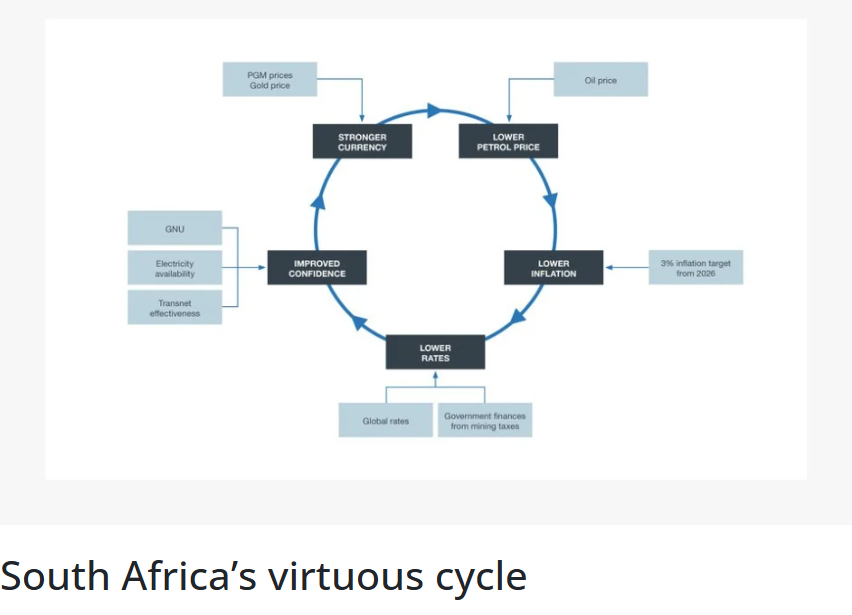

| The podcast to this newsletter can be listened to here. Market and Economic Roundup Week 36 Year-on-year, the JSE is still showing returns well above average.  South Africa 1. Job Losses Deepen: South Africa lost 291,000 jobs recently as major companies exit and retrench, worsening the already high unemployment rate. 2. The B20 Summit in Johannesburg focused on global economic challenges, trade issues, and boosting intra-African trade. The G20 will be held in Cape Town in November – it is doubtful whether Trump will attend. 3. Inflation remains modest, but food and fuel prices are expected to push up inflation slightly in the coming months. SARB may still trim interest rates this month (it is still unclear if this will be in line with the Fed). 4. Economic Growth Forecast: Growth expected between 1.0% to 1.7% in 2025 despite ongoing challenges like freight constraints and geopolitical risks. 5. Controversy over Race Quotas: New government-mandated race quotas for private businesses took effect last week, sparking debate and legal challenges over their impact on economic growth and job creation. USA 1. The Fed signalled a cut in current interest rates amid persistent inflation worries and mixed economic data. 2. The recent jobs report for August showed slowing job creation, supporting economic resilience. Non-farm payroll only came in at 54,000. (This is under the ‘leadership’ of the new Trump appointee, having fired the last head of Statistics just 6 weeks ago – is he also going to be fired?) This is a key indicator used by the Fed. 3. Technology stocks remained volatile due to ongoing regulatory scrutiny and concerns about chip supply chains (and growing concerns over Taiwan). 4. Consumer spending remains steady, bolstering GDP growth forecasts for the remainder of 2025. 5. Trade tensions with China persist, affecting market sentiment and global supply chains, especially in technology and manufacturing. In the meantime, China, India and Russia are getting chummy. Rest of the Globe 1. Inflation rates show signs of easing in many regions, though still remain above central bank targets. 2. Ongoing geopolitical tensions are causing volatility in energy prices worldwide. 3. The EU continues to invest heavily in green technologies as part of the post-pandemic economic recovery. 4. Tightening global financial conditions are triggering capital outflows, impacting emerging economies. 5. China’s growth slowdown is raising concerns about supply chain disruptions and global commodity demand.  RSA Bonds South African bonds have remained resilient amid a storm that has swept international debt markets. The graph below (R2035) shows you just how volatile they have been this year.  Mounting concerns about the sustainability of fiscal debt burdens amid low economic growth and sticky inflation has sent longer-dated yields on US Treasuries, UK gilts, German bunds and debt instruments from France to Japan soaring to historic highs. (graph) Meanwhile, SA bond yields, have been relatively stable thanks to sound fiscal and monetary policy management. Developed market bond markets have come under considerable pressure in recent weeks, particularly at the longer end of the yield curve. South African government bonds have shown notable resilience. The long end of the local yield curve has outperformed its developed market counterparts, supported by the country’s risk relative to its counterparts. The SA Reserve Bank (SARB) has reinforced its credibility by emphasising the lower bound of its inflation target, a stance recently echoed in a joint statement with the National Treasury. This alignment has bolstered investor confidence, particularly given the attractive real yields available at the long end of the curve.  RSA, still shooting itself in the foot… President Cyril Ramaphosa may have scored a major own goal for South Africa after praising Zimbabwe’s land reform programme, a policy widely viewed as disastrous for the Zim economy. His comments, made during the official opening of the Zimbabwe Agricultural Show in Harare on Friday, 29 August 2025, have drawn sharp criticism and could raise fears among investors about the direction of land reform in South Africa. In his address, Ramaphosa framed Zimbabwe’s land seizures in the early 2000s as part of a necessary process of correcting historical injustices. “On independence in 1980, the new democratic government of Zimbabwe had to take on the momentous task of dismantling colonial-era patterns of land ownership,” he said. “Most of the country’s commercially productive land and large-scale commercial farms were owned by whites. “The black majority in Zimbabwe was confined to communal lands and all but completely excluded from commercial farming. This mirrored our own experience in South Africa.” Ramaphosa argued that the reforms were essential to ensure justice, food security, and long-term growth. He congratulated the government of Zimbabwe for its efforts to revive agriculture through “policy reforms, investment in irrigation and mechanisation, and empowering large- and small-scale farmers.” The remarks were made in the presence of Zimbabwean President Emmerson Mnangagwa and immediately sparked concern. Willie Aucamp, the Democratic Alliance’s national spokesperson, said Ramaphosa’s comments were ill-judged and dangerous for South Africa’s economic future. “If you look at what happened in Zimbabwe, it is exactly an example of how not to do land reform,” Aucamp said. “Years later, we are seeing the effects of the land grabs that took place in Zimbabwe, and for our president to praise Zimbabwe for how they did land reform is just unacceptable. It should not happen.” Aucamp pointed out that Zimbabwe is still paying the price for those policies, with farmers being compensated decades later and an economy that has never recovered. “What we saw in Zimbabwe over the last 25 years was a total decay of the economy. The economy collapsed. Their currency collapsed. There was famine,” he said. People literally went hungry to bed on a daily basis, where Zimbabwe was once referred to as one of the food baskets of Africa.” This is just as we saw light at the end of the tunnel, and RSA inc showing some signs of improvement (you can read more here). This interesting article looks at the “Virtuous Economic Cycle”  The most obvious driver of a virtuous economic cycle in South Africa is the rebound in platinum and gold prices, which have soared in 2025. These commodities form the backbone of South Africa’s export earnings, and thus, higher prices translate into stronger terms of trade.This supports the rand, easing imported inflation and boosting domestic purchasing power. In particular, a stronger rand translates into lower fuel prices. These prices then feed into the economy’s broader cost structure, providing direct relief to households and indirectly easing cost pressures on businesses. With consumers feeling less pressure at the pump, disposable income improves – supporting broader spending. This is boosted further by reduced interest rates, with lower inflation giving the Reserve Bank more space to cut the repo rate. In turn, this stimulates local consumption, investment, and economic activity. Crucially, lower rates also improve the debt-servicing capacity of both households and corporates, freeing up cash for more productive use. Rising platinum and gold prices not only boost export earnings but also lift government revenue through higher mining taxes and royalties. This influx, together with a declining interest bill, helps support government finances at a critical juncture, easing pressure on borrowing and potentially creating space for higher infrastructure spend. Healthier government coffers also improve South Africa’s sovereign credit profile. If handled prudently, this can help reverse the long-standing trend of rising debt-to-GDP, restore market trust, and drive the cost of borrowing down further. All of this improves confidence in the local economy, encouraging investment, which further boosts economic growth. As confidence builds, it feeds into investment, hiring, and long-term growth planning – pushing the economy into a more sustainable trajectory. This is far from guaranteed, as things can always change, particularly with a small economy like South Africa’s that is buffeted by global factors (and Cyril’s penchant for adding fuel to the fire instead of flying under the radar of the petty and easily triggered US President.) More often than not, South Africa has been stuck in a vicious cycle rather than a virtuous one, characterised by low growth, fiscal deterioration, policy drift, and infrastructure failures. The risks remain real, with any breakdown in coalition politics, renewed load-shedding, or a global economic slowdown derailing the virtuous cycle. External shocks – such as rising oil prices, falling precious metals prices, a resurgence in global bond yields or large-scale geopolitical events – could all reverse progress.  NHI update At least once a year, we have to revisit the government’s implementation of the National Health Insurance (NHI), and it’s back in the news – but still zero clarity on how on earth the government thinks it is going to fund it. It is estimated that it will cost at least R1tn. Even an NHI ‘lite’ would cost at least R500bn. To put that in perspective, all the taxes, from all sources, in the last tax year came to R1.2tn. All the medical aid premiums only came to R60 bn. Of the circa R360bn allocated to health last year, it is estimated that at least a third is wasted. 1. Government Advancing NHI Preparations: The Department of Health, led by Minister Aaron Motsoaledi, is pushing ahead with preparations for NHI despite opposition concerns. The government is focusing on improving public health infrastructure, including the refurbishment and construction of hospitals and clinics, to ensure readiness for NHI implementation. The digitisation of the records for every South African alone will take years. 2. Infrastructure Investments: In the 2024/25 financial year, significant investments were made in revitalising health facilities, 47 clinics and community health centres and 45 hospitals were substantially upgraded, with over 400 other public health facilities maintained or repaired. New hospitals under construction across several provinces aim to strengthen healthcare delivery. 3. Political and Legislative Developments: The NHI Bill has passed major legislative milestones but remains contentious, particularly regarding the future of private medical aids. The African National Congress (ANC) and the Democratic Alliance (DA) have engaged in dialogue to address concerns, including controversial provisions that could affect private medical schemes. (That is putting it very politely, the current version of the NHI effectively outlaws medical aid for everything except cosmetic surgery (which is not on medical aids anyway). 4. Phased Implementation Timeline: NHI is planned to be fully implemented by 2028, following pilot, preparatory, and transitional phases focused on building institutional frameworks, establishing the NHI Fund, and scaling up integrated service delivery platforms. Since 2005, there have been numerous ‘pilots’, all of which have failed. I doubt that the government will be able to see this done within a decade ( by which time hopefully they will have been voted out of office) 5. Controversy and Debate Remain: There is ongoing debate over funding mechanisms (tax increases and mandatory contributions), the role of private healthcare providers under NHI, and worries about government capacity to manage such a vast reform without inefficiency and corruption. These issues continue to fuel public and political controversy. 6. Legal Challenges: Recently, the Western Cape government launched a constitutional challenge against the NHI Act, defending residents’ rights amid concerns over the government’s approach to health insurance reform. Part of the ‘cost saving’ this year has been turning away all undocumented migrants from government clinics.  |

