlords need to offset that increase, especially on new mortgages. Economists say inflation has been slow to respond to President Donald Trump’s sweeping tariffs as most retailers are still selling merchandise accumulated before the import duties took effect. How much longer will this last though? Inflation was also being curbed by slower price rises for services, including subdued airline fares. The Federal Reserve is expected to keep interest rates unchanged next Wednesday, with financial markets optimistic of a resumption in monetary policy easing in September. Before tariffs and economic uncertainty, the US was well on their way to inflation falling back to target and the main impediment to future progress is tariff-related price increases In addition to pre-tariffs inventory, economists say an uncertain demand environment was likely making some businesses hesitant to raise prices. Economists expect inflation to heat up from June and through the second half of the year and believe companies will raise prices incrementally to avoid a price shock for consumers and attract the attention of the White House. The US economy is primarily a service sector economy and the biggest cost input is the cost of workers. A cooling jobs market implies that this too will help to mitigate the tariff impact. Higher prices are likely coming. The Fed’s Beige Book report last week noted “widespread reports of contacts expecting costs and prices to rise at a faster rate going forward.” The CPI data will come under close scrutiny in the months ahead, also, for another reason: Last week the BLS (Bureau of Labour Statistics) , which also compiles other economic releases including the closely watched employment report, announced the suspension of CPI data collection in three cities because of resource constraints. The BLS, like all government agencies, has been severely affected by mass firings, voluntary resignations, early retirements and hiring freezes, which are part of an unprecedented campaign by the White House to drastically reduce the size of government and remake it. The BLS has also announced that it would, effective with the release of the July PPI data in August, end the calculation and publication of about 350 indexes. That would include data from PPI industry, commodity, final demand-intermediate demand and special index classifications. Amid estimates that BLS staffing was down by at least 15%, that is raising concerns about data quality. But the BLS said on Tuesday its published data met rigorous standards. It, however, did not address staffing issues.  Trump Accounts One of the prettier parts of the One Big Beautiful Bill. It would create Trump Accounts — every newborn American would receive $1,000 invested in a tax-privileged index fund, not to be touched before they turn 18. The man’s determination to put his name on things may grate, but this is a sensible idea. The amount isn’t much more than a symbol, although over 18 years it’s likely to grow into a sum that could genuinely help young people embarking on their lives. During an 18-year span, the S&P 500 is overwhelmingly likely to deliver a profit, and the discipline of having to leave the money untouched is a good life lesson. (Similar to the discipline of a retirement annuity which had to remain untouched to 55 ( and now the compulsory portion of the pension/provident fund too.)) If one were to go back to 1989 in the US 1989, Trump Accounts would never have lost money by the time their holders came of age, and always made gains of at least 150%. That said, structuring it as a one-time payment adds risk. This is the 18-year total return of the S&P, starting in each quarter since 1989 (with returns to date for accounts that started less than 18 years ago):  The nest eggs for anyone born in late 2008 or early 2009 would have been mightily impressive, which might be a hint not to trust this rally to keep going much longer. History also shows better returns for those who wait. The gains for those who bought after Black Monday in 1987, but before the 1990s bull market took hold, illustrate the power of compound interest, and patience. Business executives are keen to back the idea, with many promising to top up the Trump Accounts of children born to their employees. The more obvious disadvantages apply to many other things: The accounts will be passive to keep costs down, so at the margin will amplify the distortions already caused by index funds. They provide a prod to invest in the US at a time when returns might well be better elsewhere — this proposal buttresses the move toward “national capitalism” and away from globalism. The history of such ideas is patchy, understandably, as they cost public money. Tony Blair’s government operated a similar program in the UK between 2002 and 2010 known as the Child Trust Fund (not the Blair Account for some reason). While the US is providing a universal basic amount, the British plan was means-tested, with bigger allocations for children born into poor backgrounds. And it built on the UK’s popular existing “baby bonds,” life assurance policies for newborns. The UK plan ultimately fell victim to the financial crisis, growing steadily less generous before it was shelved by the Conservatives in 2011. Sadly, there are now websites to help you find your child fund, so people seem to have found it hard to keep track. Trump accounts might easily meet a similar fate. In RSA, parents can start their own similar account in a TFSA (Tax Free Savings Account). This is capped at R36k per annum contributions (R500k lifetime cap) but can still provide kids with a decent amount for tertiary education, deposit on a house, etc. Author: Dawn Ridler  The hunt for skill As we obsess over tariffs, deficits and trade wars, there is another much larger war at play. This is a war for skill and wealth. I wrote last week that groups of people may start identifying with the skills they have. Those who have and profit from AI might find themselves attracted to a specific geography where others with a similar skill reside. They will do this for the sake of collaboration and enhancement of their own skill. In the 1950’s Silicon Valley saw the start of Fairchild Semiconductor which ultimately became Intel, the bedrock of processing chips. The ability to