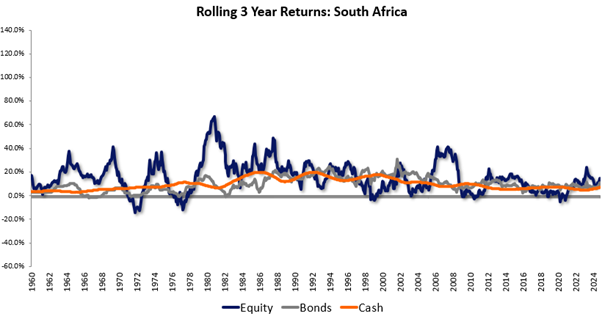

| Cobie and I like to keep this newsletter and our podcast evolving. We’d love to hear from you about what you like or dislike, what you’d like more or less of – both in the newsletter and podcasts. Do you have topics you’d like to hear a blog on? Do other people’s wealth journeys interest you? The podcast of the newsletter is available and you can download it HERE. We welcome all your input so please don’t hesitate to contact us if you’ve got any queries or suggestions. Market Watch Despite the turmoil created by the ratcheting up of tensions in the Middle East, markets are holding onto their gains with a little softening over last week. The JSE is managing to almost keep pace with offshore markets and showing growth of 21.35% y-o-y.  For those of you who don’t already know, Rexsolom has a number of funds (which we almost exclusively use in the retirement fund environment). Our Medium equity fund is our most popular “Regulation 28” compliant fund and here is an exert from the latest fund fact sheet:  (The full fund fact sheets are available on request)  Eskom We have often talked in the past about Eskom’s cozy pricing deal it has with Aluminium smelters – specifically South 32 – and finally some of those details are coming to light. You can read this superb bit of investigative reporting here ). South32, headquartered in Australia, owns and operates the largest aluminium smelter in the southern hemisphere, Hillside in Richards Bay. More to the point, Hillside is South Africa’s single largest industrial consumer of electricity, accounting for more than 5% of Eskom’s total electricity sales – more than 10TWh per year (and by all accounts has always been virtually exempt from load-shedding since inception). The smelter has been controversial since load-shedding began in 2007 and while Hillside has created jobs, most of South32’s profit leaves South Africa, along with much of the manufactured product. Last year, Hillside was the largest revenue source for South32, contributing $1.8bn (R34bn) out of $9bn revenue. In a nutshell, what South32 and Eskom have effectively done is export South African energy – and this over a decade when power was the scarcest commodity around. This is because aluminium is made from the raw product alumina, which is imported from Australia for processing, with South Africa’s scarce energy being the major input into the process. Hillside has a long history of striking preferential pricing deals with Eskom and for refusing to divulge details. The first such deal was struck in 1992, pegging the electricity price for Hillside to the aluminium price – which meant that lower global aluminium prices allowed Hillside to pay Eskom less for energy. At that time, the basis of the massive discount was that Eskom had abundant coal and a large surplus of power, and it was useful to have a large anchor consumer. Subsequent pricing deals continued along this template even though Eskom knew by the late 1990s that it would face electricity shortages within a decade if it did not invest rapidly in new generation. As indeed happened. The full discount offered by Eskom to Hillside only became public knowledge in 2013 – and only after Media24 waged a four-year court battle to get this information. Eskom and BHP Billiton, from which South32 was unbundled, had cited “commercial confidentiality” for hiding this information. When it came out, you could see why they’d fought to keep it secret. Media24 revealed that Hillside was buying electricity at a staggeringly low 22ckWh from Eskom. This was far below the average R1.40/kWh paid by domestic consumers at the time, and half the 41c/kWh it cost Eskom to supply electricity. It also meant Billiton was paying far less than the average R1.61 that many factories were paying for power at the time. Nersa declined the request to have this agreement revised. In July 2021, at the height of Covid, South32 and Eskom said they had negotiated an updated pricing agreement for Hillside that would run for 10 years. But yet again, despite the court finding back in 2013, Eskom, South32 and Nersa once again chose to withhold the pricing information from the public. Nersa approved the deal with the claim that the “net benefit” to the country is a positive – but it provided none of the detail that would allow anyone to verify that. In July, in response to a Promotion of Access to Information Act request, Eskom responded, sharing only the publicly available (and heavily redacted) agreement. Yet, there is information in the public domain that provides clues. First, while South32 is clearly paying more for electricity, this hasn’t hurt its bottom line. In 2022, it reported that the aluminium price, which had just hit an all-time high, had more than offset the increase in energy costs and problems at South Africa’s ports. Things were going so well, in fact, that it declared a record dividend of more than R6bn immediately after the new deal was signed with Eskom. (You can read rest of this superb bit of investigative reporting here ).  Middle East The Yom Kippur War of 1973 still stands as the one terrifying precedent that shows conflict in the Middle East can create economic turmoil for the rest of the world. It led to the Arab oil embargo and round after round of stagflation. Will we live to talk of a Rosh Hashanah War shock to match that of Yom Kippur? The odds are against it, although the day’s frantic events shows that the oil price has not, after all, lost all its potency as a gauge of geopolitical risks, especially in the Middle East. Save for a few brief periods after Hamas’s Oct. 7 attacks when the price spiked, oil has generally remained range-bound through almost exactly a year of escalating conflict. A supply glut coupled with weak demand as the global economy emerged from the pandemic made for muted prices despite rising tensions. Tuesday’s rapid escalation when Iran fired a barrage of at least 180 missiles, which immediately promised an Israeli response, saw oil briefly climb by about 5%, the most in 12 months. The strike was a reprisal after Israel carried out a dramatic series of attacks in Lebanon in recent days, killing Hezbollah leader Hassan Nasrallah in a Beirut airstrike and sending ground forces across the border. Tehran had already threatened to retaliate after the political leader of Hamas was killed in Tehran in July — an attack blamed on Israel.  Oil With increased tensions in the Middle East as with Israel potentially opens up another active front in its war against terrorism with (effectively) Iranian proxies. Of course, last week Iran attacked Israel directly and, as I write this, we are still waiting for the retaliation which is undoubtedly coming (likely after the end of the Jewish high holy holiday of Rosh Hashanah). The geography of the Middle East is quite important here:  The price of oil jumped some 7% after the first attack. Bear in mind that Iran only produces about 2% of global oil but most of the oil produced is found in a rough horseshoe shape around the Persian Gulf – the entire northern part taken up by Iran – and more importantly they are on the northern part of the vital Straits of Hormuz, through which 30% of the world’s oil transits (70% of it destined for the East). Although Saudi Arabia (as the largest oil producer in the region at circa11.5%) has gone to great pains to remain neutral and has even banned public displays of Palestinian support in recent weeks, the majority of their oil exports go through the Straits of Hormuz. A bottleneck in the Straits would result in a significant spike in oil prices.  US Employment report America’s employers added a surprisingly strong 254,000 jobs in September, easing concerns about a weakening labour market and suggesting that the pace of hiring is still solid enough to support a growing economy. Last month’s gain was far more than economists had expected, and it was up sharply from the 159,000 jobs that were added in August. And after rising for most of 2024, the unemployment rate dropped for a second straight month, from 4.2% in August to 4.1% in September, the Labor Department said Friday. The latest figures suggest that many companies are still confident enough to fill jobs despite the continued pressure of high interest rates. In an encouraging sign, the Labor Department also revised up its estimate of job growth in July and August by a combined 72,000. Including those revisions, September’s job gain — forecasters had predicted only around 140,000 — means that job growth has averaged a solid 186,000 over the past three months. In August, the three-month average was only 140,000. This sort of good economic news bodes well for the Harris/Walz campaign.  The two great Republican businessmen The ‘broship’ between Trump and Musk is well known (and still has many of us saner Saffers shaking our heads) and he has been contributing tens of millions to Republican campaigns since 2022 but how are their latest business projects faring? We have often tracked Trump’s Truth Social company, listed as DJT which listed earlier this year at just over $16 and rose to over $65 just before Biden dropped out of the race, last week it traded as low as $12.50.  Musk famously bought Twitter in October 2022, delisted the share and took it private for $44bn. At the time it was valued at less than half that. Although now private and the share price can only be estimated, it is now valued at $19.6 bn and has dropped markedly since July (when Harris stepped into the picture). Much of the decline in value has come from the perception that advertisers are abandoning the platform due to the extreme content (and largely unmoderated) – not helped by Musk famously and publicly telling advertisers to “Go F# yourselves” (my redaction, not his). At the end of the day though, X still has over 500m active monthly users and in time, is likely to increase in value despite all the political extremism (especially if this is Trump’s last hurrah, and in the future the Republicans return to their less-extreme conservative roots). What you may not know about X is that the data has helped train Grok, the artificial intelligence chatbot developed by X, Musk’s increasingly valuable AI startup. X has emerged as the unique angle for Grok – and could ultimately be extremely valuable for Musk. It’s unlikely that this was Musk’s original reason for buying X, but in time will probably be touted as such.  Change in ad spend in the US elections With the inevitable changes in media consumption over the decades, it’s hardly surprising that politicians, especially post-2020 where social media played such an important role (and led to the creation of Truth Social), that this is where political ad spend was going to go. It makes sense that politicians like Vice President Harris and former President Trump, with their teams, are going all in on political ad spending, knowing that the eyes of their nation and their perceptions of them, via interviews, social media ads, clips, and sound bites, ultimately shape their perceptions when they get to the voting box in September. As it stands today, Democrats outpace Republicans by $500 million. Political advertising has become essential over the past decade, so it is no surprise that the 2024 election cycle is set to break records. Spending projections range from $10.2 billion to as high as $17 billion—a more than 30% increase from 2020. While the presidential race is expected to account for $2.7 billion, down-ballot races are projected to dominate, commanding between $7.5 billion and $9 billion in spending. This is one area where there is a difference in Republican v Democratic spending with the Harris team diverting funds away from her campaign down-ballot, especially in the swing states.  Traditional television remains the primary advertising channel, expected to capture over 70% of total ad spend, with local broadcast TV being a primary focus (and by all accounts in the swing states it has reached nauseating saturation levels). Meanwhile, digital platforms are rapidly gaining ground, with political ad spending on these platforms expected to increase by 156% from 2020, accounting for 28% of total ad expenditure. With conventions and debates now over, there are no more “set pieces” to give the campaign shape and direction over its remaining month. Without an October that “surprises”, it will come down to mobilization efforts across seven disparate swing states on the first Tuesday in November. Either side could win. Gauging whom in such a contest is impossible. There are any number of arguments that either candidate will emerge victorious, but none on which you’d be prepared to base any major investment or business decision. Markets aren’t moving with the election campaign, simply because nobody is confident they can perceive who’s ahead.  Ukraine war While the war in the Middle East heats up, we shouldn’t forget Ukraine – because Putin certainly hasn’t. While Western intelligence agencies calculate that Russia is incurring record troop losses in eastern Ukraine, Putin keeps supplying his killing machine. The president signed a law allowing criminal suspects to avoid prosecution if they join the army, a sign both of Russia’s growing difficulties in replacing troop losses and of the Kremlin’s determination to avoid repeating an unpopular mobilization two years ago. Russian forces are creeping forward in eastern Ukraine — they took the strategic town of Vuhledar this week. Putin plans to devote 40% of next year’s state budget to defence and national security — much more than spending on education, health care and social policies combined — as he intensifies repression at home and bets on Ukraine’s allies growing tired of supporting its defence. Much depends on next month’s US presidential election, with Republican contender Donald Trump far more ambivalent about continued military aid than his Democratic rival Kamala Harris (and undisguised disdain for Zelensky). Putin has no such concerns. He ramps up nuclear sabre-rattling to try to spook the US and Europe into stalling further on long-range strikes. As a third full winter of war approaches, the strategic question facing Kyiv’s allies is the same as on day one: Are they helping Ukraine to defeat Putin’s invasion or ensuring it ends in a stalemate?  JSE All Share The JSE All Share gained 4% during September to end the last 12 months 23.9% higher. The decade annualised All Share return is a mere 9.4% p.a, underperforming its global peers by a large margin. I thought it would be an interesting time to look again at the South African market and its long-term trends. This is something I did with great dedication when starting my career. I was the proud owner of a data set which was the result of a study by Firer and McLeod on the long-term capital history of South Africa. For you who may be interested, it was published in the Investment Analyst Journal of 1999. I have continued to update the study through time. Below is the rolling 3 year returns for the local market going back to 1960.  The lost decade under Jacob Zuma when state capture was at its height is most evident. As a matter of fact, the average return for SA equities from 2016 to 2021 was 3.8% p.a. when measured over rolling 3-year periods. Both cash and bonds handsomely outperform equities during this period. When measured on a rolling 3-year basis, SA equities had never experienced such a lacklustre market since the 1960’s. There were brief periods of market sell downs, but these generally washed through the system quickly to attain the long-term average return of 15% p.a (here I measure equities since 1925). I could almost feel the life leaving the SA market. Companies were delisting, some leaving the country altogether, and the vibrant market which was a byproduct of the successful multiracial 1994 process was at an end. Emerging economies need economic and political stability to attract foreign flows. If one thought this was only a myth, the above chart confirms exactly this point. During this time many market observers were calling for the death of the local market and persuaded investors to rather invest offshore than locally. A political scandal was the only confirmation required that this was the right thing to do. But as the GNU now takes hold, the rolling 12-month returns are starting to creep up. To the end of October it was both Industrials (25.1%) and Financials (39.8%) which aided the All Share return, not Resources (3.4%). These are investors who are buying a depressed local market in the hope that the political landscape will allow for higher earnings and thus support expanding valuations. These are all good things but real effort on the ground is required to ensure that delivery occurs. If one is looking for a country which requires effort to enable a brighter future, look no further than South Africa. But perhaps coinciding with this internal change at play, is a changing geo-political landscape. Last week I wrote about the Chinese releasing liquidity into their markets in order to kickstart their economy. A growing Chinese economy is good for other markets, especially if this can coincide with resource prices climbing. This has certainly been the case in the past but one would need to see if this correlation holds as the Chinese economy is more consumer driven today than in the past. At the same time, the US Dollar is weakening which is generally good for resources as these are priced in US Dollars. Also remember that the US market has been on an upward trajectory for many years now. In Dollar terms, the US market has compounded over 12% p.a for the last decade whereas South Africa is barely positive (in Dollars). Perhaps this picture looks different in a decade’s time? Author:- Cobie Legrange EXCHANGE RATES:  The Rand/Dollar closed at R17.48 (R17.12, R17.42, R17.85, R17.82, R17.71, R17.85, R18.32, R18.26, R17.95, R18.23, R18.20, R17.91, R18.37, R18.90, R18.87, R18.42, R18.26, R18.43, R18.51, R19.09). Dollar strength  We have all watched the dollar weaken over the last two years, coming close to the ‘neutral zone’ of 100 on the DXY, and while it has strengthened again over the last week, this is probably just natural volatility and we’re unlikely to see any big changes before the outcome of the US presidential election. Republican presidencies are inclined to favour a weaker dollar than Democratic presidencies.  The Rand/Pound closed at R22.93 (R22.90, R23.20, R23.44, R23.41, R23.13, R23.39, R23.28, R23.32, R23.34, R23.00, R22.63, R23.37, R24.18, R23.98, R23.46, R23.11, R23.80, R23.22, R23.62)  The Rand/Euro closed the week at R19.19 (R19.12, R19.47, R19.79, R19.72, R19.80, R19.70, R20.01, R19.94, R19.58, R19.74, R19.49, R19.14, R19.67, R20.59, R20.42, R19.97, R19.08, R19.86, R19.92, R20.35)  Brent Crude: Closed the week sharply up at $77.95 ($71.96, $74.68, $71.47, $76.99, $79.05, $79.09, $79.43, $77.56, $85.03, $83.83, $84.86, $85.22, $82.30, $79.91, $81.73, $82.16, $83.43, $82.73, $82.82,$87.39). This is likely due to increased tension in the Middle East.  Bitcoin closed at $62,267 ($65,596, $62,603, $54,548, $57,947, $63,936, $59,152, $60,847, $61,903, $59,760, $56,814, $61,436, $65,635, $ 66.975, $71,257, $68,362, $69,391, $66 328, $60,880, $63,154, $64,135). Articles and Blogs: Wealth creation is a balancing act over time NEW Wealth traps waiting for unsuspecting entrepreneurs Two Pot pension system demystified Keeping your legacy shining bright Financial well-being when dealing with Dementia and Alzheimers Weathering the storm Pruning your wealth farm Should you change your investments with changing politics? Taking a holistic view of your wealth Why do I need a financial advisor? Costs Fees and Commissions The NHI and what to do about it New-Normal for Retirement? Locking-In Interest rates – The inflation story Situs – The Myths and Reality Tax Residency – New Rules new headaches Are retirement annuities dead A new look at retirement Offshore investing – an unpopular opinion Cobie Legrange and Dawn Ridler, Rexsolom Invest, Licensed FSP 45521. Email: cobie@rexsolom.co.za, dawn@rexsolom.co.za Website: rexsolom.co.za, wealthecology.co.za |