| Europe: European efforts to threaten and cajole countries from doing business with Russia received another blow last week. China agreed on a major new deal with the Kremlin-controlled gas giant Gazprom, deepening Eurasian energy cooperation and extending Russia’s reach into growing Asian economies. The announcement follows just days after European Union leaders threatened secondary sanctions on countries helping finance the war against Ukraine. Europeans want to turn their taps off completely to Russian gas over the next couple years. News that China and Russia agreed to build the long-anticipated Power of Siberia 2 gas pipeline emerged following meetings at this week’s Shanghai Cooperation Organisation reunion. It is just one of some 20 deals, which also included visa-free travel for Russian citizens visiting China. Russian President Vladimir Putin and Chinese leader Xi Jinping continued to share bonhomie ahead of a Victory Day commemoration in Beijing. With these new alliances, we can probably expect a renewed effort by Beijing to bring Taiwan back into the fold (knowing that Trump would probably do nothing). Back in the EU, leaders continued looking for new ways to pressure supply chains extending deep into the bloc’s eastern flank. German Economy Minister Katherina Reiche called on Europe to stop selling so much scrap copper to China. But any EU move to stem supply risks creates additional trade issues — including Chinese battery exports — which may strain ties between Brussels and Beijing even further. The message China and Russia want to project from this week’s meeting seems clear: they have too much global clout to be dictated to by Europe or the US.  Far-right forces in France are building momentum ahead of this week’s confidence vote. Marine Le Pen, the National Rally’s most prominent figure and its president, Jordan Bardella, sat down today with Prime Minister Francois Bayrou. A new election may be inevitable to break French political gridlock. Despite the chaos, Goldman Sachs is still positive on the economy and expects dealmaking to pick up. British long-bond yields rose to their highest levels this century, adding pressure on Prime Minister Keir Starmer’s government to win back the confidence of investors who are concerned about the UK’s fiscal outlook. Gilts are falling ahead of an autumn budget where Chancellor of the Exchequer Rachel Reeves is under pressure to find savings or raise taxes to improve the UK’s precarious fiscal position.   Risk of Taiwan If Beijing takes control of Taiwan, the implications for the West, especially regarding the Taiwan Semiconductor Manufacturing Company (TSMC), would be profound and disruptive. Semiconductor Supply Disruption: Taiwan produces over 60% of the world’s semiconductor supply, with TSMC alone controlling about 50% of the global foundry market. These advanced chips are critical for industries such as electronics, automobiles, AI systems, and military technology. A Chinese takeover would likely disrupt production, causing severe global chip shortages, significant price hikes in electronics, and inflation in tech-reliant economies, adversely impacting the West notably. Strategic and Economic Leverage for China: Beijing’s control of Taiwan would elevate its position as a semiconductor hegemon. China currently accounts for about 8% of global production but lags in advanced chips. Acquiring Taiwan’s semiconductor capabilities would strengthen China’s tech giants (e.g., Huawei) and give it strategic leverage over U.S. and Western technology firms reliant on TSMC chips, severely impacting industries such as Apple and Nvidia. Geopolitical and Supply Chain Risks: Western countries, especially the U.S., have invested in boosting domestic chip production to counter this risk (e.g., the CHIPS Act), but it would take years to reach Taiwan’s advanced capacity. Beijing’s control would also complicate the geopolitical landscape, intensifying the tech and trade tensions between the West and China, creating uncertainty and risk for technology supply chains globally.t Potential Retaliation and Economic Interdependencies. Although Beijing may seize technological control, it faces economic vulnerabilities because China’s tech sectors rely heavily on global supply chains, including Taiwan’s inputs. Aggressive retaliation or disruption could backfire economically. Western companies could face operational challenges, and efforts to decouple from Chinese technology may accelerate, fragmenting the global tech ecosystem further. In summary, a Beijing takeover would cause major disruption in semiconductor supply and technology markets, elevate China’s tech dominance at the West’s expense, increase geopolitical tensions, and force Western economies and companies to navigate heightened uncertainty in critical tech sectors.  Trump’s tariffs might be illegal President Donald Trump insinuated trade agreements with economies including the European Union, Japan and South Korea would be axed if his global tariffs are ultimately ruled illegal by the US court system. Trump on Wednesday said the duties gave him leverage to strike deals with major trading partners that saw the US raise import taxes on their products without retaliation — arrangements he said had given the world’s biggest economy “a chance to be unbelievably rich again.”“If we don’t win that case, our country is going to suffer so greatly,” Trump told reporters in the Oval Office. “These deals are all done. I guess we’d have to unwind them.” And yes, the tariffs would have to be repaid to the importers – some $100bn. The US president has said his administration would ask the Supreme Court as soon as Wednesday for a quick ruling in the hopes of overturning a lower court decision — upheld on appeal — that he wrongfully invoked an emergency law to impose his so-called “reciprocal” tariffs. Trump has relied on a broad interpretation of the International Emergency Economic Powers Act, or IEEPA, to impose sweeping, country-specific duties without relying on Congress. IEEPA does not mention tariffs and has never been used to impose them. Without those duties, it’s unclear if Trump would have the authority to unilaterally strike tariff deals with trading partners. Trump has repeatedly warned of dire economic consequences should the courts rule that he lacks the power to set tariff levels on his own. In another sideshow, Trump has formed a panel of 11 pretenders to Powell’s position – months ahead of the end of his tenure next year. These are being conducted in a manner eerily (but unsurprisingly) similar to ‘The Apprentice’. RFK jnr, the Health Secretary who has been running his own version of ‘You’re fired’ and embedding his anti-vax conspiracy theories in the Dept of Health, was hauled in front of Congress and was grilled by both sides of the aisle. In another ‘important’ policy move, Trump has changed the Department of Defence to the Department of War (good way to get a Peace Prize, Donald). Author: Dawn Ridler  Workplace AI Academics are starting to model the effects that AI may have on the workplace. Most of what people believe about AI is simply conjecture at this stage or vague interpretations of the future. But a recent paper by Enrique Ide and Eduard Talamas called: Artificial Intelligence in the Knowledge Economy has some interesting insights. The research is theoretical in nature and lacks empirical evidence. But this is understandable as real live cases are not evident yet. The research becomes a basis to test empirical evidence as this body grows over time. The authors start with an economic model with its own knowledge hierarchy. So basically, there are workers and higher up the knowledge scale (think managers and directors), there are solvers. Both of these groups work to solve problems in a traditional way. Then AI is introduced. The AI module that is introduced uses computational resources to mimic human knowledge for both workers and solvers. Generally speaking, the AI module copies and mimics the knowledge workers’ activities, whereas the solvers’ AI module is more advanced as it is needed for problem-solving. The AI module is also allowed to work autonomously if required. The findings show that AI shifts the knowledge frontier. In the past, where knowledge was power, as soon as this is democratised (in an AI world) and everyone has access to it, the need for large layers of middle management disappears. The commensurable need for complex human resource policies would thus also reduce. At the same token, the need for solvers increases. These are individuals with a deep understanding of the organisation, its environment and the problem at hand. It is these individuals who can stop an AI process to direct workflow into a different direction because the previous path would have unintended consequences. This means that the top layer in a business will probably see extra specialisation. AI directly competes with knowledge workers as it learns to replicate their tasks. Once AI learns how to do basic tasks it can be used for basic problem solving and thus reduces the need for lower skilled staff. The irony of all of this is that the traditional path up the company hierarchy is now disrupted. Previously new graduates would join the ranks of workers to learn the ropes so to speak. Once they proved useful and dedicated to the company, they would be given the chance to move into managerial positions. The need in an AI world for workers becomes diminished, which begs the question how a company will identify and cultivate future generation skills? There is evidence from another paper: Canaries in the Coal Mine? Six Facts about the Recent Employment Effects of Artificial Intelligence written by Erik Brynjolfsson, Bharat Chandar and Ruyu Chen which suggests that older workers stand the most to gain from AI. Generally speaking, companies are used to retire older workers. Younger workers are cheaper and as long as the knowledge base can be replicated somewhere inside the organisation the firm can survive and do so with better margins. But if knowledge becomes democratised and the need for high-end solvers with deep company and industry knowledge is required, this can very well extend the life span of older workers. The company by default, can still control margins because they are hiring fewer entry-level jobs. Perhaps in this world entry entry-level jobs are replaced by mentorships. Funny how it still comes down to who you know .. not what you know. Author: Cobie Le Grange EXCHANGE RATES:  The Rand/Dollar closed at R17.58 ( R17.65, R17.44, R17.61, R17.74, R18.15,R17.76, R17.72, R17.90, R17.58, R17.89, R17.99, R17.92, R17.77, R17.95, R17.88, R18.04, R18.16, R18.39, R18.64, R18.89, R19.12, R19.10, R18.36, R18.21, R18.18, R18.20, R18.71, R18.35, R18.38, R18.41, R18,67, R18.38, R18.73, R18.03, R18.05, R18.11, R18.21,)  The Rand/Pound closed at R23.73 (R23.84, R23.53, R23.84, R23.84, R24.09, R23.88, R23.76, R24.22, R24.08, R24.49, R24.22, R24.35, R24.05, R24.18, R24.14, R23.95, R24.16, R24.40, R24.82, R25.10, R25.01, R24.73, R23.78, R23.55, R23.52, R23.50, R23.53, R23.19, R23.12, R22.85, R23,16, R22.93, R22.80, R22.99, R22.98, R22.72, R22.99, R22.73, )  The Rand/Euro closed the week at R20.61 ( R20.62, R20.44, R20.56, R20.64, R21.04, R20.86, R20.61, R20.93, R 20.70, R20.91, R20.74, R20.68, R20.24, R20,37, R20.27, R20.13, R20.43, R20.78, R21.21, R21.52, R21.72, R20.93, R19.95, R19.72, R19.83, R19.72, R19.41, R19.20, R19.29, R19.02, R19,35, R19.31, R19.23, R19.09, R18.87, R19.19, R18.85, ,)  Brent Crude: Closed the week $65.52 ($67.38, $67.73, $66.08, $66.07, $69.46, $68.29, $69.21, $70.58, $68.27, $67.39, $77.27, $74.38, $66.56, $62.61, $65.41, $63.88, $61.29, $65.86, $67.72 $64.76, $65.95, $72.40, $72.13, $70.51, $70.33, $73.03, $74.23, $74.51, $74.65, $76,40, $77.60, $79.98, $71.00, $72.38, $75.05, $70.87, $73.86, $73.99).  Bitcoin closed at $110,752 ($108,923, $114,916, $117,371, $118,043, $113,608, $118,139, $118,214, $117,871, $108,056, $107,461, $103,455, $105,017, $105,643, $104,049, $103,551, $104,615, $96,405, $94,185, $84,571, $84,695, $82,661, $83,074, $84,889, $82,639, $83,710, $85,696, $96,151, $96,821, $96,286, $99,049, $104,559, $104,971, $99,341, $97,113, $97,950). Articles and Blogs: Who needs a plan anyway NEW 8 questions you need to ask around retirement NEW What to do when interest rates drop How to survive volatility in your investments What to do when interest rates drop Difficult Financial Conversations Financial Implications of Longevity Kick Start Your Own Retirement Plan You matter more than your kids in retirement To catch a falling knife Income at retirement 2025 Budget Apportioning blame for your financial state Tempering fear and greed New Year’s resolutions over? Try a Wealth Bingo Card instead. Wills and Estate Planning (comprehensive 3 in one post) Pre-retirement – The make-or-break moments Some unconventional thoughts on wealth and risk management Wealth creation is a balancing act over time Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Keeping your legacy shining bright Financial well-being when dealing with Dementia and Alzheimers Weathering the storm Pruning your wealth farm Should you change your investments with changing politics? Taking a holistic view of your wealth Why do I need a financial advisor? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |