| 2024 Budget Highlights/Lowlights: The economic environment in South Africa is muted at best and is closely tied to the commodity cycle. That commodity cycle, in turn, is closely tied to the economic activity in China – who have problems of their own. The social wage accounts for 60.2 per cent of non-interest spending, covering community development, employment programmes, health, education and social protection. R19 Million people now receive grants. The spending below paints a pretty gloomy picture.  Relative to the 2023 MTBPS, R57.6 billion is added over the next three years to pay the salaries of teachers, nurses, doctors, the police and employees in other critical services. While this is laudable, the massive slice of taxpayers’ funds that go to consumables as opposed to investment in infrastructure is worrying. Here’s an idea, let’s get the private sector to pay for it, like they’re doing with renewables: “The government will accelerate the rollout of public infrastructure by bringing in skills and financing from the private sector.” Starting from 1 September 2024, new retirement reforms will allow access to a portion of one’s retirement savings before retirement. The fiscal deficit will be reduced and government debt will stabilise at 75.3 per cent of GDP in 2025/26. (We’ve heard that before) The economic growth outlook remains stable for the next three years. Expectations include reduced load-shedding, lower inflation and a gradual recovery in credit extension. Debt servicing costs now at R382.2 or 16% of the budget or , the second largest item on the spend list! This is very concerning. Just bringing this back to 1994 levels of 30% would release a massive amount of money to be used for infrastructure (for example).  Tax collection: The table below shows the breakdown of tax revenue and some projections  It is depressing to see that the government is still not ‘ living within its means’ but constantly going further into debt. Individuals continue to shoulder the lion’s share of the taxes, but this pool of taxpayers is shrinking every year. The government has little wriggle room to increase personal taxes, but VAT is low-hanging fruit and spreads the burden across all consumers. I am a little surprised the government hasn’t introduced a ‘luxury tax ‘ level. Increases in VAT often come in the Medium Term Budget (which would be after the elections and have less of an impact on the ruling party’s popularity.)  |

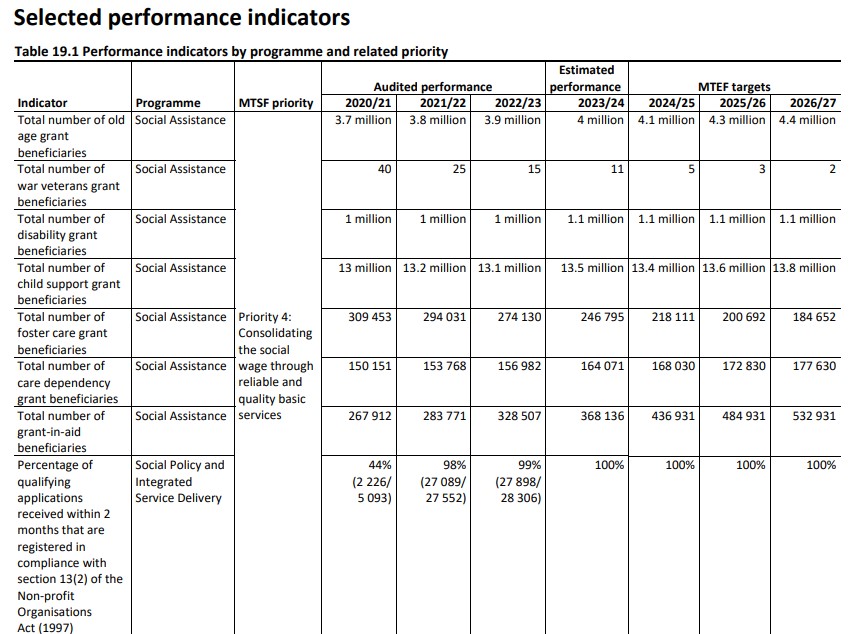

Government expenditure: The table below clearly shows how our hard-earned taxes are being spent.  Potential Problem areas: Grants as a proportion of government spending continue to balloon out of control.  If you break down these figures into the sheer number of people who are now receiving grants this is what you get:   Personal Income Tax: This is the largest revenue Bucket that the government has, at R738Bn. Last year: It is important to look at last year so we can determine if the government is increasing our taxes by stealth, in other words, not moving the tax brackets in line with inflation. Annual inflation in December (January is due any day) was 5.1%.  This Year  Bracket creep alert. Unlike previous years there has been ZERO amendment to the tax brackets to allow for inflation. Usually, the government at least tries to pretend to move these brackets!  Annual Allowances Interest allowance: Unchanged (now for many years) R23 800 Capital Gains Tax inclusion: 40% for individuals, 80% for Companies and Trusts – no change. No change in allowances. Medical tax credit: UNCHANGED. R364pm for the primary member. This is the thin edge of the wedge as the Treasury looks to give us less by stealth and as the NHI has to be funded – removed completel. Over 65 Medical allowance; Unchanged  Sin Tax: As always, this is the low hanging fruit, and are implemented immediately.   Retirement Funds Contribution : Unchanged. R350k pa capped or 27.5% of income (which ever is the larger) Pre-retirement lumpsum tiers: No change Post retirement lumpsum tiers: No change Two Pot retirement proposals: From 1 September. I am going to be writing a blog on this in the near future, there will be links in the weekly newsletter  Other taxes Fuel Levy : No change. This is unusual, and was a so-called R4bn gift to the consumer. In reality, with the massive increase in fuel thanks to the weaker Rand (in the main), adding insult to injury would be extremely unpopular. Remember that these funds are not ring-fenced to use on infrastructure but go into the great big government gravy boat. Fuel levy is around 18% of the fuel price, the RAF another 10%, and of course there is VAT too. Company Tax : Unchanged  OTHER: NHI This bill is currently waiting to be signed by President Ramaphosa – despite there being not a single meaningful budget on how this is going to be funded (despite first being launched over 20 years ago.) The estimates range from an EXTRA R200bn to R550Bn. I am currently updating my NHI blog and it should be available next week – my estimates are R550bn for NHI lite. The current spending is R251bn. To quote from the detailed Budget document:The National Health Insurance Bill has been endorsed by the National Assembly and the National Council of Provinces. If enacted, it will have significant implications for the funding and organisation of health care in South Africa. Preparatory work for this, which includes capacity building, is largely funded through the national health insurance indirect grant, which has an allocation of R6.9 billion over the MTEF period. The only solace I take from this is is the two words highlighted in red above “If enacted“. We should all hope that it never does. At the very least this bill is going to be lost for years in constitutional and other challenges, funded by medical aids and hospital groups with deep pockets (and who would be put out of business by the Act.) If you’d like any of the following documents, kindly send us an email and ask: 1. 2024 People’s Budget Guide (most of the info is in this email) 2. 2024 Budget Highlights (most of the info is in this email) 3. 2024 Tax Guide (Very useful) 4. 2024 Budget speech Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za |