share ideas and skills in Silicon Valley led to many other tech companies setting up shop there as well. There was also an abundance of private equity chasing new ideas, allowing for the advancement of technology for the decades to come. The identity of much of this was American and the freedom under the flag allowed for the proliferation of ideas. In this world, it’s easy to be an American. It’s the dream everyone aspires to. But as the priorities of the West change to de-globalisation and closed borders, it is going to become more difficult to identify with particular nationalities. You can see that the Americans is on a drive trying to ascertain who they can be aligned with and who is outside their circle of trust. All of this leaves Western countries with a narrow group of friends, copious amounts of debt that need to be serviced and a population fragmenting as they attempt to hold onto failed political promises. In this type of world, citizens of a country fail to identify, especially if the nation’s priorities are starkly different to theirs. In the past, wealth, freedom and capitalism all went together. I am not sure if all of these themes are bedfellows in the future. In the past, it was a far easier task applying one’s wealth to new ideas in a country which upheld freedom as a virtue. Freedom is certainly waning, and with this will become the tendency for those with wealth to become more selective on how this is spent. Because national identities are being reshaped there is the tendency for highly skilled workers to start identifying with their trade rather than their nationalities. Tax-free havens worldwide know this and are actively seeking these individuals. Think of the Middle East and Singapore as examples of this. They provide tax incentives and a ready attitude to set up companies quickly and efficiently. It becomes a symbiotic relationship between workers and the country, which attracts more workers until an industry is concentrated in a specific geography. These people may come from wide and far but as Silicon Valley attracted tech workers in the past, these geographies may very well become the “new” Silicon Valleys. In this world workers are no longer concerned with obtaining a specific passport but rather live in a foreign country because it provides freedom and tax incentives regardless of nationality. If one adds both access to capital and institutions of higher learning, it becomes difficult to ignore. This is going to be a major priority for the US in the future as they lose citizens to other jurisdictions, and dare I say, for Europe as well. The priorities in Europe are about safety and fighting for the soul of what constitutes a European. Due to immigration, Europe has become a far more heterogeneous space than before. But this melting pot of differing beliefs and customs is causing havoc. Last week Jordan Peterson asked if an international dialogue between Western countries with traditional customs and ethnically Muslim countries is not required. The hope is that this will lessen the friction between different ethnic groups in Europe before this spills over into a much larger issue with conflict as a distinct possibility. Now think again of super-skilled workers. Do they stay put in their country of birth or do they move where others with their skill set is evident, leaving behind the messy political status quo? My bet is that they move. Author: Cobie Le Grange EXCHANGE RATES:The Dollar remains weak and dropped significantly again last week, we can expect the dollar to be soft for the foreseeable future.   The Rand/Dollar closed at R17.92 (R17.77, R17.95, R17.88, R18.04, R18.16, R18.39, R18.64, R18.89, R19.12, R19.10, R18.36, R18.21, R18.18, R18.20, R18.71, R18.35, R18.38, R18.41, R18,67, R18.38, R18.73, R18.03, R18.05, R18.11, R18.21, R17.58, R17.60, R17.66, R 17.41, R17.48, R17.12, R17.42, R17.85, R17.82, R17.71, R17.85, R18.32, R18.26, R17.95, R18.23, R18.20)  The Rand/Pound closed at R24.35( R24.05, R24.18, R24.14, R23.95, R24.16, R24.40, R24.82, R25.10, R25.01, R24.73, R23.78, R23.55, R23.52, R23.50, R23.53, R23.19, R23.12, R22.85, R23,16, R22.93, R22.80, R22.99, R22.98, R22.72, R22.99, R22.73, R22.72, R22.89, R22.75, R22.93, R22.90, R23.20, R23.44, R23.41, R23.13, R23.39, R23.28, R23.32, R23.34, R23.00, R22.63, )  The Rand/Euro closed the week at R20.68 (R20.24, R20,37, R20.27, R20.13, R20.43, R20.78, R21.21, R21.52, R21.72, R20.93, R19.95, R19.72, R19.83, R19.72, R19.41, R19.20, R19.29, R19.02, R19,35, R19.31, R19.23, R19.09, R18.87, R19.19, R18.85, R19.09, R19.07, R19.05, R19.19, R19.12, R19.47, R19.79, R19.72, R19.80, R19.70, R20.01, R19.94, R19.58, R19.74,)  Brent Crude: Closed the week well up at $74.38 ($66.56, $62.61, $65.41, $63.88, $61.29, $65.86, $67.72 $64.76, $65.95, $72.40, $72.13, $70.51, $70.33, $73.03, $74.23, $74.51, $74.65, $76,40, $77.60, $79.98, $71.00, $72.38, $75.05, $70.87, $73.86, $73.99, $75.57, $78.67, $77.95, $71.96, $74.68, $71.47, $76.99, $79.05, $79.09, $79.43, $77.56, $85.03, $83.83, $84.86, $85.22).  Bitcoin closed at $105,017 ($105,643, $104,049, $103,551, $104,615, $96,405, $94,185, $84,571, $84,695, $82,661, $83,074, $84,889, $82,639, $83,710, $85,696, $96,151, $96,821, $96,286, $99,049, $104,559, $104,971, $99,341, $97,113, $97,950, $90,679.47, $79,318, $68,277, $66,989, $62,876 , $62,267, $65,596, $62,603, $54,548, $57,947, $63,936, $59,152, $60,847, $61,903, $59,760,). Articles and Blogs: Kick Start your own Retirement PlanNEW You matter more than your kids – in retirement NEW To catch a falling knife Income at retirement 2025 Budget Apportioning blame for your financial state Tempering fear and greed New Year’s resolutions over? Try a Wealth Bingo Card instead. Wills and Estate Planning (comprehensive 3 in one post) Pre-retirement – The make-or-break moments Some unconventional thoughts on wealth and risk management Wealth creation is a balancing act over time Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Keeping your legacy shining bright Financial well-being when dealing with Dementia and Alzheimers Weathering the storm Pruning your wealth farm Should you change your investments with changing politics? Taking a holistic view of your wealth Why do I need a financial advisor? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |