The podcast of the newsletter is available and you can download it HERE. We welcome all your input so please don’t hesitate to contact us if you’ve got any queries or suggestions.

Market watch

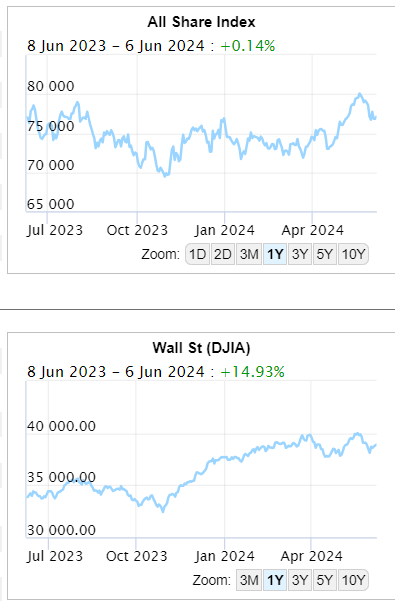

As expected, the turmoil around the direction of the government has created turbulence in the markets which have retreated over the week, and probably will continue to do so until the markets see some progress and solidification of the ‘Government of National Unity”.

| Although the ruling party managed to exceed the matric pass rate, it is being forced into political polygamy and is going back to the Mandela days with this latest take on coalitions. This probably prevents the role of ‘King Maker’ developing where a coalition partner calls the shots and blackmails the majority party into doing their bidding, but instead doles out cabinet posts to partners in this marriage of convenience, but is not devastated if one of the wives wants out. Sure, the doomsayers are out in force, having been distinctly silent last month when the Rand was showing some strength. Whether the country will see a noticeable difference in the coming years is debatable, but at least some of the potentially damaging policies may have to take the back burner. On a brighter note the MK’s declared intention of boycotting the opening of parliament will not stop the government being formed because they will still have a quorum.  KZN, as the third biggest province economically, is going to still be a major concern. Tribalism is alive and well in KZN and the MK party came out of nowhere to win 45% of the vote. In coming out of nowhere, they do not have anywhere near enough seasoned politicians to run the province let alone posts in the government (although they have stated they don’t want to be part of the GNU.) We don’t need to be reminded of the havoc caused by the rioting when JZ was jailed (and the contamination outside of KZN too) – and they won that standoff by him being released on ‘medical parole’. This has emboldened them and State Capture and its consequences forgotten. Theoretically all the other parties could combine to form a coalition but this province in particular is going to continue to be problematic.  Ghosts of conflicts past There were 2 notable anniversaries last week, 80 years since D-day (in Normandy) which has seen remembrance events attended by most Western Leaders and Royalty (except Rishi who is trying to win the upcoming election – the pundits aren’t betting on that). The other notable anniversary was the 35th Tiananmen square event – an event that many of us in the West hoped would bring some change in China, but more than a decade under Xi has disabused us of that foolish notion. The incident led to a massive death toll among unarmed students, and for decades, the CCP has systematically censored all information related to the massacre. Prior to the Pandemic this event was publicly remembered in Hong Kong – but HK pre and post Covid are very different regions – it has almost entirely been assimilated into mainland China.  Demographics We talk about global demographics often in this newsletter – because they shape global economics. Fertility rates, or rather reproductive rates, are declining in most places. According to the UN, in 1990, the average number of births per woman globally was 3.2. By 2019, this had fallen to 2.5 births per woman; by 2050, it is expected to decline further to 2.2 births. Notably, a fertility level of 2.1 births per woman is necessary to avoid a national population decline over the long run (not including net immigration).  China’s birth rate has fallen the fastest in recent years among the countries highlighted here. The country registered 7.6 annual births per 1,000 people in 2021, compared to 24.4 in 1990 and 41.0 in 1950. This trend suggests that China could face challenges similar to those faced by Japan, which has a vast senior population and significant economic and social implications. The U.S. registered 11.1 annual births per 1,000 people in 2021, compared to 16.7 in 1990 and 22.8 in 1950. It’s worth noting, however, that the U.S. also adds people to its population through net immigration each year, unlike some other countries in the above dataset. Nigeria, with the highest birth rate on the list, registered 37.1 annual births per 1,000 people in 2021, compared to 43.8 in 1990 and 45.6 in 1950. South Africa’s birthrate is 2.37 (but like the US we have a net – not entirely legal –net migration rate in 2024 of 1.757 per 1000 population, a 4.51% decline from 2023, in similar developing nations Venezuela is top at 9.5 per 1000.)  |

| Interest rates start to drop globally Remember when “developed world” central banks pretended their inflation target was 2%? Well that’s no longer the case after the ECB cut rates and BOC cut rates for the first time in 4 years, and less than a year after its last rate hike, even as Canada’s inflation remains a very sticky 2.7%. And just to underscore the death of the 2% inflation target, the ECB will also cut rates for the first time since March 2016 (and 8 months after the last rate hike), even though core Eurozone CPI remains 3%. This breaking ranks and not following the FED (so-called front running) is important. Can the FED be far behind? The FED is stuck in an awkward position – cutting rates when inflation is not in the target, and before the November elections will be seen as a political move to bolster the chances of the incumbent. The opposing party appears undeterred by his new honorific of Convicted Felon, and was back at work with back to back rallies that he was prevented attending due to court. Sorry, correction, he has been hard at work for 5 days of solid golf.  China China’s property market is still in a world of pain. Expect more housing easing efforts down the road — especially on the demand side — with funding and implementation as key for the effectiveness of the property rescue plan. On the funding, any game-changing housing easing measures (including those for housing destocking) would require significantly more funding than available thus far, while many inland local governments remain financially stretched after the three years of zero-Covid policy and amid the prolonged property downturn. This will require a larger top-down funding scheme from the central government, beyond the RMB300bn relending quota. Moreover, strengthened fiscal discipline and financial regulation may dampen some officials’ incentives for more concerted and forceful policy efforts. Upcoming policy events — such as the July Politburo meeting will be worth monitoring closely, especially on solutions to address funding and implementation bottlenecks.  Nvidia (yes, again) Nvidia Corp was already the world’s most valuable semiconductor firm. Now, it’s become the first computer-chip company ever to hit $3 trillion in market capitalization. The shares of the Santa Clara, California-based firm have rallied roughly 147% this year, adding about $1.8 trillion as the insatiable demand for its chips used to power artificial intelligence tasks skyrockets. On Wednesday, shares rose 5.2% to close at a record $1,224.40, pushing the market value to more than $3 trillion and overtaking Apple Inc. in the process.  The last time Nvidia was worth more than Apple was in 2002, five years before the first iPhone was released. At the time, both companies were worth less than $10 billion each. The company has been arguably the biggest beneficiary of a massive flood of AI spending, helping vault the company into a race to claim the title as the world’s most valuable company. The chipmaker still trails Microsoft Corp by market value, but with shares on a tear Wall Street sees it as only a matter of time before Nvidia overtakes it. Apple has struggled this year with the technology giant’s shares pressured by concerns over cooling iPhone demand in China and a fine from the European Union. Shares in the company have only recently turned positive for 2024 as investor sentiment toward the iPhone maker is slowly improving. Some of these gains could well be due to the run-up to the 10 for 1 stock split due after close of markets on Friday (and trading again Monday morning). This will drop the share price from around $1200 to $120. (Alphabet, Amazon and Tesla have all split shares in the last 2 years). Even after the 10-for-1 split, Nvidia’s stock will be more expensive than it was just four years ago, when it traded at $88 per share.  New scam doing the rounds You may have picked up in the last week that Discovery announced a (smallish) data breach in its Insure division – but this is the tip of the iceberg in a worrying new trend in the insurance, assurance, investment and even pension field. Although the companies are not saying it outload, it is strongly suspected that insiders are involved in these breaches. Higher net worth individuals and dormant funds are being targeted (Sygnia CEO Magda Wierzycka was one of them). FICA documentation which as to be provided for almost every account today is being stolen – and sophisticated identity theft being perpetrated. One of my clients came within a hair’s breath of having her pension stolen from a Alex Forbes pension account. This is how it works: With all your FICA in hand, fraudsters open a bank account in your name (in my client’s case it was with Sasfin Bank and if you see the copies of the FICA used as I have, your blood will run cold). They then open an email address in your name, and a new telephone number. They will then attempt to change your profile details on investment accounts to the new ones they have created. This should, ideally trigger contact by the FSP with you at your old email address (which is how my client tripped up her fraudsters) but if your email address has changed, you don’t monitor your emails frequently or they have inside help – then investments are at risk. What can you do to protect your investments and your identity? Make sure you are keeping tabs on all your investments, if they are all over the place, consolidation might be a better option. If you’ve got pensions lying in a dormant account because you ‘haven’t got round to’ preserving them properly – please find the time to do it. (You’re welcome to contact me if you’re not sure how to). If your ID has been stolen, right down to a new ID card being made (as was the case with my client above), you are going to have to report it as stolen on every available platform and you may have to change your ID number. I strongly recommend everyone make use of a free credit check service with a monthly email which will alert you to new accounts that are being opened in your name. Whenever you can, use double authentication on your accounts. You can manage passwords using an online vault (which isn’t as easy or secure as it appears) and prime your laptop to do it’s own double authentication – incase it too is stolen. Put the location tracker on with Microsoft or Apple, and make it easier to block or even kill the hard drive of a device once if is stolen. If you give away or on sell a computer the hard drive needs to be shredded so none of you details can be retrieved. Restoring to factory settings may not be enough. One way to manage the myriad of passwords is to have a ‘core’ password – say P@ssw0rd, and put the first/second/third letter of the company’s name in it in your unique spot to make it unique to that account – say P@ssw0rdF or P@ssFw0rd for FNB. Using one password right across the web is asking for trouble.  Prevention is better than cure: As it is in medicine so it seems to be in politics as well. Post the Mbeki era, the ANC has found itself in a wilderness marked by policy confusion and infighting amongst its factions. The default position was to unite the party regardless. This became more difficult as the state capture inquiries took hold, and the mantra of the day was for an ANC to correct itself. All of this became hollow words and when married with the lack of delivery, led to the ANC losing its ability to self-govern. Their chance to self-correct and introspectively find a new path to follow was always hampered by factionalism and their roots as a liberation movement. Almost never do liberation movements become successful governments. Its not easy to self-correct as this involves confronting the problem and the causes for it. This requires the cutting away of the dead branches of ill devised plans and the pain in ending relationships which no longer work. I still remember a journalist rhetorically asking of Cyril Ramaphosa to become a free market radical… what did he have to lose ultimately? But the ANC happily bumbled on believing that its biggest threat was not the elections but its own factions and keeping all of these in check. Then the elections happened. The ANC, it seems, was almost dumb struck that the voters had spoken against it. Surely, they as a liberation movement and the bastion of a better life for all should not have to undergo such treatment? But ultimately the voter in SA is after an actual better life rather than the talk of it. The ANC now has no choice but to correct as the window for self-correction has closed. They have in essence given away the chance to be the authors of the blue print to make South Africa prosperous. That privilege has been given to a much broader grouping who bring their own ideas, ideologies and experiences. Call it a coalition, government of national unity or a supply and confidence model… all of these mean one thing: The future of the country is going to be determined by a broader group of people. This is a good thing. For the first time, I am reading of an ANC attempting to clarify the real issues at hand. They unsurprisingly have to do with the grinding poverty of many and the lack of quality education. The road to achieve these is being debated. Its good news that the Constitution is seen by both the ANC and DA as a foundational block to take the country forward. Upon this can rest the principles that can lead to delivery. Economic growth alongside distribution seems to be at the order of the day but how this will be achieved is still being debated. It seems that the ANC is rejecting far left principles favouring a measured approach which they have in common with the DA. This invariably will leave some in the ANC disgruntled. They will ultimately leave to join left leaning organisations which, if the ANC self-corrected, could have happened a lot longer ago. I still believe that the centrist ANC with the DA should form a new party at some point. Both the parties have stigmas attached to them which make them unpalatable for some. The success of any of this lies in actual delivery. Once the downtrodden sees change and have renewed hope, there is no reason why they wont vote accordingly. So the path is emerging but the detail is missing. Make no mistake this is not going to be easy but is critical to a prosperous country. Time is already ticking for delivery…. And the future is at stake! Remember the left (MK and the EFF) are watching. Author:- Cobie Legrange EXCHANGE RATES:  The Rand/Dollar closed softer again at R18.90 (R18.87, R18.42, R18.26, R18.43, R18.51, R19.09, R18.68, R18.99, R18.76, R18.72, R19.15, R19.30, R18.97, R19.03, R18.80, R18.78, R19.03).  The Rand/Pound is also softer at R24.18 (R23.98, R23.46, R23.11, R23.80, R23.22, R23.62, R23.61, R23.93, R23.90, R24.06, R24.18, R24.47, R23.61, R24.03, R23.87, R23.86, R24.15.)  The Rand/Euro closed the week down at R20.59 (R20.42, R19.97, R19.08, R19.86, R19.92, R20.35, R20.25, R20.56, R20.43, R20.47, R20.71, R20.93 R20.38, R20.51, R20.38, R20.40, R20.72.)  Brent Crude: Brent closed the week down again at $79.91 ($81.73, $82.16, $83.43, $82.73, $82.82,$87.39, $90.87, $86.58, $85.33, $81.80, $83.80, $83.40,$83.14 $80.91, $77.36, $83.66, $78.33.) If the price remains softer, even with the change in exchange rate there may not be a big impact on the price at the pump.  Bitcoin was up at $71,257 ($68,362, $69,391, $66 328, $60,880, $63,154, $64,135, $68,804, $64,681, $69,078, $68,340, $62,315, $54,649, $52,510, $47,195, $ 42,897, $41,608, $41,680). Articles and Blogs: Taking a holistic view of your wealth NEW Why do I need a financial advisor ? Costs Fees and Commissions The NHI and what do do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |