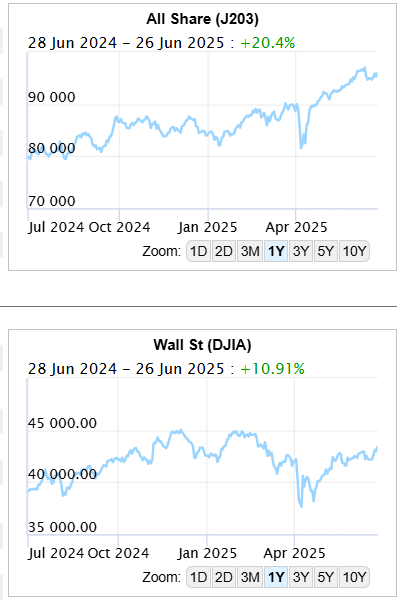

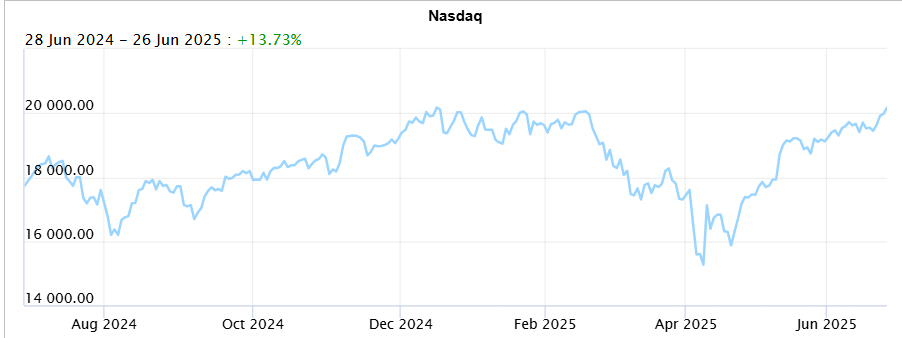

| The podcast to this newsletter, can be listened to here Market View Like most markets around the world, the JSE had a bit of a wobble during the heat of the Iran/Israel/US attacks last week, but that was short lived.  The Nasdaq has been the first US bourse to get back to business, and is closing in on new highs.   US exceptionalism watch Is US influence on the wane? Empires don’t crumble in a day, but inevitably they have their heyday and then give way to a new centre of influence – this has been happening for millennia. (There is a great book/audio book on this by Ray Dalio called Principles for Dealing with the Changing World Order. ) Economically, the U.S. dollar has weakened significantly in 2025, hitting multi-year lows against major currencies like the euro and Swiss franc. We track this in the DXY index (which is found at the bottom of this newsletter).  Graph: The DXY index This reflects growing concerns about the independence of the Federal Reserve, political volatility, and the long-term sustainability of U.S. fiscal policy. Trump is talking openly about Powell’s replacement now – and he could well look to replace him with a “Yes Man” as is his want. Geopolitically, the re-election of Donald Trump has signalled a more unilateral, transactional foreign policy. This marks a departure from the traditional ideals that underpinned American exceptionalism, such as promoting democracy and multilateralism, and instead positions the U.S. as a more conventional great power. Even culturally and socially, critiques are mounting. The U.S. lags behind other developed nations in addressing poverty and inequality, challenging the narrative of moral or developmental superiority. That said, some argue this is more of a cyclical correction than a permanent decline (i.e. a Trump/Republican/MAGA phenomenon). The U.S. still leads in innovation, especially in AI and tech, and its capital markets remain deep and liquid. As Cobie and I discussed in last week’s podcast, the issue with this is that those tech companies need fresh talent, up to now the US institutions have been providing that – but those institutions are under fire, especially w.r.t foreign students who often have had a far better schooling than their American counterparts, especially when it comes to critical thinking and creativity – critical in the next leg of the AI race.  Perhaps the question may not be whether exceptionalism is ending, but rather how it’s being redefined. The Israel-Iran ceasefire is a big political achievement for President Donald Trump and he is hugely invested in it sticking. He still has his eye on the Nobel Peace prize, which seems to be slipping out of his grasp. Trump’s presidential arch nemesis, Barack Obama has one, and he desperately wants one too. A more significant win for everyone, in economic terms, is his success in getting NATO allies to raise their defence spending. Of course this is indicative of the uncoupling of NATO from the US, they know that the US, especially under DJT is an unreliable ally. Despite the massive volatility we have seen in the markets, Bessant’s plan does seem to be coming together, at least the trend is there. On Friday, the US and China announced a trade deal which was penned earlier in the month. Now called the Geneva Consensus, you can read more about it below. But alas, remember, this could change in one bleat of DJT’s policy declarations via Truth Social. International markets are handing Trump 2.0 another victory. The S&P 500 is almost back to its record.  Treasury Secretary Scott Bessent has targeted lower bond yields, cheaper oil, and a weaker dollar. The market, so far, is delivering all of them (but frankly, way too early to call this a success): It’s questionable whether this recent positive trend is going to reverse the decline in American exceptionalism. Some of the most recent developments don’t help US outperformance. Cheaper oil is more important for European and Asia-Pacific economies than for the US, while the benefits of NATO members spending more on defence will likely flow primarily to European companies. While the market trend has shown the US regaining ground, there’s no sign that investors are rethinking the judgment they made earlier this year that tariffs were a good reason to move elsewhere. In relative terms, the US has gained nothing since the eve of Liberation Day, April 2, but that trend may be changing. Recent fund flows have helped Europe; this could continue. European funds actually exceeded those to the US over the last three months, while money has also gone into global funds that exclude the US. There are no flows out of the US as yet, so no particular reason to think that this trend cannot intensify. And in any case, as other markets are smaller than the US, any investment into them will have greater proportionate impact. If the US labour market finally begins to crack, that would force the Fed to act and would this weaken the dollar further? Tariffs and the possibility that they raise inflation are causing the Fed to stay its hand for now, and again, if inflation does recur, that isn’t going to help the dollar. Further, the administration wants a weaker dollar. Washington is getting its way on military spending, and can probably get its way on this, too. If it were to pressure the Fed into cutting rates prematurely, that would weaken the dollar not only by lowering rate differentials, but also by harming the credibility of the central bank.  Middle East tensions rattle markets The big news over the last week has been the involvement of the US in the Iran conflict. This story changes minute by minute, so please excuse me if this is already out of date when you read it. (To be updated if the story changes) In case you missed it, the conflict between Israel and Iran has involved significant military actions, including Israeli airstrikes on Iranian nuclear and military sites starting mid-June 2025, and Iranian missile and drone retaliations targeting Israeli cities and military bases. Israel then launched “Operation Rising Lion” on June 13, striking multiple Iranian nuclear facilities and killing Islamic Revolutionary Guard Corps commanders, marking a direct and intense escalation. Iran responded with “Operation True Promise III,” launching hundreds of ballistic missiles and drones at Israel, causing civilian casualties and some disruption to oil infrastructure. Despite heavy exchanges, a ceasefire was announced around June 23-24, 2025, with both sides agreeing to halt hostilities under conditions such as Iran stopping attacks. As of now, that cease fire is holding. Market Reaction to this ‘war’ has been interesting, and perhaps shows signs of desensitisation in the markets. The announcement of the ceasefire led to a significant easing in market tensions:Global equities rallied, with shares hitting record highs as investor risk sentiment improved.Oil prices plunged sharply, dropping nearly 4% on the day following the ceasefire announcement, after having surged over 10% during the height of the conflict fears.US crude oil prices fell to around $66-67 per barrel, the lowest since early June, reflecting reduced fears of supply disruptions through the Strait of Hormuz. You might remember that earlier in the conflict, oil prices had surged due to fears of supply disruptions, with Brent crude rising above $75 per barrel and US crude surpassing $74, driven by concerns over Iranian oil export interruptions.Safe-haven assets like gold and the US dollar initially rose amid the conflict but saw some easing as the ceasefire took hold.  |

| U.S. and China agree to tariff reductions In a surprise move last week, the U.S. and China reached a preliminary agreement to substantially lower tariffs, easing trade tensions and boosting investor sentiment midweek. China and the US have finalized a rare earth trade deal as part of broader negotiations, with more trade agreements expected soon. This deal was signed around June 24-25 and codifies commitments including China supplying rare earths critical for industries like wind turbines and aerospace. The US and China have reached a tariff understanding based on a framework agreement from talks in London and Geneva. This agreement maintains a baseline 10% reciprocal tariff on Chinese goods, with additional tariffs layered on specific products:20% tariff on goods linked to fentanyl precursor controls25% Section 301 tariffs on certain goods addressing unfair trade practices. This layered tariff structure results in effective rates above 30% on many Chinese imports, despite the headline 10% baseline. The complex tariff regime involves stacking multiple tariffs, including Section 301, Section 232 (steel, aluminum), fentanyl-related tariffs, and reciprocal tariffs. Despite some reductions, the average US tariff on Chinese goods remains above 50%Remember there is a self-imposed July 9 deadline to avoid tariff snapbacks of up to 125%. The White House has indicated the July 9 tariff deadline may be extended, signaling ongoing negotiations and flexibility on tariff policy. Meanwhile, US ports on the West Coast continue to feel the impact of these tariffs, with cargo volumes down and supply chain disruptions persisting since the tariffs took effect earlier in 2025.  IMF warns of surging global debt The International Monetary Fund projected that global public debt will exceed $100 trillion this year, reaching 93% of global GDP—raising concerns about long-term fiscal sustainability. Here’s a closer look at the IMF’s recent warning on global debt: The International Monetary Fund (IMF) has projected that global public debt could approach 100% of global GDP by the end of this decade, surpassing even the levels seen during the COVID-19 pandemic. As of 2025, the debt-to-GDP ratio is already climbing again after a brief post-pandemic dip. Advanced economies average 110% debt-to-GDP, while emerging and developing economies average 74%. The U.S. debt-to-GDP is 123%; Japan is at 235%; Sudan leads globally at 252%. Over 80% of global GDP is now in countries with higher and faster-rising public debt than before the pandemic. Why are we seeing this trend?Rising interest costs: Many countries are now spending more on interest payments than on defence, especially in the OECD bloc.Hidden liabilities: The IMF flagged growing use of opaque financial instruments, like securitized or collateralized debt tied to state-owned enterprises or pension funds—which often escape official reporting.Shrinking fiscal space: Emerging and developing economies are particularly vulnerable, with debt service costs crowding out spending on health, education, and infrastructure. Why is this a problem? This trend raises serious concerns about fiscal sustainability, especially in a world still grappling with geopolitical tensions, climate financing needs, and uneven post-pandemic recovery. The IMF emphasized that “you can’t manage what you can’t see”, calling for stronger legal frameworks and greater debt transparency.  China posts weakest GDP growth since 2023 China’s latest economic data showed its slowest quarterly growth in two years, driven by weak consumer demand and sluggish industrial output. You can see from the graph below that the trend in China’s GDP has been consistently down. The Asian tiger has lost his mojo (but, to be honest, wouldn’t we Saffers love to see that sort of growth?)  China’s latest GDP growth for Q1 2025 was 5.4% year-on-year, maintaining the same pace as Q4 2024 and exceeding market expectations of around 5.1%1. For the full year 2025, China’s government has set an official GDP growth target of “around 5%”. The Growth drivers include retail sales recovery, infrastructure investment, and policy support, though risks remain from global uncertainties and trade tensions.  UK inflation falls, paving way for rate cuts A notable drop in UK inflation has increased expectations that the Bank of England may begin cutting interest rates soon, potentially easing pressure on households and businesses.  The latest UK inflation data shows that the Consumer Price Index (CPI) annual inflation rate edged down slightly to 3.4% in May 2025, from 3.5% in April 2025, matching market expectations. The UK inflation rate was 3.4 percent in May 2025, down from 3.5 percent in the previous month, and the fastest rate of inflation since February 2024. Between September 2022 and March 2023, the UK experienced seven months of double-digit inflation, which peaked at 11.1 percent in October 2022. Due to this long period of high inflation, UK consumer prices have increased by over 20 % in the last three years. As of the most recent month, prices were rising fastest in the communications sector, at 6.1 %, but were falling in both the furniture and transport sectors, at -0.3 % and -0.6 % respectively. High inflation is one of the main factors behind the ongoing Cost of Living Crisis in the UK, which, despite subsiding somewhat in 2024, is still impacting households going into 2025. In December 2024, for example, 56 percent of UK households reported their cost of living was increasing compared with the previous month, up from 45 percent in July, but far lower than at the height of the crisis in 2022. After global energy prices spiralled that year, the UK’s energy price cap increased substantially. The cap, which limits what suppliers can charge consumers, reached 3,549 British pounds per year in October 2022, compared with 1,277 pounds a year earlier. Along with soaring food costs, high-energy bills have hit UK households hard, especially lower-income ones that spend more of their earnings on housing costs. As a result of these factors, UK households experienced their biggest fall in living standards in decades in 2022/23. Just as a reminder: The UK’s high inflation and cost of living crisis in 2022 had its origins in the COVID-19 pandemic. Following the initial waves of the virus, global supply chains struggled to meet the renewed demand for goods and services. Food and energy prices, which were already high, increased further in 2022. Russia’s invasion of Ukraine in February 2022 brought an end to the era of cheap gas flowing to European markets from Russia. The war also disrupted global food markets, as both Russia and Ukraine are major exporters of cereal crops. As a result of these factors, inflation surged across Europe and in other parts of the world, but typically declined in 2023, and approached more usual levels by 2024. In the US there was an additional complication in the ‘Stimulus Cheques’ which created a flood of liquidity into the economy. The Bank of England maintained the Bank Rate at 4.25% in June 2025, citing ongoing disinflation and a weakening labour market that is expected to ease pay pressures and inflation further. So, although UK inflation is moderating but remains above the Bank of England’s 2% target, with core inflation showing signs of easing and the central bank holding interest rates steady for now, but this could change. Author: Dawn Ridler  Diversification An advisor asked me about diversification the other day. I will be the first one to tell anyone that diversification is important to not only drive long term returns but also to reduce volatility. There is certainly those that shy aways from diversification as they believe this reduces the benefit of long-term equity holdings. The theory is if you truly believe in an investment case you would need to lean into the position to gain the full benefit. This is not untrue, but it does come at a volatility cost which in my experience most long-term investors wants managed. The time one wants to maximise exposure is where the investor is personally involved in turning a profit on an investment. Perhaps this is in an entrepreneurial role where a company is started or purchased. Your efforts are directly linked to the success and to make this a reality it is important to be invested over long periods of time. Here a concentrated position I fully understand. But when it comes to markets, are we truly in charge of the outcome? The investment world is littered with investors perceiving an investment to be at a favourable entry point only to realise that this was not the case. This realisation often occurs years later after a sizable amount of capital has been lost on paper. The decision then becomes does one hold or sell… and this often accompanies what the investor perceives their holding period to be. Again, if you start a company your holding period should be decades, but this isn’t necessarily true for investors in an equity fund. The reality is that equity prices rise because fundamentals improve, the economy improves and attracts liquidity, or a company finds itself at an inflection point due to structural changes in its industry. Much like what AI could deliver in the tech market today. None of these fundamentals are in your direct control and for this reason not diversifying your holdings is akin to gambling and not investing. So if one is to diversify what seems to be the correct number of holdings. A range of studies have been done over the years and most of them conclude that circa 20 holdings seems to be the sweet spot.  The above chart sums it up. It shows the relationship between number of holdings in an equity portfolio relative to the Standard deviation of the portfolio. Holding less than 10 shares in a portfolio leads to volatility. Here you are a business owner, and your holding period should be forever. The chart shows that the risk that is assumed can be diversified away by adding more holdings to the portfolio. As the holdings increase so the diversifiable risk diminishes until the only risk left is Systemic in nature. This type of risk is defined as a risk which affects the whole system or in this case the market. Think of when the tariff tantrum occurred in markets a few months ago. Assets sold down worldwide.. not only in a specific country. That is systemic risk at work. Systemic risk is the risk most equity investors need to assume to profit from their equity holdings. Yes, one can cover this risk through derivatives but remember this adds costs to portfolio management and needs to accompany impeccable timing. In other words… it’s pretty much ineffective long term. If one considers the investment world today, diversification isn’t just a nice-to-have but important to drive long-term returns. The world is in a debt refinancing cycle where bond yields and currencies have to be manipulated to allow economies to exist. This has a profound effect on asset classes. Those assets which allow for the preservation of buying power will endure. But within each of these asset classes, one could diversify. To complicate matters, AI is changing the world of work. From this alone there is going to be clear winners and losers; the only problem is no one knows who. So that’s two large forces applying pressure to capital worldwide. Surely there has never been a better time to diversify. Author: Cobie Le Grange EXCHANGE RATES: The Dollar remains weak, and weakened significantly last week. We can expect the dollar to be soft for the foreseeable future.   The Rand/Dollar closed at R17.89 (R17.99, R17.92, R17.77, R17.95, R17.88, R18.04, R18.16, R18.39, R18.64, R18.89, R19.12, R19.10, R18.36, R18.21, R18.18, R18.20, R18.71, R18.35, R18.38, R18.41, R18,67, R18.38, R18.73, R18.03, R18.05, R18.11, R18.21, R17.58, R17.60, R17.66, R 17.41, R17.48, R17.12, R17.42, R17.85, R17.82, R17.71, R17.85, R18.32, R18.26, R17.95, R18.23, R18.20)  The Rand/Pound closed at R24.49 (R24.22, R24.35, R24.05, R24.18, R24.14, R23.95, R24.16, R24.40, R24.82, R25.10, R25.01, R24.73, R23.78, R23.55, R23.52, R23.50, R23.53, R23.19, R23.12, R22.85, R23,16, R22.93, R22.80, R22.99, R22.98, R22.72, R22.99, R22.73, R22.72, R22.89, R22.75, R22.93, R22.90, R23.20, R23.44, R23.41, R23.13, R23.39, R23.28, R23.32, R23.34, R23.00, R22.63)  The Rand/Euro closed the week at R20.91 (R20.74, R20.68, R20.24, R20,37, R20.27, R20.13, R20.43, R20.78, R21.21, R21.52, R21.72, R20.93, R19.95, R19.72, R19.83, R19.72, R19.41, R19.20, R19.29, R19.02, R19,35, R19.31, R19.23, R19.09, R18.87, R19.19, R18.85, R19.09, R19.07, R19.05, R19.19, R19.12, R19.47, R19.79, R19.72, R19.80, R19.70, R20.01, R19.94, R19.58, R19.74,)  Brent Crude: Closed the week $67.39 ($77.27, $74.38, $66.56, $62.61, $65.41, $63.88, $61.29, $65.86, $67.72 $64.76, $65.95, $72.40, $72.13, $70.51, $70.33, $73.03, $74.23, $74.51, $74.65, $76,40, $77.60, $79.98, $71.00, $72.38, $75.05, $70.87, $73.86, $73.99, $75.57, $78.67, $77.95, $71.96, $74.68, $71.47, $76.99, $79.05, $79.09, $79.43, $77.56, $85.03, $83.83, $84.86, $85.22).  Bitcoin closed at $107,461 ($103,455, $105,017, $105,643, $104,049, $103,551, $104,615, $96,405, $94,185, $84,571, $84,695, $82,661, $83,074, $84,889, $82,639, $83,710, $85,696, $96,151, $96,821, $96,286, $99,049, $104,559, $104,971, $99,341, $97,113, $97,950, $90,679.47, $79,318, $68,277, $66,989, $62,876 , $62,267, $65,596, $62,603, $54,548, $57,947, $63,936, $59,152, $60,847, $61,903, $59,760,). Articles and Blogs: Difficult Financial ConversationsNEW Kick Start your own Retirement PlanNEW You matter more than your kids – in retirement To catch a falling knife Income at retirement 2025 Budget Apportioning blame for your financial state Tempering fear and greed New Year’s resolutions over? Try a Wealth Bingo Card instead. Wills and Estate Planning (comprehensive 3 in one post) Pre-retirement – The make-or-break moments Some unconventional thoughts on wealth and risk management Wealth creation is a balancing act over time Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Keeping your legacy shining bright Financial well-being when dealing with Dementia and Alzheimers Weathering the storm Pruning your wealth farm Should you change your investments with changing politics? Taking a holistic view of your wealth Why do I need a financial advisor? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |